Altvia Correspond Market Edition

Dynamic Email Solution Built for prospecting, fundraising, deal announcements, roadshows, and more.

Our market is so relationship driven—we really get to know our business partners and understand their needs. With Altvia, it’s clear that they value having a relationship that comes along with the software.

Michael Painter, Plexus Capital

How Market Edition Helps Firms

Increased market competition for deals and capital in Private Equity has uncovered opportunities to strengthen and grow your network as a competitive advantage. Altvia Correspond Market Edition, an end-to-end system, gives you the key features of a mass email application built right in your CRM.

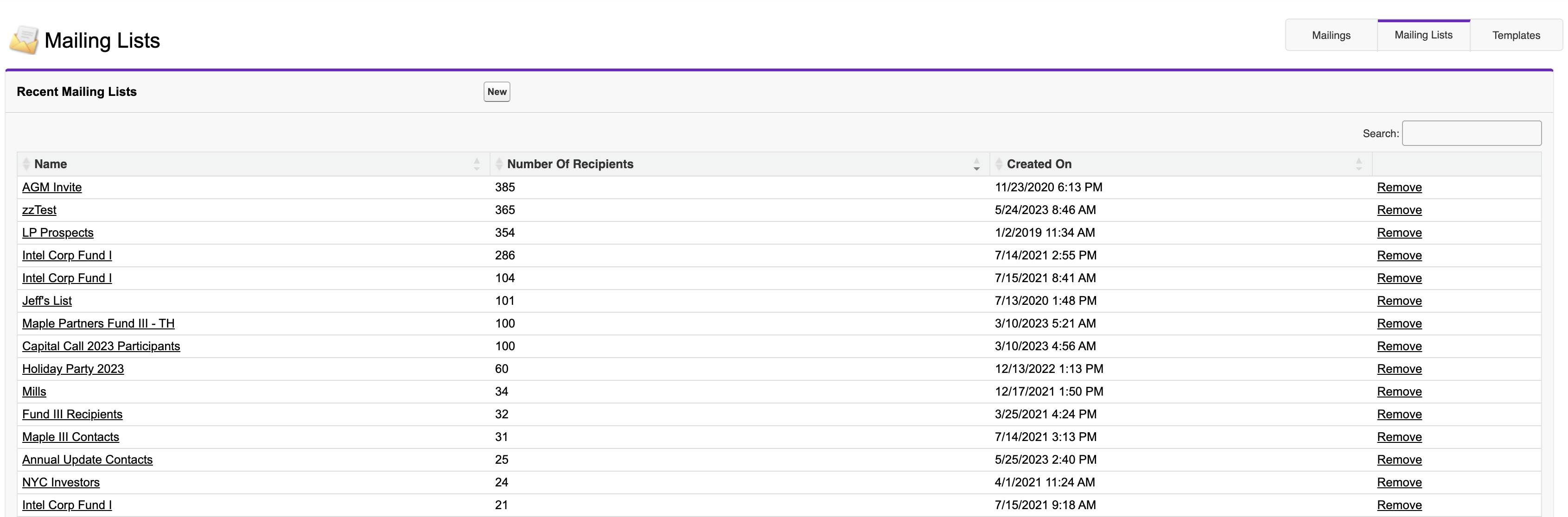

Ensure the accuracy of your mailing lists and save time with reports to add contacts. Market Edition allows your team to effectively manage communications for prospecting, fundraising, deal announcements, and roadshows through seamless sync between your systems.

Engage With Your Network Straight From Your CRM

Save time with your mailing lists and easily ensure accuracy using reports to create lists. Quickly refresh for updates or manually add contacts on the fly. Create beautiful emails with the email template library and preview for quality assurance. Use one central system to seamlessly manage your mass communications for prospecting, fundraising, deal announcements, roadshows, and more.

- Smart list builder with real-time contact syncing

- Capacity of 50,000 contacts per send

- Auto de-duplication and advanced scheduling

Understand Performance with Advanced Reporting

Glean the most up-to-date information about your outreach with email analytics. For each mailing, you can quickly determine what percentage of recipients have received, opened, and clicked through your email. Make more informed decisions for deals and fundraising with the ability to drill down to individual contact performance stats.

- Full-mailing and individual delivery metrics

- Click tracking for any link included in your emails

Maintain Data Privacy and Compliance

Altvia Correspond Market Edition is designed with compliance requirements in mind. Unsubscribe functionality allows users to immediately opt-out of future mailings, and email tracking allows you to be sure of exactly what you’ve sent to whom.

- Internal compliance monitor with BCC’s

- Unsubscribe technology and tracking

- Support compliance efforts with our Altvia team

Full Lifecycle Communications with Investor Edition

Whether you need to mass email contacts or exchange communications and documents with your investors, Investor Edition paired with Market Edition provides a full spectrum of tools in one system to easily send personalized communications and take your relationships to the next level.

- Built on your CRM to visualize end-to-end communications

- Generate and split investor documents

- Publish to your LP Portal and ensure compliance and security

Highlights

Create dynamic smart lists directly from CRM data

Flexible and responsive email templates

Grow relationships with personalized communications

Smarter decisons with enhanced analytics

Support deal sourcing and investor relations teams

Integrated communications including mass or secure email services

Reach up to 50,000 contacts from one send

Compliance monitoring and tracking

Want to get started?

We have a team of experts, with decades of private equity experience to support system adoption and change management.