In Private Equity, the quality of your interactions, or meeting notes with investors, is one of the most critical factors in whether they choose to invest. And because multiple individuals and teams throughout your organization will likely play a role in securing the investment, everyone must be able to quickly retrieve and review the content of any interaction or note at any time from a single source of truth.

This means that your customer relationship management (CRM) system must-have functionality for recording and managing interactions effectively. Specifically, the system should enable you to:

- Track communications efficiently. What was communicated? From and to whom? When, why, and in what medium (email, phone call, in-person meeting, etc.)?

- Relate or link interactions to multiple records. One interaction may be associated with or influence several contracts, deals, co-invests, fundraises, or investor records for potential limited partners. And if the investor you’re currently communicating with is linked to multiple funds or portfolio companies, you want to know.

- Provide transparency. Often, heads of Investor Relations or Deal Teams will ask about deal sourcing or outbound call activity, even coverage across intermediaries or LPs, and interactions help you answer those questions. They are also an essential source of information in the area of compliance.

- Manage relationships effectively. Interactions help you improve the way you nurture relationships, and ultimately raise and deploy more capital.

Without purpose-built private equity technology that includes these capabilities, you risk losing potential investors to firms that do a better job of developing a strong connection with them.

One Measure of the Importance of Interactions: 5.3 Million Entries and Climbing

At Altvia, we are, as you would expect, a data-centric company, and we track data trends very closely. One measure of the importance of interactions is that across all of the clients that use our private equity CRM, the number of interactions entered is over 5.3 million and climbing rapidly. In fact, the system’s interaction tracking capability is one of its most highly leveraged features.

6 Best Practices for Managing Interactions

When using an interactions feature, there are six best practices that we’ve identified that allow users to maximize the benefit of that functionality. They are:

1. Have all users make entries in the system. Clients will sometimes ask us if it’s better to have one administrative person or a few people tasked with recording interactions based on information provided by other users. We’ve found that that approach can create a logjam that prevents entries from being added promptly. Plus, having each user make their own entries encourages them to check out and leverage the information that’s already in the system.

2. Use descriptive subjects. It’s easy to give an interaction a one-word subject like “Meeting” or “Call.” However, it’s not particularly helpful to someone who is browsing through subject lines to have dozens or hundreds of meetings logged. Users get much more out of the system when the subjects are detailed.

3. Enter detailed notes. As with subjects, the more detailed the notes for an interaction are, the more benefit other users get from the entry. It’s a good idea to reread an entry you’ve just written as if you are someone with no knowledge of the interaction to see if you can make sense of it. Detailed notes are also important for transparency around what has taken place.

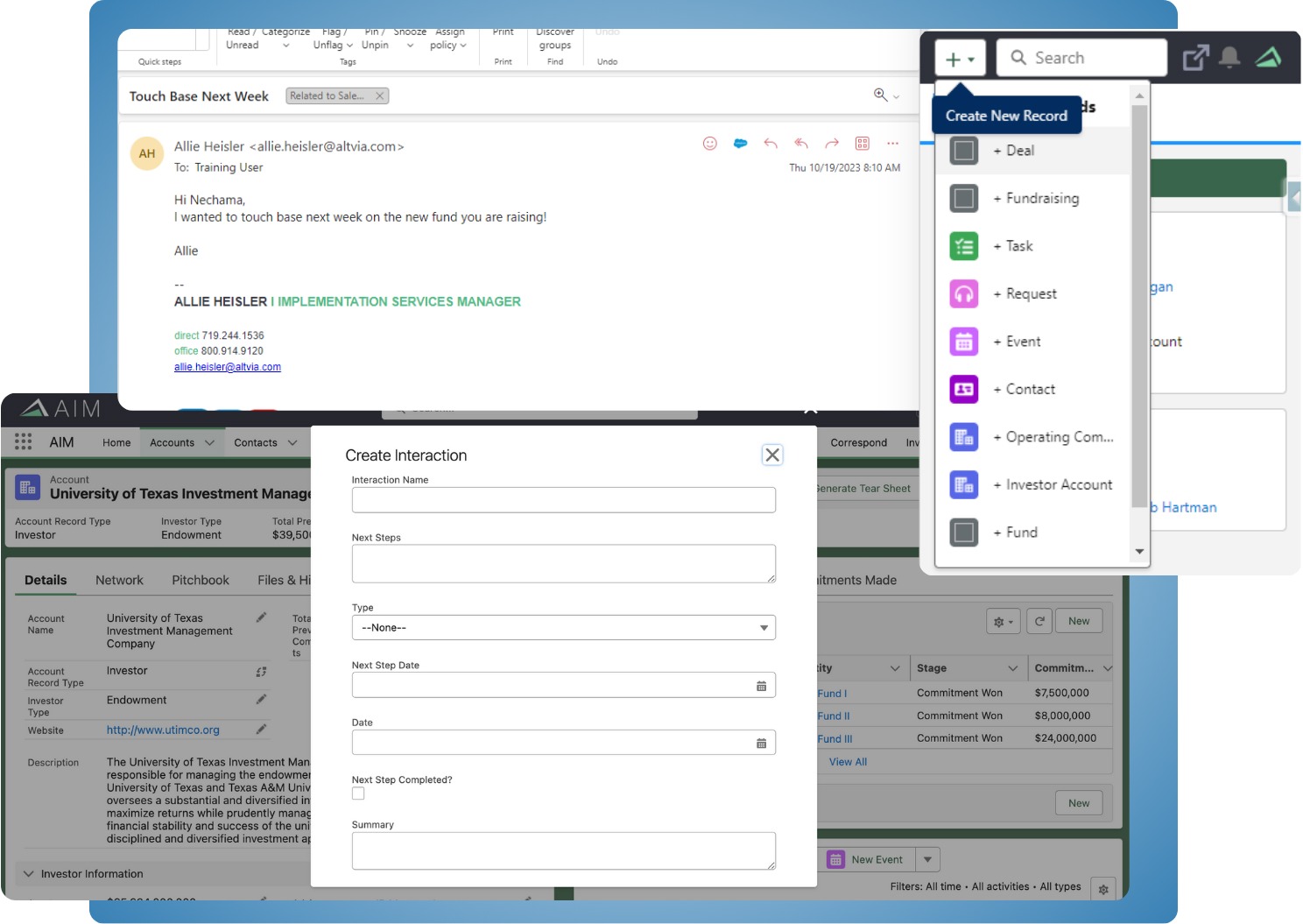

4. Develop a standard process. What types of information should be entered as interactions and at what point? For example, should every email be logged, or is it better to wait until an email conversation has run its course and log the entire thread? Reaching a consensus among stakeholders at your firm and then educating all users on the process you come up with is very helpful. See our image below for an example how your firm can create an interactions process.

5. Use the cascade feature. An interactions feature should have automation that simplifies the process of making entries. You should leverage that automation whenever you can.

6. Ensure that you are entering meaningful interactions. While you want to capture important information, recording absolutely every time you connect with an investor or other stakeholder can create unwanted “noise” in your system. Every interaction may be a candidate for entry, but then you need to focus on recording only information that will help with decision making and next steps.

Experience Interaction Management for Yourself

The best way to understand the value of the interactions feature in Altvia is to see it in action. Learn why top tier firms turn to Altvia for their private equity technology and improve the efficiency of your processes with an industry-specific platform. Request a demo today or see how firms like yours partner with Altvia.