Answers

The preferred business intelligence solution for private capital markets.

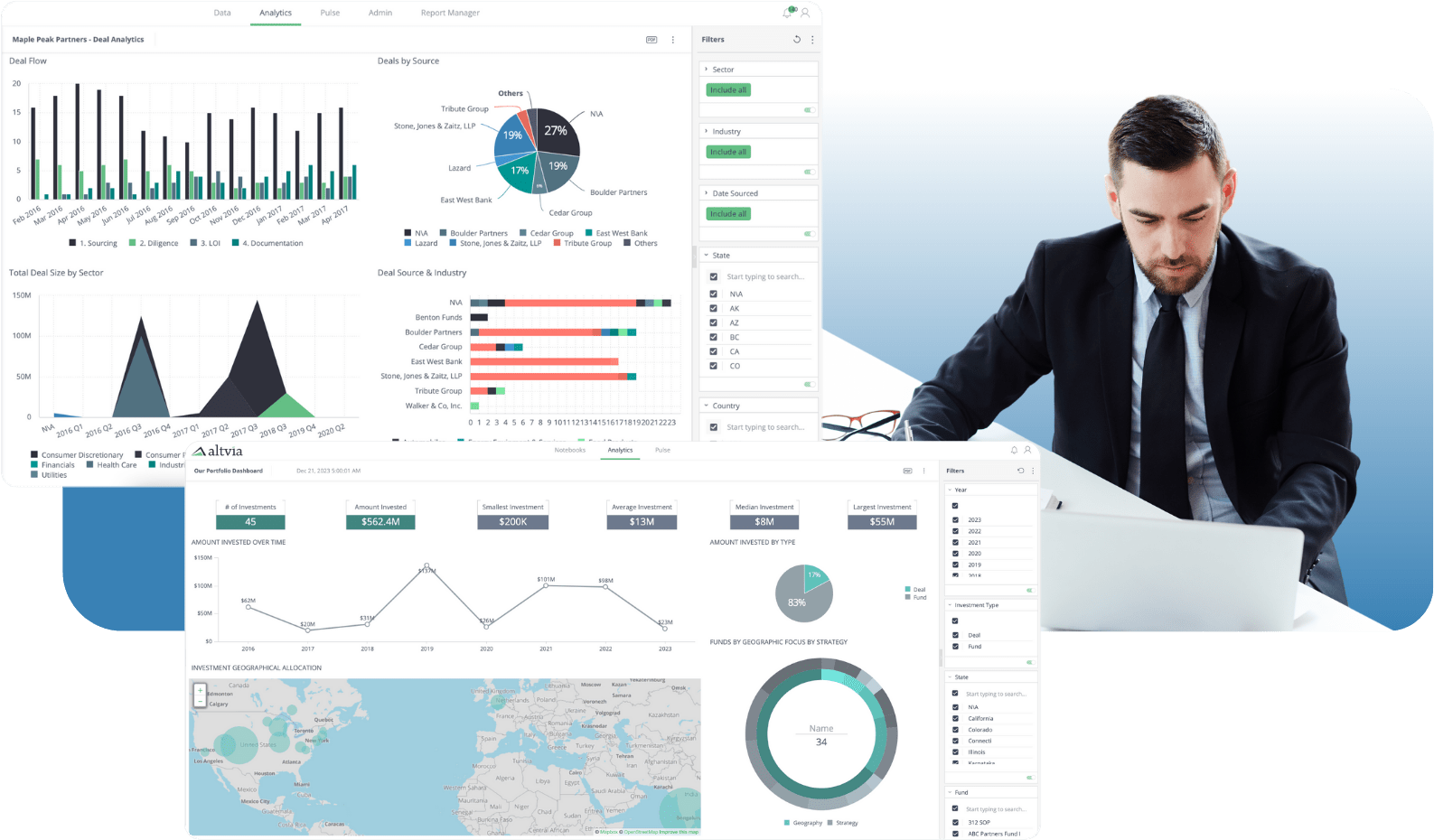

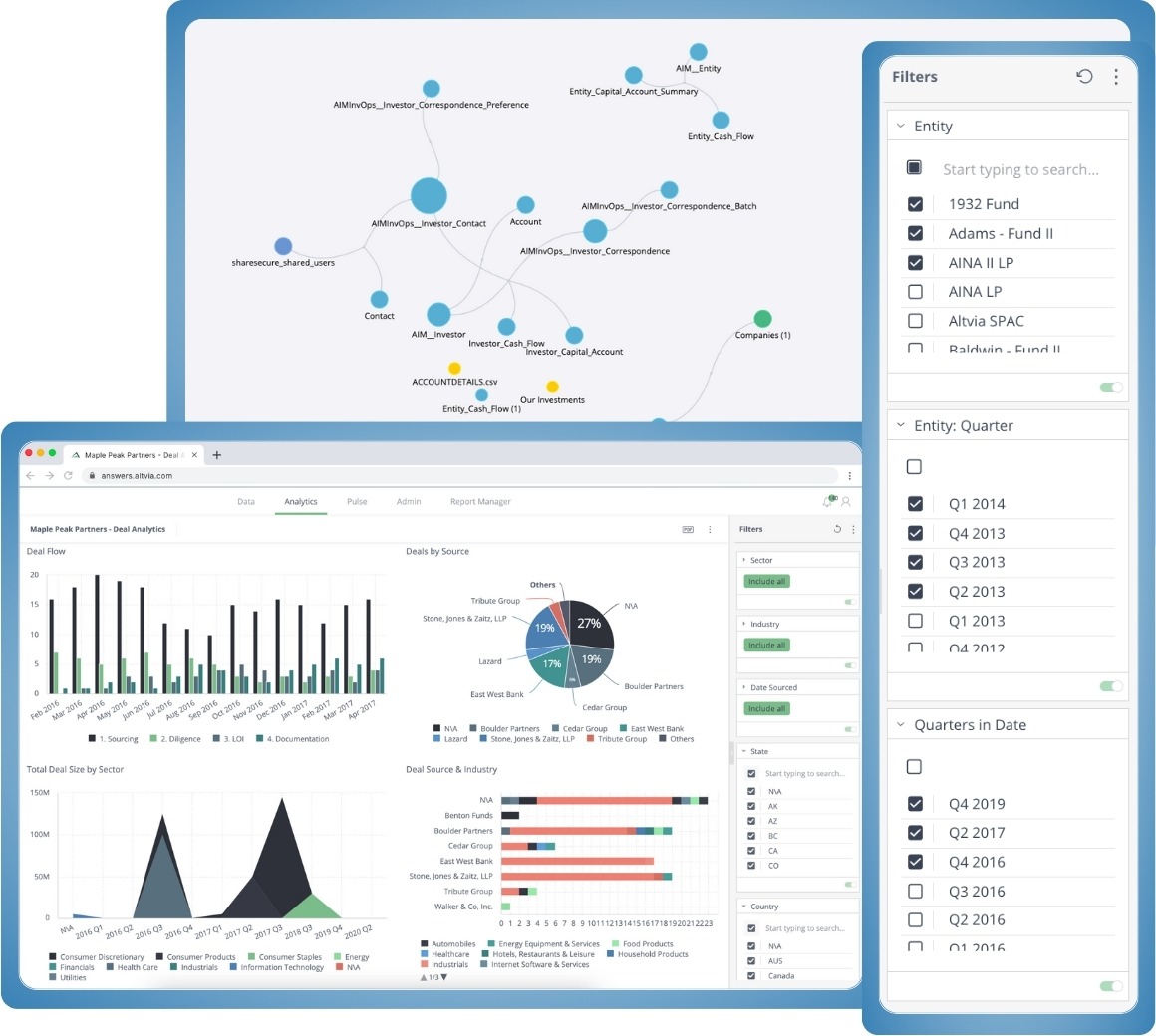

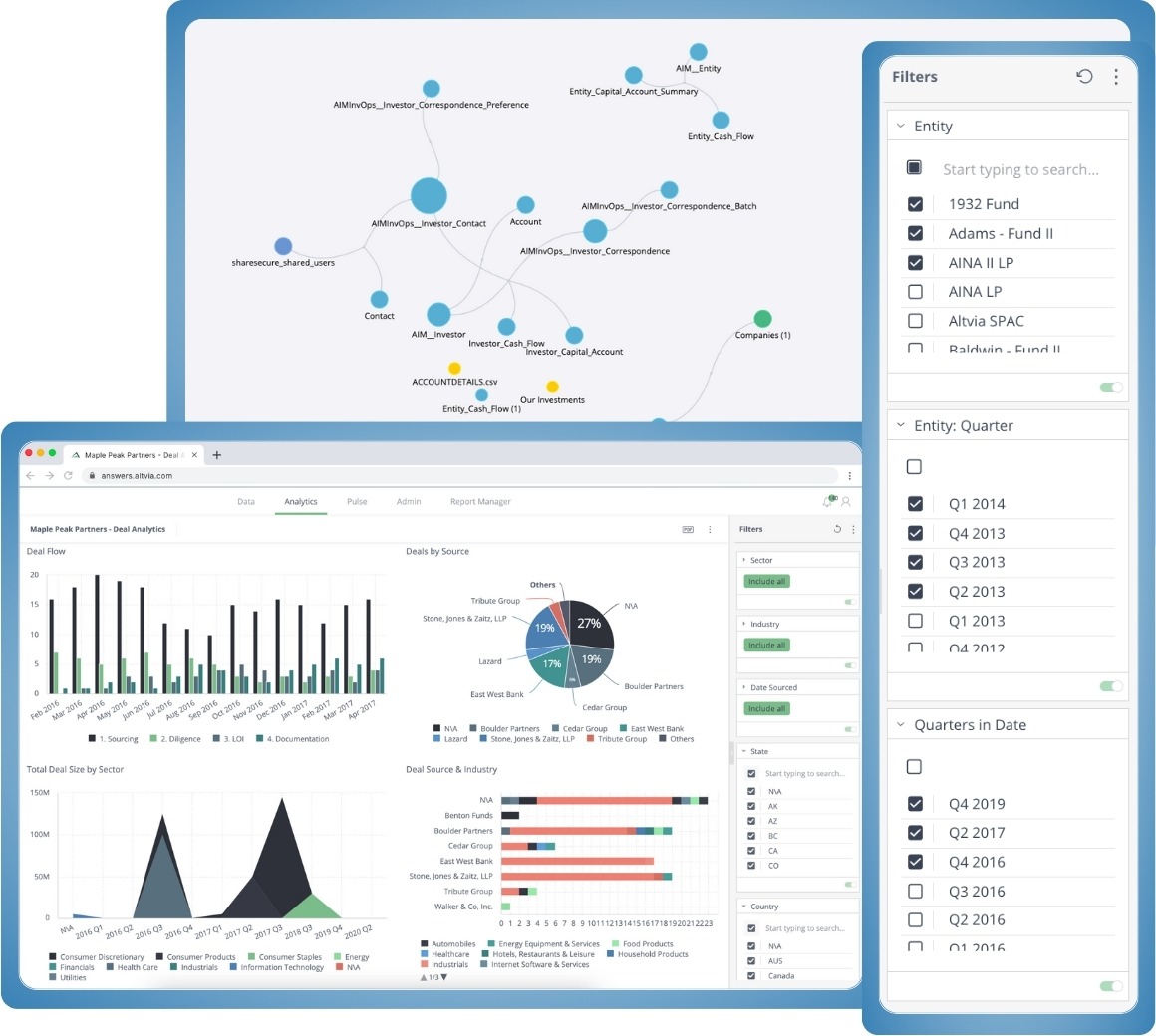

Analyze and understand complex data with intuitive data visualization.

A business intelligence solution for fast data analysis and reporting.

In the fast-paced world of GPs, the constant demand for swift and accurate information for internal and external reporting is paramount. Answers ensures you have precise data at your fingertips, providing a powerful advantage in streamlining data analysis and reporting. By eliminating manual and error-prone procedures, it enhances data transparency, enabling deeper insights and flexibility for informed and strategic decision-making.

With a unified data source, you can access real-time data to swiftly address any questions, eliminating frustration in delays of searching for scattered data sources. Save valuable time and deepen your data insights with a single source of truth that enables automation, facilitates impactful communication with both internal and external stakeholders, and drives transformative business outcomes.

- Seamlessly connect all of your firm’s data sources in one place.

- Real-time data connections eliminate the need for manual downloading and updating.

- Integrate with all your data sources, from flat files like Excel to software solutions such as AIM, Salesforce, Microsoft Dynamics, and more.

- Answers’ cloud-based functionality guarantees seamless operation without enduring extended wait times or loading delays.

Enhance your reporting efficiency by seamlessly filtering real-time data, eliminating the need for manual revisions stemming from outdated, scattered, and unreliable information. Unleash your data storytelling with a robust analytics tool that enables you to easily explore and visualize ‘what-if’ scenarios that uncover answers for any query.

- Reduce manual entry and opportunity for error.

- Dynamically filter, drill down, and explore data on the fly.

- Explore intuitive visuals and widgets as an end-user to tailor solutions that fit your firm’s unique data and business requirements.

Enhance the evaluation of fund and direct investment opportunities from inception to completion. Answers consolidates all essential information related to potential investments, including deal specifics, fund details, and due diligence, empowering you to make well-informed and strategic decisions. As well as monitor performance metrics over time, such as valuation information and key indicators.

- Ensure rigorous compliance through a structured process for auditors and investors.

- Calculate insightful ratios for direct investments.

- Customize tracking to align with your firm’s preferred stages, investment types, and asset classes.

With a unified data source, you can access real-time data to swiftly address any questions, eliminating frustration in delays of searching for scattered data sources. Save valuable time and deepen your data insights with a single source of truth that enables automation, facilitates impactful communication with both internal and external stakeholders, and drives transformative business outcomes.

- Seamlessly connect all of your firm’s data sources in one place.

- Real-time data connections eliminate the need for manual downloading and updating.

- Integrate with all your data sources, from flat files like Excel to software solutions such as AIM, Salesforce, Microsoft Dynamics, and more.

- Answers’ cloud-based functionality guarantees seamless operation without enduring extended wait times or loading delays.

Enhance your reporting efficiency by seamlessly filtering real-time data, eliminating the need for manual revisions stemming from outdated, scattered, and unreliable information. Unleash your data storytelling with a robust analytics tool that enables you to easily explore and visualize ‘what-if’ scenarios that uncover answers for any query.

- Reduce manual entry and opportunity for error.

- Dynamically filter, drill down, and explore data on the fly.

- Explore intuitive visuals and widgets as an end-user to tailor solutions that fit your firm’s unique data and business requirements.

Enhance the evaluation of fund and direct investment opportunities from inception to completion. Answers consolidates all essential information related to potential investments, including deal specifics, fund details, and due diligence, empowering you to make well-informed and strategic decisions. As well as monitor performance metrics over time, such as valuation information and key indicators.

- Ensure rigorous compliance through a structured process for auditors and investors.

- Calculate insightful ratios for direct investments.

- Customize tracking to align with your firm’s preferred stages, investment types, and asset classes.

Hear Why Our Clients Love Answers

“Answers has been the solution to what every GP wants, ‘Can’t I just click a button to get the information I need?’ Previously, that wasn’t an option. But, with Answers filtering capabilities, GPs can do exactly that.”

Kelli Fontaine

Partner, Cendana Capital

Read a case study to hear how Altvia’s software can help you as your firm grows, your funds multiply, and your LP base expands.

Highlights

Cloud-based, Business Intelligence Solution.

Powerful data visualization and personalization.

Eliminate risk by ensuring a single-source of truth.

Integrate with virtually any data source: Excel, AIM, SF, etc.

Mobile responsive for easy access to data.

Purpose-built for Private Equity.

Continuous refreshing of data analytics.

No database or hardware to maintain.

Resources

CRM For Private Equity

AIM is a holistic, industry specific CRM built for Private Equity on the Salesforce platform.

Guide: Data For Private Equity

How private equity uses software and technology to gain a competitive advantage.

Blog: Automate Investor Relations

Use automation to optimize administrative tasks and follow up and focus on relationships.

Case Study: LFM Capital

LFM makes the switch to Altvia to maximize deal sourcing and third-party app integrations.

Want to get started?

We have a team of experts, with decades of private equity experience, to support system adoption and change management.