AIM CRM

The private equity CRM for data excellence.

Reimagine what becomes possible with data at your fingertips.

A CRM purpose-built for private capital relationships and dealmaking.

Looking for a robust data solution to keep up with the evolving market and increasing competition? It’s no secret that in order to stay ahead of the wave, your firm needs to partner with a software solution that can prioritize, protect, and position its data. With Altvia, the market-leading private equity CRM built atop Salesforce, your firm can stop getting by with a generic CRM and start getting ahead with an industry-focused data management solution.

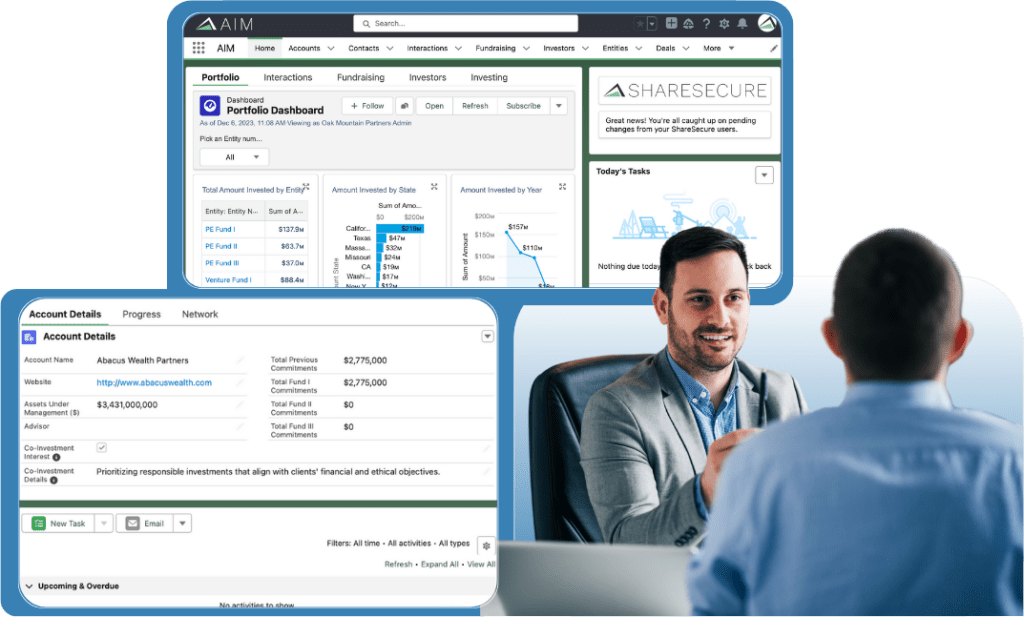

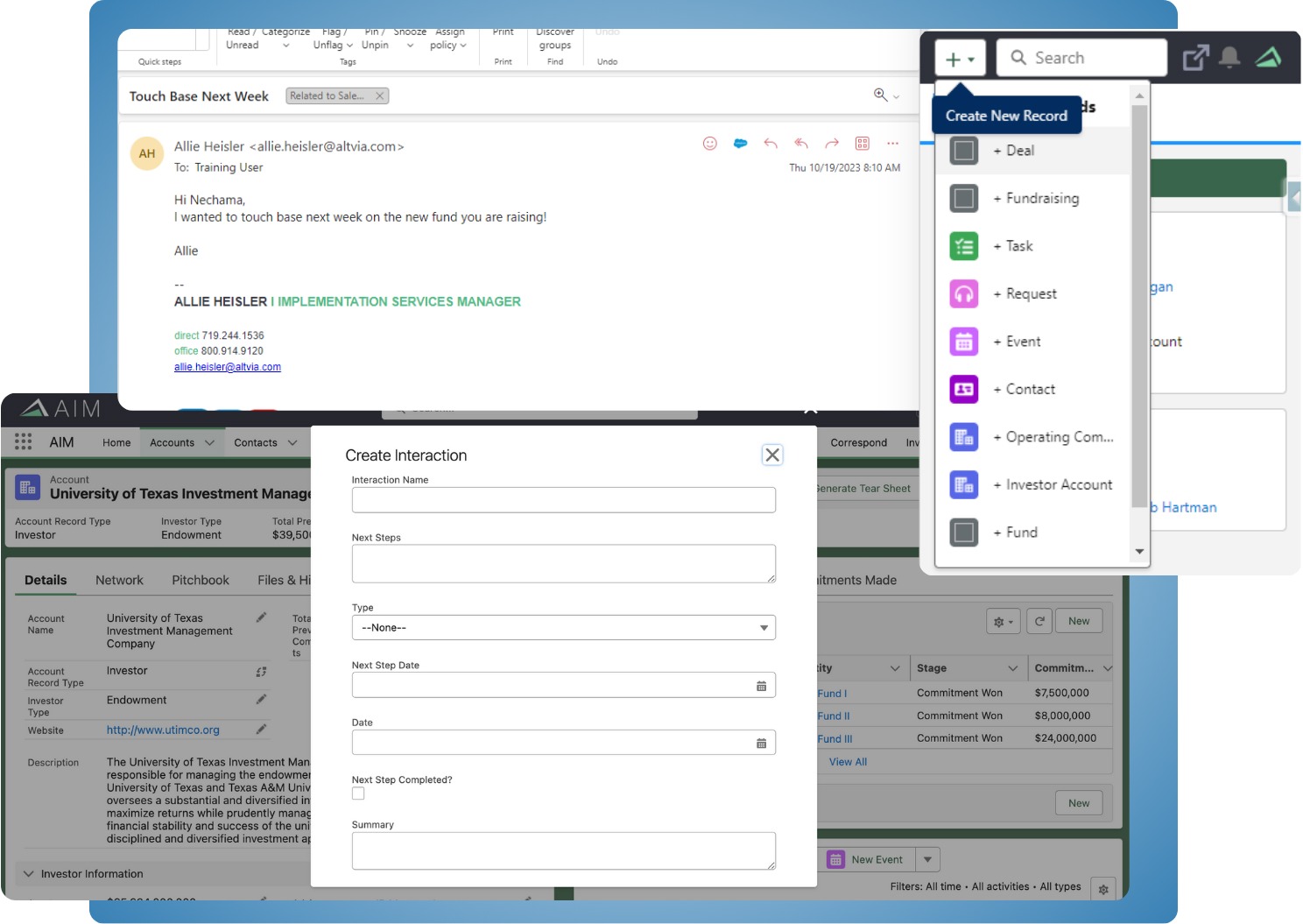

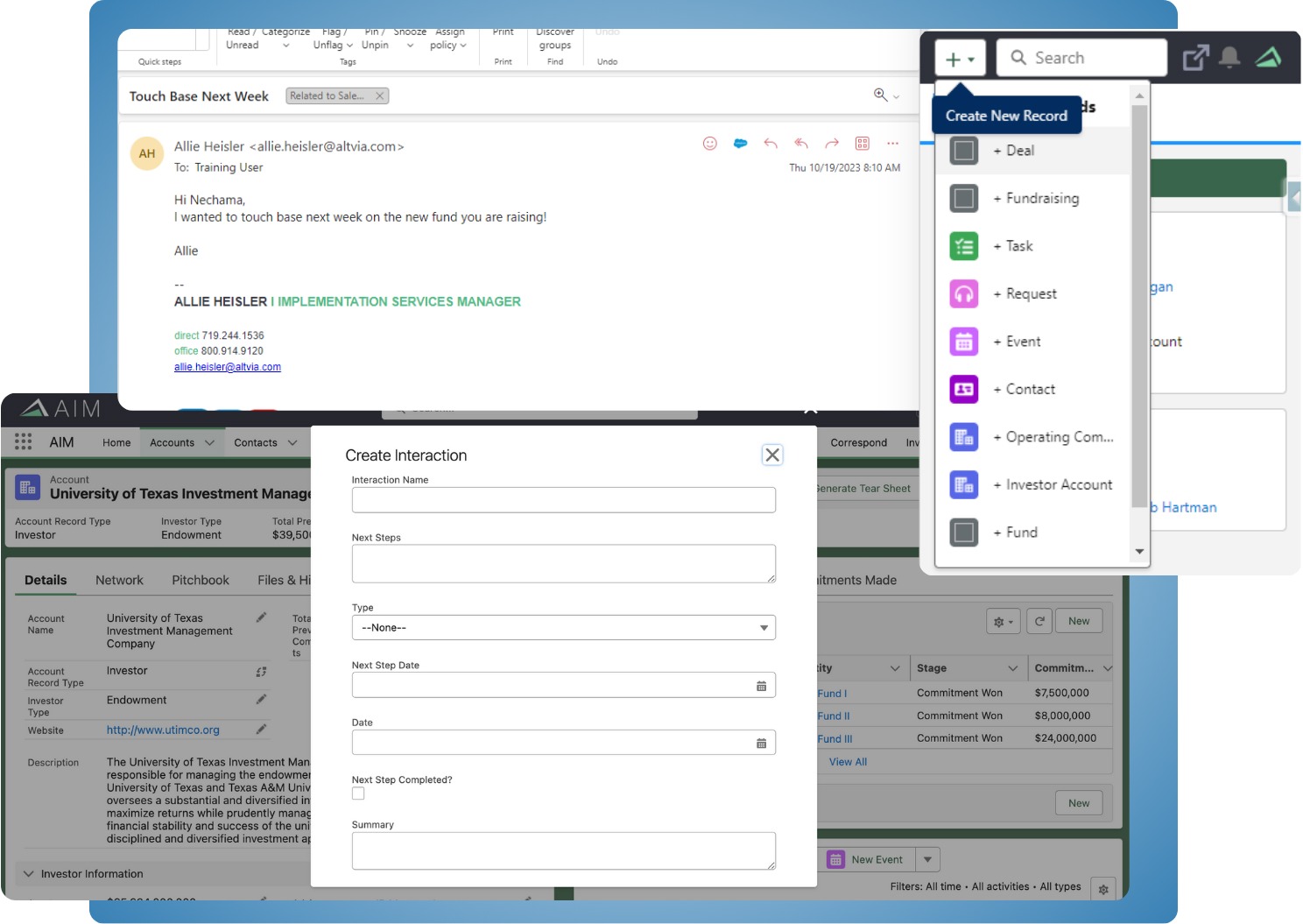

Ditch manual, error-prone data entry. Altvia’s AIM CRM transforms data chaos into organized efficiency, prioritizing smart engagement through proprietary interaction functionality for insightful connections that elevate your strategies.

- Automatic capture of customer relationship interactions.

- Track detailed notes on calls, meetings, and emails.

- Leverage in-app email notifications to keep your team aligned.

- Harness 360-visibility by connecting native force.com account and contact records to deals, funds, and investor records.

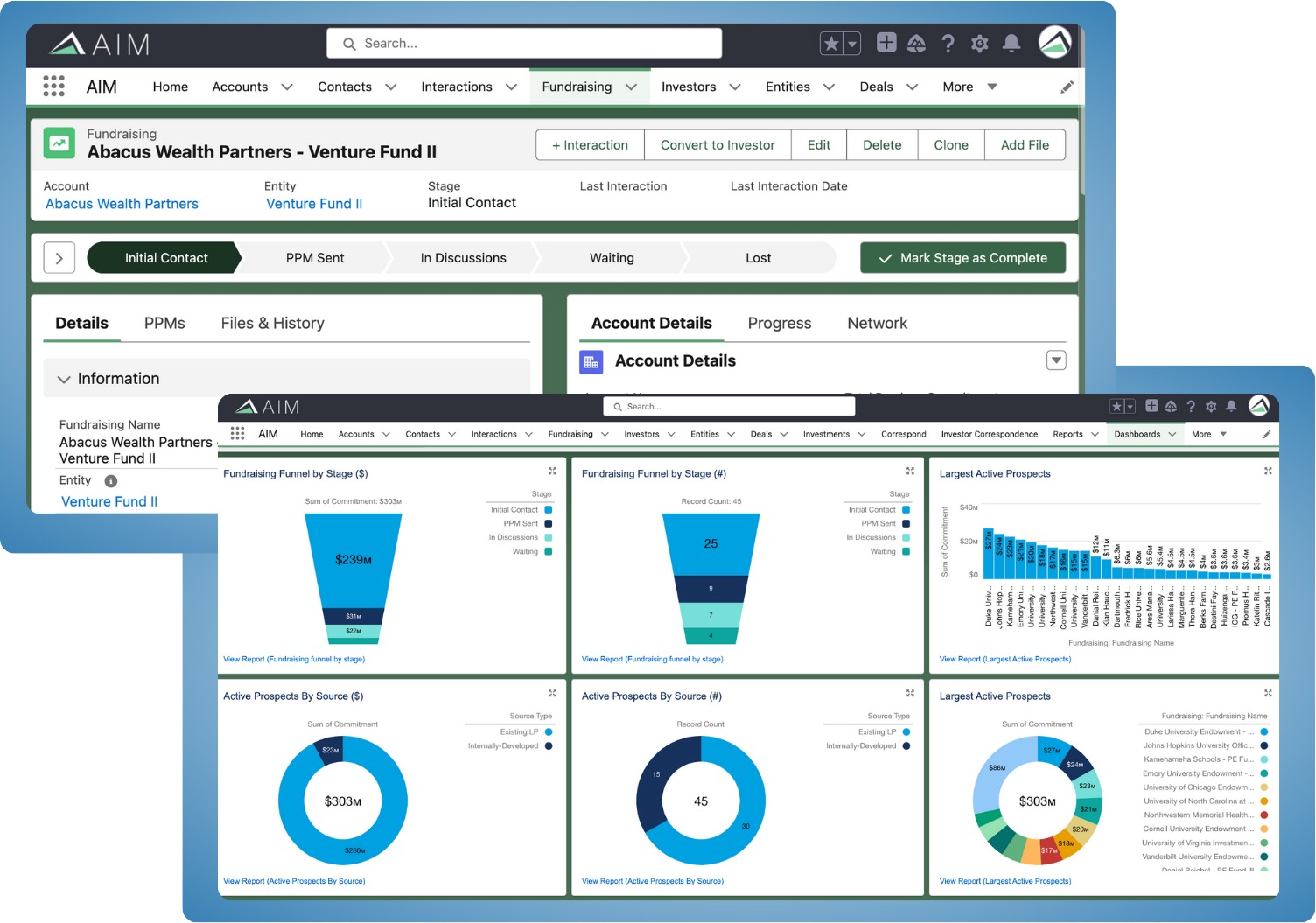

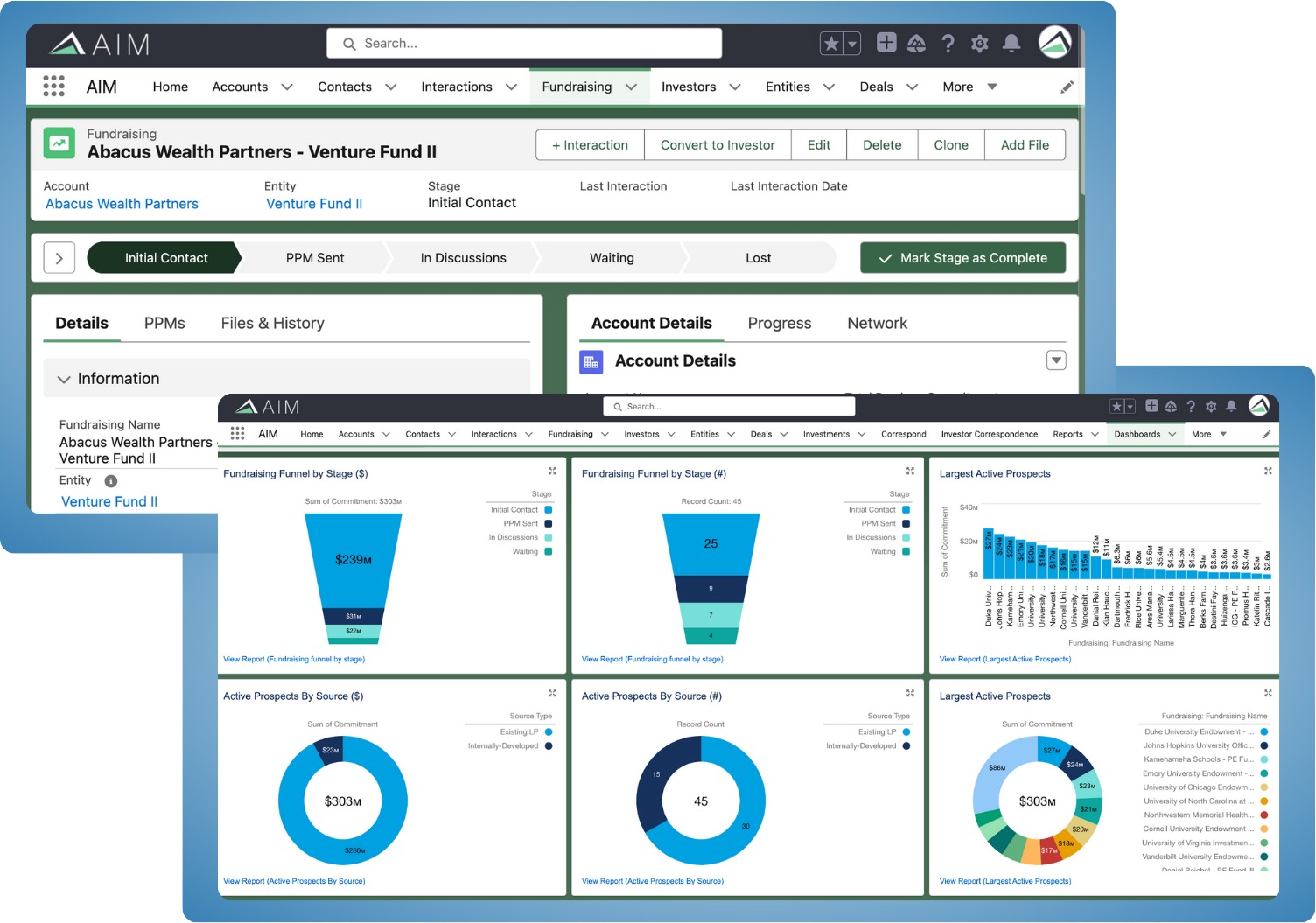

Fundraising is hard on its own for private capital markets, so it seems only fair that tracking prospects and committed investors shouldn’t add to the difficulty. Altvia’s AIM CRM guides you through the entire capital raising process to ensure absolute clarity and unprecedented detail on both prospects and investors, so you can focus on strategic and differentiated fundraising efforts.

- Have new and existing investor data at your fingertips at all times.

- Launch new fundraising efforts from previous fund data.

- Generate, distribute, and track PPMs automatically.

- Follow real-time fundraising progress with rich reporting.

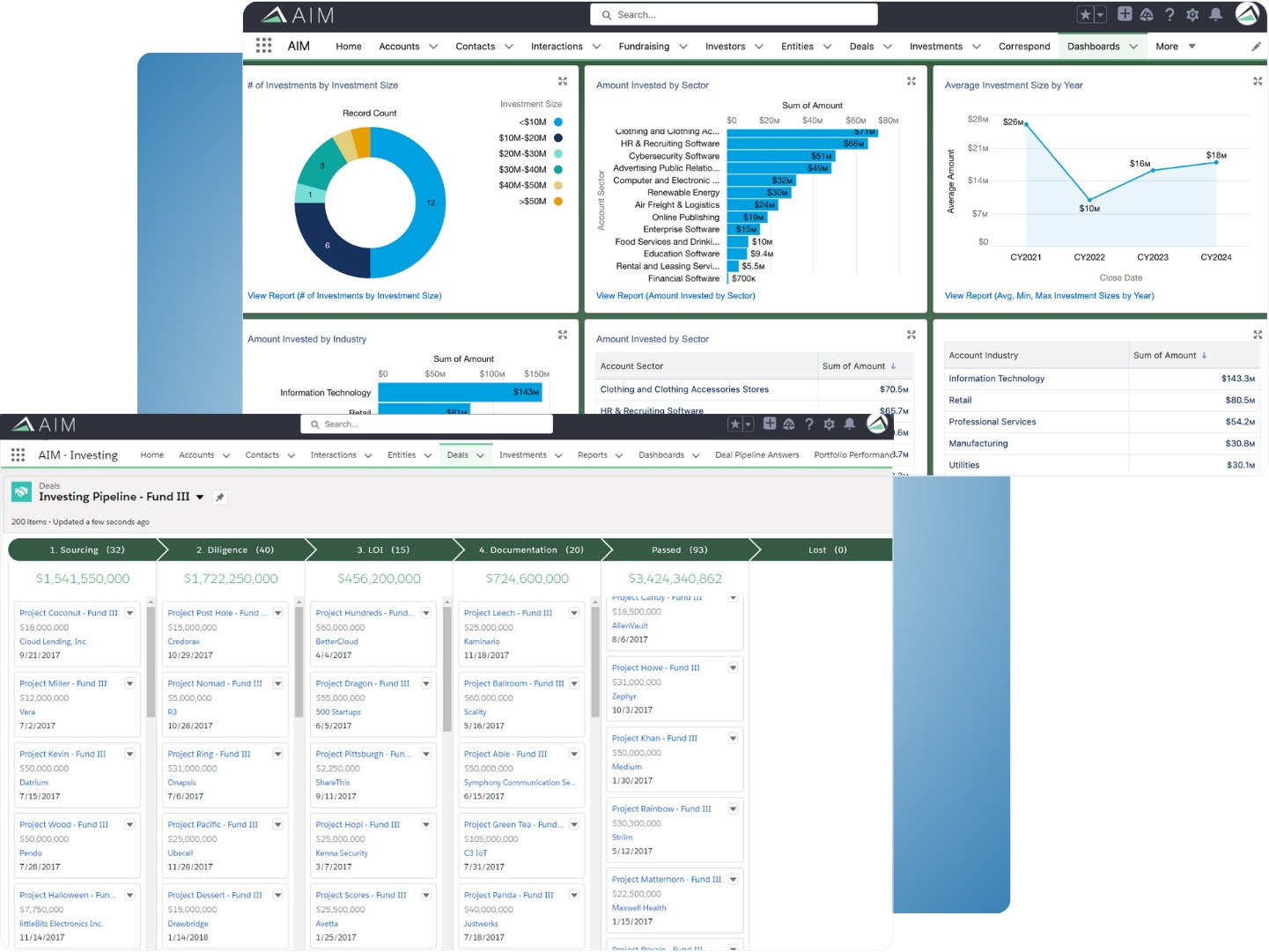

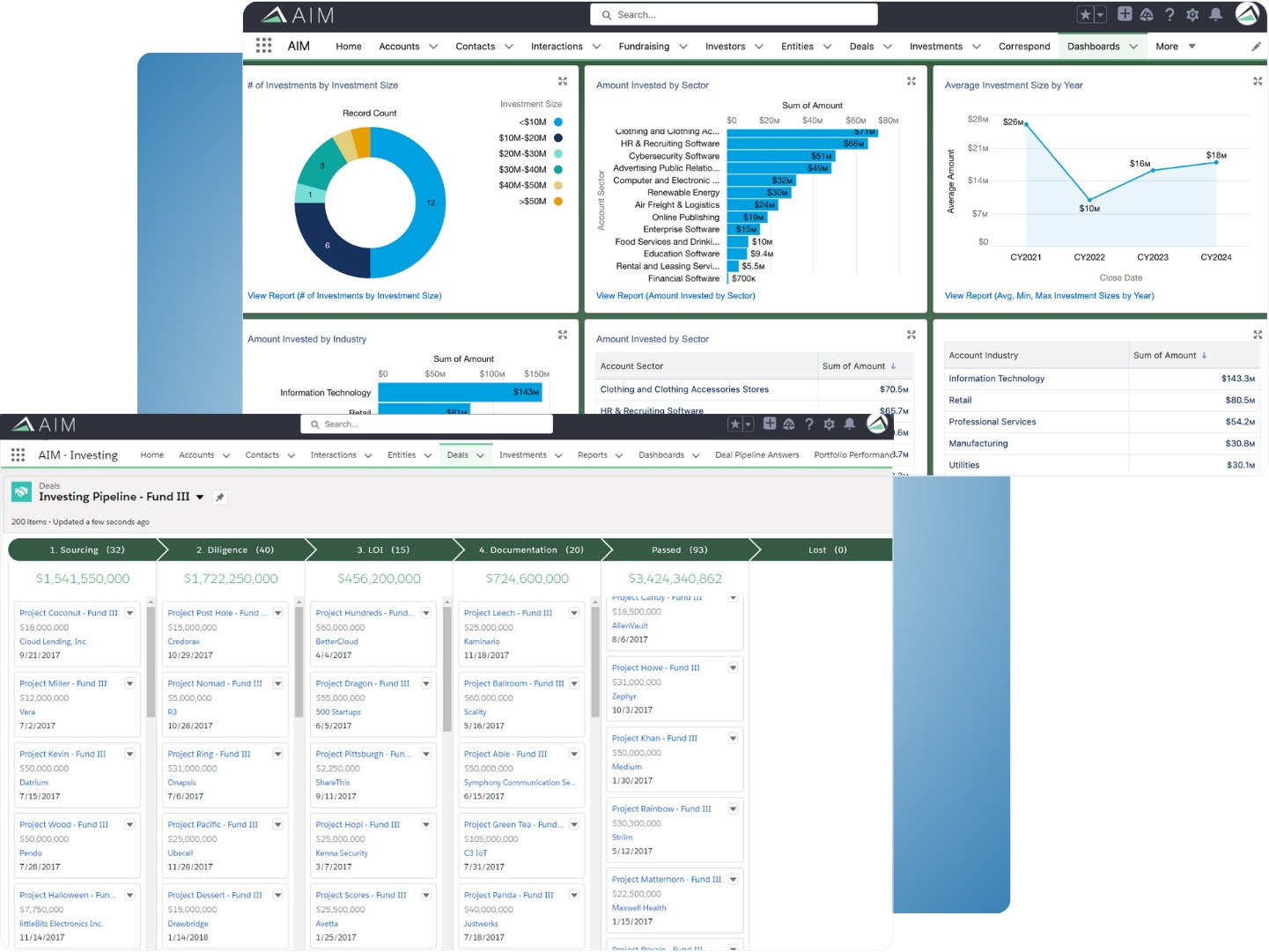

Navigating the dynamic landscape of dealmaking involves numerous complexities. Altvia’s AIM CRM streamlines the assessment of fund and direct investment opportunities, enhancing the entire deal flow process from sourcing to completion. With AIM, all crucial information on potential investments is at your fingertips, empowering you to make informed and efficient decisions.

- Enhance due diligence efficiency with tailored checklists designed for each evaluation stage.

- Uphold compliance standards through a structured process that aligns seamlessly with auditor and investor requirements.

- Extract insightful ratios for direct investments, providing a deeper understanding of their financial implications.

- Tailor tracking mechanisms to align precisely with your firm’s preferred stages, investment types, and asset classes.

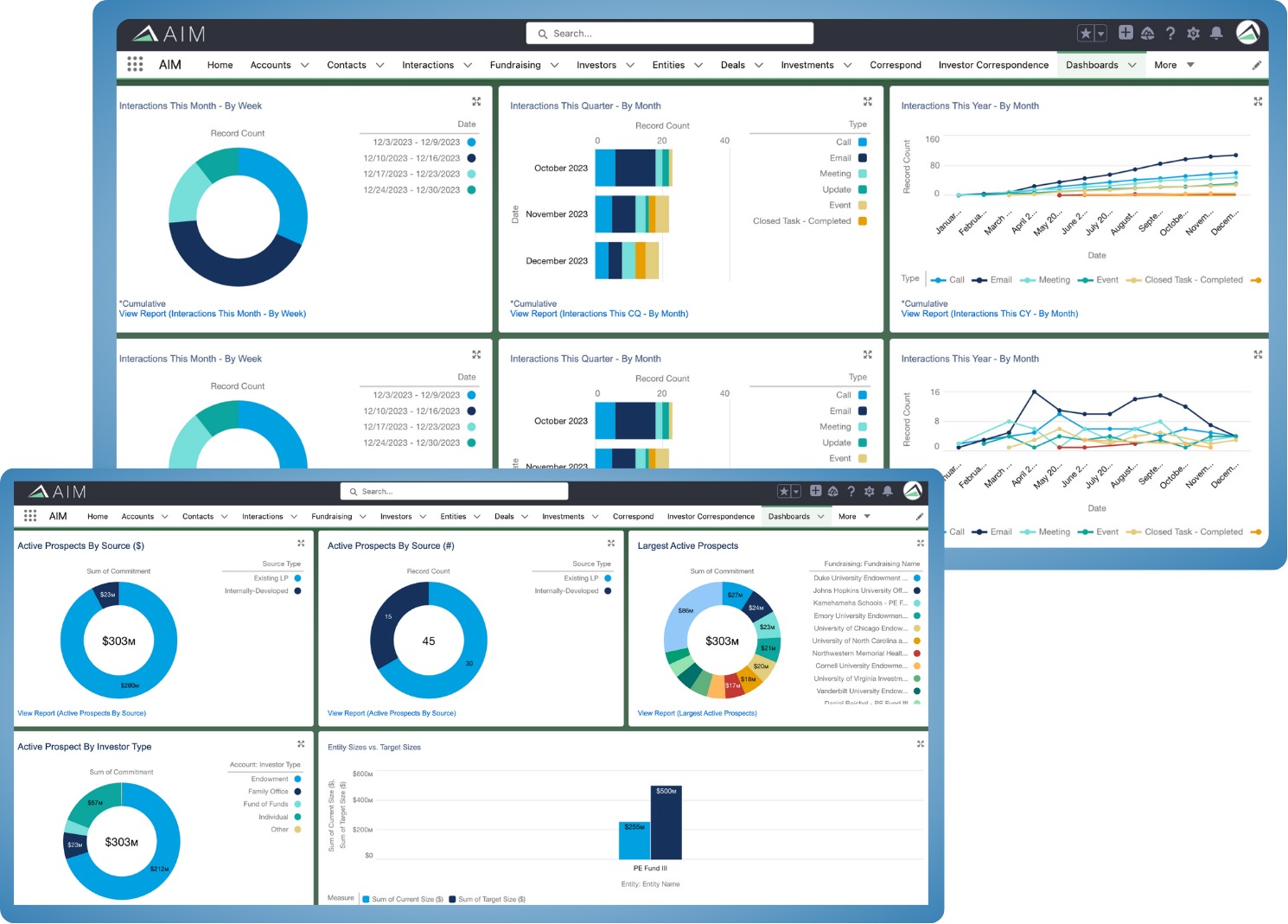

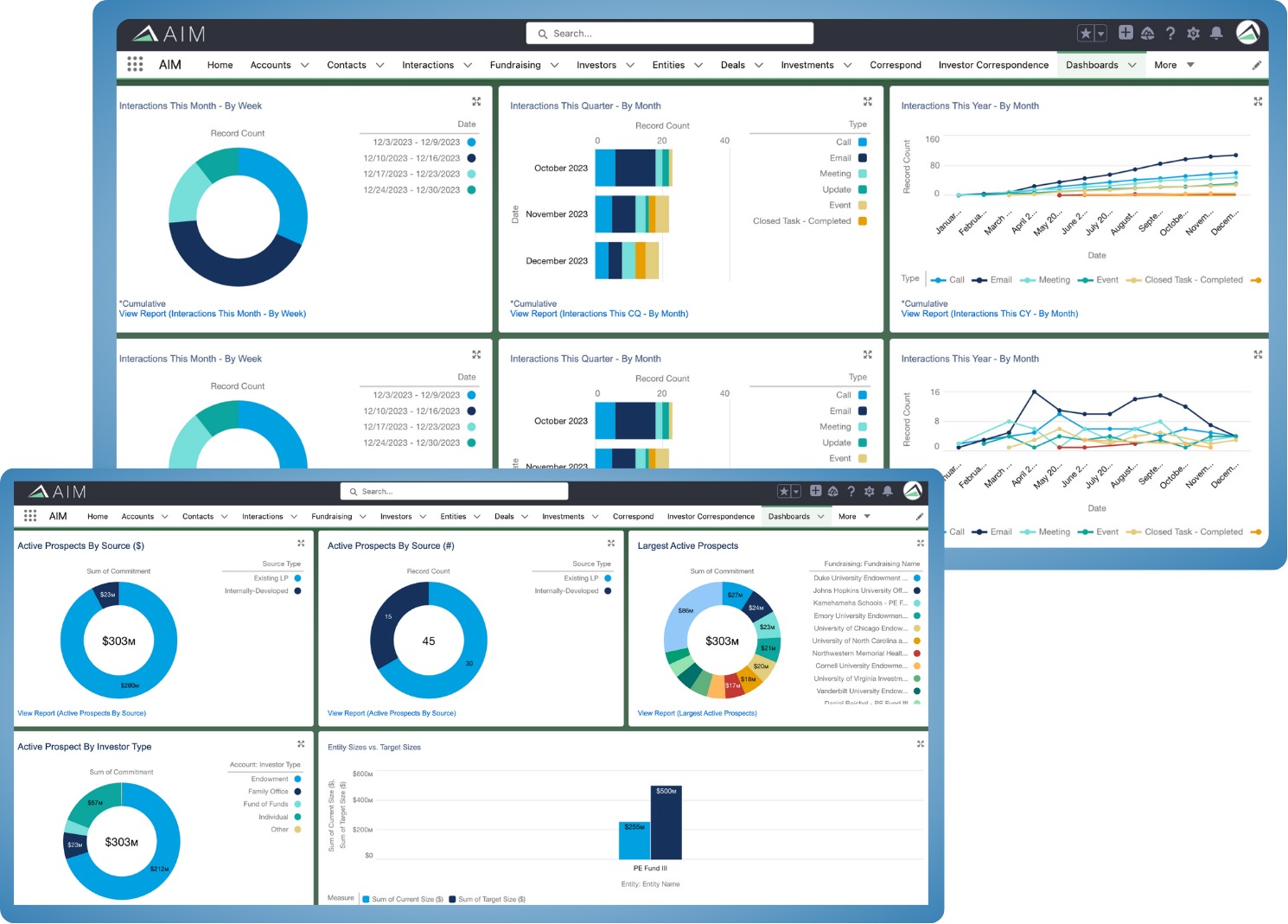

Stop looking at spreadsheets and see beyond the numbers by visualizing your firm’s data. Altvia’s AIM CRM helps to uncover opportunities that allow you to make informed decisions.

- Gain unparalleled insight into your deal flow sources, valuation trends, capital-raising, LP communications, and more.

- Leverage dynamic, easy-to-configure dashboards to derive insights.

- Harness the power of visual storytelling to close deals.

Ditch manual, error-prone data entry. Altvia’s AIM CRM transforms data chaos into organized efficiency, prioritizing smart engagement through proprietary interaction functionality for insightful connections that elevate your strategies.

- Automatic capture of customer relationship interactions.

- Track detailed notes on calls, meetings, and emails.

- Leverage in-app email notifications to keep your team aligned.

- Harness 360-visibility by connecting native force.com account and contact records to deals, funds, and investor records.

Fundraising is hard on its own for private capital markets, so it seems only fair that tracking prospects and committed investors shouldn’t add to the difficulty. Altvia’s AIM CRM guides you through the entire capital raising process to ensure absolute clarity and unprecedented detail on both prospects and investors, so you can focus on strategic and differentiated fundraising efforts.

- Have new and existing investor data at your fingertips at all times.

- Launch new fundraising efforts from previous fund data.

- Generate, distribute, and track PPMs automatically.

- Follow real-time fundraising progress with rich reporting.

Navigating the dynamic landscape of dealmaking involves numerous complexities. Altvia’s AIM CRM streamlines the assessment of fund and direct investment opportunities, enhancing the entire deal flow process from sourcing to completion. With AIM, all crucial information on potential investments is at your fingertips, empowering you to make informed and efficient decisions.

- Enhance due diligence efficiency with tailored checklists designed for each evaluation stage.

- Uphold compliance standards through a structured process that aligns seamlessly with auditor and investor requirements.

- Extract insightful ratios for direct investments, providing a deeper understanding of their financial implications.

- Tailor tracking mechanisms to align precisely with your firm’s preferred stages, investment types, and asset classes.

Stop looking at spreadsheets and see beyond the numbers by visualizing your firm’s data. Altvia’s AIM CRM helps to uncover opportunities that allow you to make informed decisions.

- Gain unparalleled insight into your deal flow sources, valuation trends, capital-raising, LP communications, and more.

- Leverage dynamic, easy-to-configure dashboards to derive insights.

- Harness the power of visual storytelling to close deals.

Hear Why Our Clients Love AIM CRM

“AIM helped us look at our data in a different way. We had been looking very high level and now we are able to break it down and be more specific. We have more accurate and more meaningful data – we can do everything more real-time. We are a lot more efficient.”

Adam Ciborowski

Vice President, RCP Advisors

Read a case study to hear how Altvia’s software can help you as your firm grows, your funds multiply, and your LP base expands.

Highlights

Cloud-based CRM with pre-built workflows built for the Private Capital Markets.

Lighting ready for fast navigation, powerful data visualization, and personalization.

Effectively manage day-to-day operations and compliance.

Desktop integration for Microsoft Outlook and Excel.

Mobile application for easy access to AIM data or log calls and meetings from your phone.

Purpose-built modules specific to Private Equity.

Integrated communications including mass or secure email services.

No database or hardware to maintain.

Resources

Email For Private Equity

AIM integrates with Outlook and Gmail to help you take your relationships to the next level.

Guide: Data For Private Equity

How private equity uses software and technology to gain a competitive advantage.

Blog: Efficiency For Fund Managers

Security, transparency and access to data are basic requirements for fund managers.

Case Study: RCP Advisors

RCP Advisors uses AIM to make better decisions with access to deeper insights and better reporting.

Want to get started?

We have a team of experts, with decades of private equity experience, to support system adoption and change management.