Private Equity technology is advancing at a breakneck pace, forever changing the way we do business.

While the Private Equity (PE) industry has been notoriously slow to adopt new technology, that is changing. From the Blackstone Group to TPG Capital, more PE firms recognize how investor relations technology is transforming the industry.

The EY 2020 global private equity survey found that CFOs at PE firms are increasingly tasked with leading the effort to find new ways to deploy innovative technologies. The technologies that they choose streamline everything from data management to compliance reporting.

Investor relations, specifically, is an area that has seen high adoption rates. 62 percent of PE CFOs invested in investor relations software in 2018—showcasing an industry-wide move towards leveraging technology to manage their most important relationships.

The CFOs leading the charge towards technology will also be called upon to demonstrate the ROI for the technology they adopt. In order to do so, the technologies that firms choose need to address the top five problems that PE firms experience and be able to illustrate an impact on the bottom line.

The Top 5 Problems Firms Can Solve with Private EquityTechnology

- Appearing Outdated to Investors

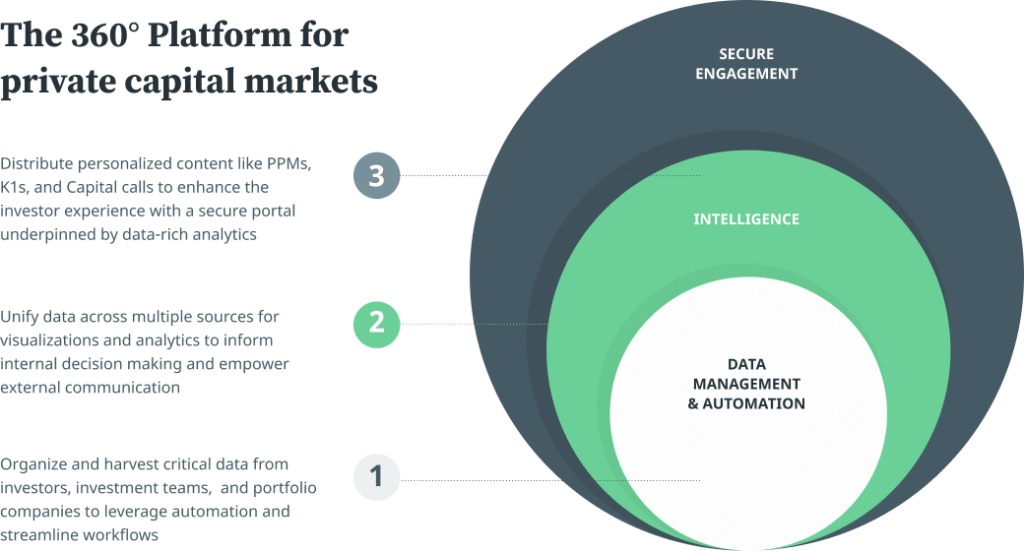

Being “old school” in PE is not a good thing. Lack of technology in investor relations becomes apparent to investors by an obvious lack of organization. Those using technology know more about their investors, can closely manage the sales pipeline, provide data visualizations, and easily communicate portfolio metrics and forecasting. Without the ability to quickly complete these tasks, PE firms appear disorganized and damage their reputation and ability to raise capital.

- Slow Process for Audits and Compliance

Time is money. What PE technology can do in seconds could take humans hours, days, or weeks. Technology reduces the margin for error. That’s super important when it comes to audits and compliance. Firms can speed up these costly processes and concentrate on more lucrative activities with the right technology partner.

- Failing to Do the Proper Due Diligence

The due diligence process represents a priceless opportunity to gather information about potential investees. Firms use the information collected in the due diligence phase to make an informed decision before investing. Technology can help manage these fund details and support a firm’s investment decisions—helping them avoid potential disasters and potentially locate a diamond in the rough.

- Lack of Transparency in LP Communications

Many firms claim that hiring good people is their secret ingredient to building lasting relationships—which ultimately leads them to success. Not to say those good people aren’t necessary, but there is only so much any one person can do. Intuitive solutions like Altvia give customers, investors, or constituents easy, self-serve data access and important functionality right on their desktop. This transparency removes time-consuming back-and-forth and gives everyone what they need to know at their fingertips.

- Information Gets Lost in the Shuffle of Multiple Systems

Centralizing your data, research, and history of relationships creates more focus for your firm and puts everyone on the same page. With a single source of truth, not only do firms drastically increase efficiency, but they also experience new insights, better decision making, and streamlined communication.

Avoid These Problems and Increase ROI with Private Equity Technology

Solving these five most common problems eliminates headaches and makes firms drastically more informed and efficient—leading to less waste and more revenue. With the right technology in place, organizations will be ready for healthy growth and better prepared for whatever storm lies ahead.

If you’ve been putting off the work to incorporate technology into your organization, the time has run out. Now is the time to invest in a transformation. If you’re interested to see how a private equity technology solution could work for your firm, contact Altvia today.