The Benefits of Software for Fund Managers and Investors During a Virtual Annual Meeting

Restrictions on indoor meetings of large groups of people, travel restrictions, and concerns from members about attending large-group meetings during the COVID-19 pandemic may mean that holding a traditional, physical annual general meeting (AGM) is impossible. These limitations have forced many firms to start planning a virtual annual meeting.

As a fund manager, you need an AGM to communicate with investors and reflect on a year’s worth of work (and investment). This requires a format that enables you to celebrate portfolio companies victories, learn from defeats, and present your firm’s strategy moving forward.

Annual meeting preparation is already stressful considering the months of hard work dedicated to planning the event. Now throw in the uncertainty of a pandemic.

This is where it gets good. Fund managers that use fund management software are at an extreme advantage for presenting and promoting a fully virtual event.

Fund managers that use fund management software are at an extreme advantage for presenting and promoting a fully virtual annual meeting.

Prepping for a Virtual Annual Meeting

It’s your first virtual annual meeting. Typically you are planning an event to gather all of your investors together to feed them full of information (and food and booze). To most, it’s a necessary evil that requires months of preparation and some serious time away from your core business activities.

This year you are busy selecting a virtual platform that can support your AGM and stay compliant. Focus on the event and let your fund software handle the data details.

Using only spreadsheets of data and calendars to track your activities, your analysts are going to have to comb through a year’s worth of Excel rows and shared calendars (read 10 Reasons Why Excel for Fund Management Doesn’t Work), essentially to count up how many meetings you’ve had, how many calls you’ve had and with whom, and the number of companies you’ve invested in and their revenues or changes in revenues.

This is a tedious process. But it’s also likely to be highly inaccurate due to human error.

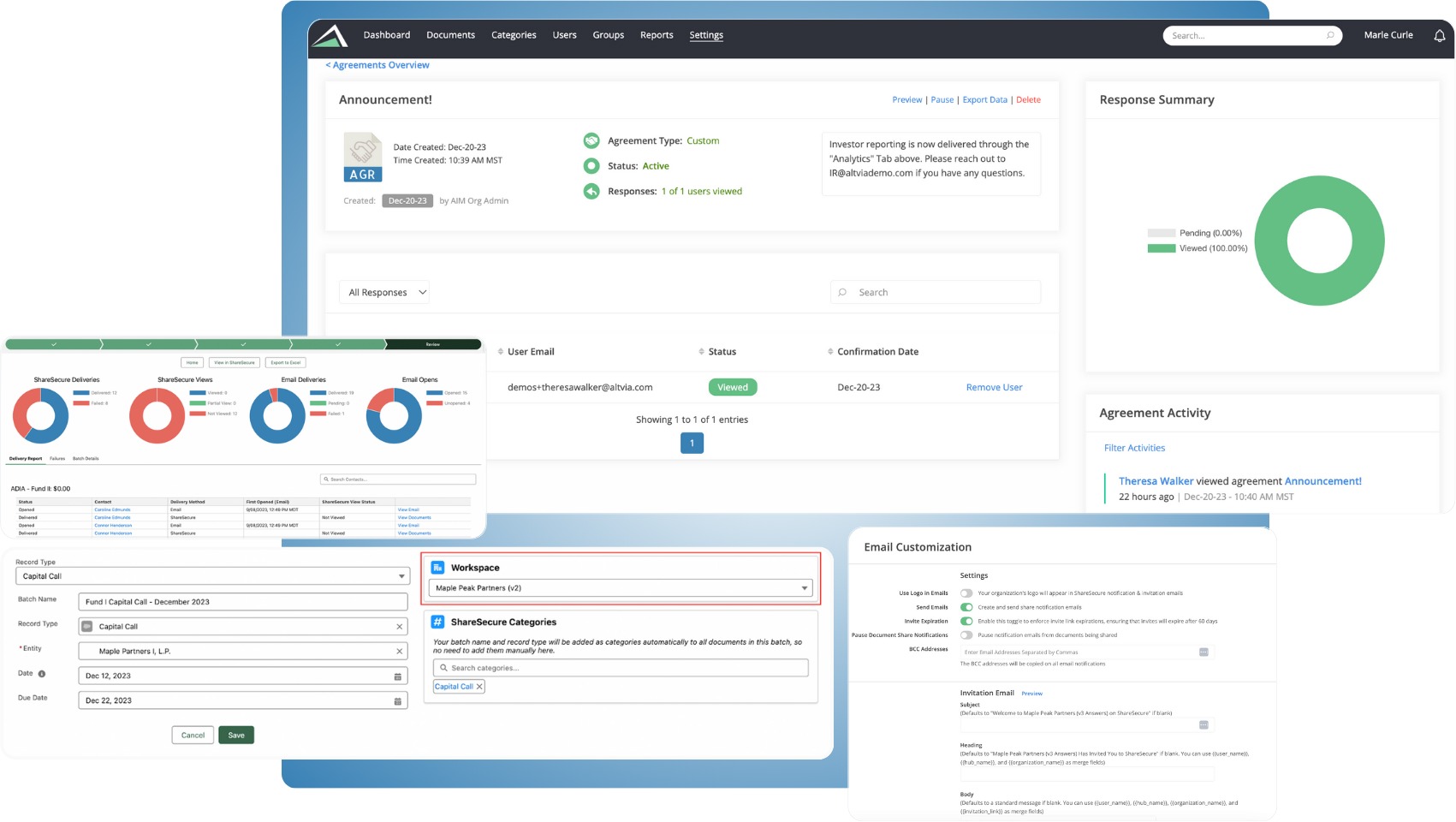

For fund managers with a fund management software system, the process is easy and more efficient with a quick look at an interactive dashboard. Quickly see how many interactions you’ve had with each investor and real-time visual representations of portfolio companies’ performance.

For fund managers that enlist a capable fund management software system, the data compilation process for an annual meeting is made easier and more efficient.

Good private equity fund management software is designed to, among other things, track and report on exactly the data that analysts are spending weeks or months gathering: what have you been up to in the past year? If you have the right system, getting this information for your annual meeting can be as easy as the click of a button.

We have several clients doing this reporting already. Click here to read our client case studies.

Improve Annual Meetings for Investors

As a Limited Partner, the most obvious benefit to using fund management software is the potential to significantly reduce the amount of prep work required to understand fund performance.

Every diligent LP plans to arrive at the meeting, knowing what the manager’s portfolio looks like. However, without a regimented approach and effort, this plan usually results in a chaotic scramble that produces a half-baked summary. While this summary will remind you of the more notable recent events or pieces of information, it will never tell you what hundreds of pages of quarterly reports have explicitly (and not-so-explicitly) conveyed over the course of the year.

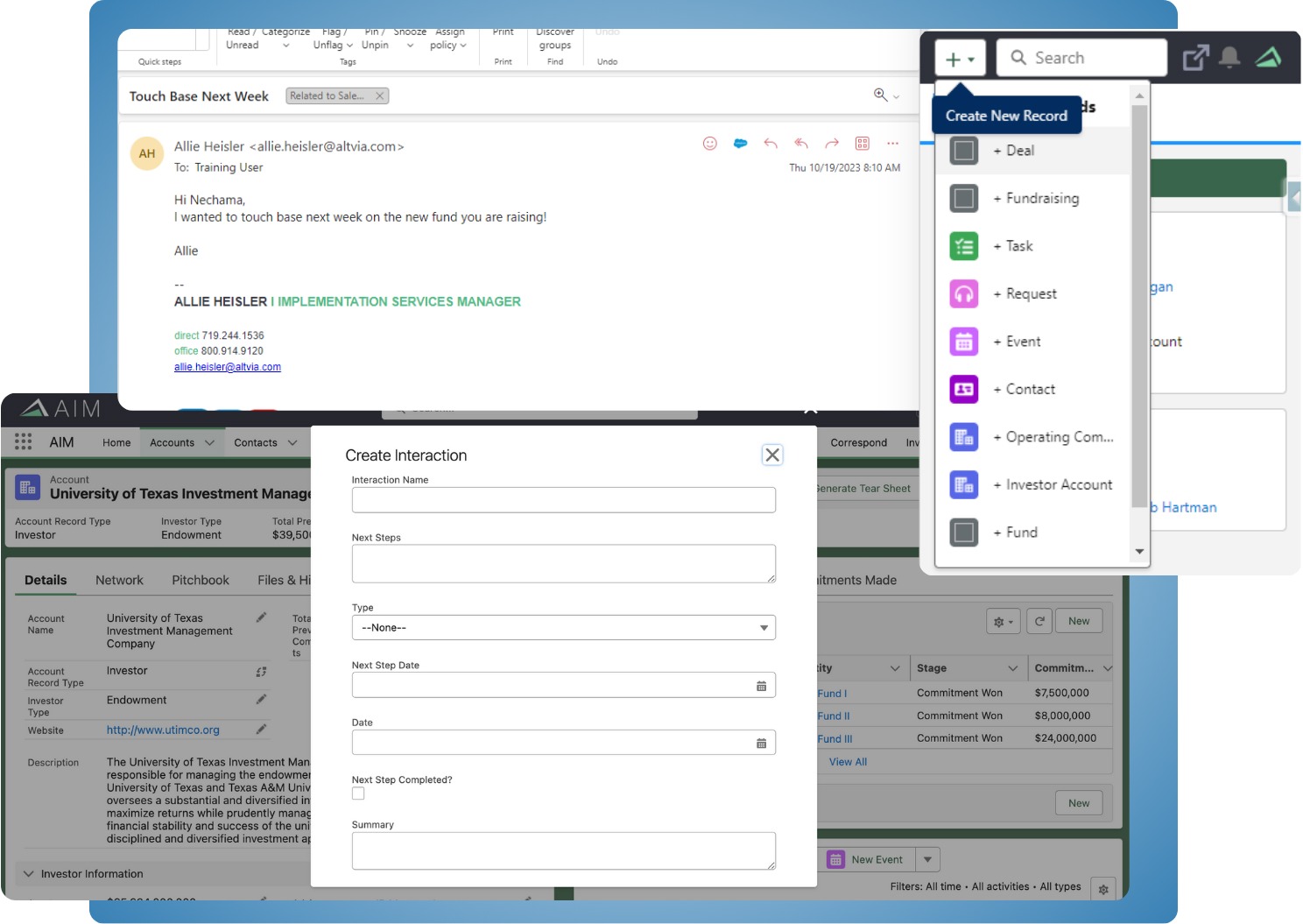

On the other hand, when you have a GP that shares detailed performance information in a fund or data management portal, tracking each portfolio company becomes easier. In mere moments, you can see operational metrics and broader portfolio analytics. You already know what the manager has to share at the virtual AGM. You are one step ahead, ready to ask about the value drivers or the portfolio companies that have grown revenue or EBITDA most over the last year.

Using private equity fund management software, you can capture that data and are better equipped to analyze and understand it. Not only do you save yourself time, but you also have an advantage because you’re already making sense of the data they’re reporting on. Demonstrating to a GP that you are an active and interested investor can earn your priority.

A final justification for a digital fund management software for investors during the annual meeting season is simply to make it easy to catch up on the prior year’s activities, including meetings you were a part of, but meetings and conversations that you weren’t. We all want to avoid getting caught off guard, and while technology can help prevent that, it can also enable more meaningful conversations with managers that make you stand out and open up the highest potential for value creation. Whether being proactive in offering to co-invest in a value driver you’re already aware of, or simply coming off as on top of your relationship with the manager, avoid being caught off guard and falling behind by using technology as a strength.

Annual meetings are a gathering of who’s who in the alternative investment community.

Annual meetings are a gathering of who’s who in the alternative investment community. For investor relations teams, they can be a great hunting ground. So, understanding who is going to be at the meeting and knowing who in your network can provide an introduction is a very valuable tool. All of these things are easily captured in data but easily forgotten in our heads. That is where a CRM system built for private equity comes in and helps you act on network connections.

Every fund manager or investment firm needs fund management software. For those that are actively raising capital, chasing new deals, managing a portfolio, and communicating with investors, it’s absolutely a strategic advantage. Of course, the software needs to be used all year long, but it becomes evident just how beneficial it is during your firm’s annual meeting and in the firm’s road to digital transformation.