Deal Flow Management

The premiere solution for deal teams to manage, track, and report on investment pipelines.

Deal Flow Management

One logical location for tracking every piece of information your firm has on a potential investment—deal information, fund details, and due diligence.

Track Portfolio Investments

Gain better insight on deal progress and velocity with deal tracking capabilities. View metrics and fund holdings to store portfolio details.

Custom Reporting & Data Analytics

Reduce manual entry and instantly download sophisticated, print-ready reports to create a positive experience for your partners.

“We are more disciplined, more accountable and we are finding more ways to be smarter about how we generate deal flow.”

Michael Painter

Managing Partner, Plexus Capital

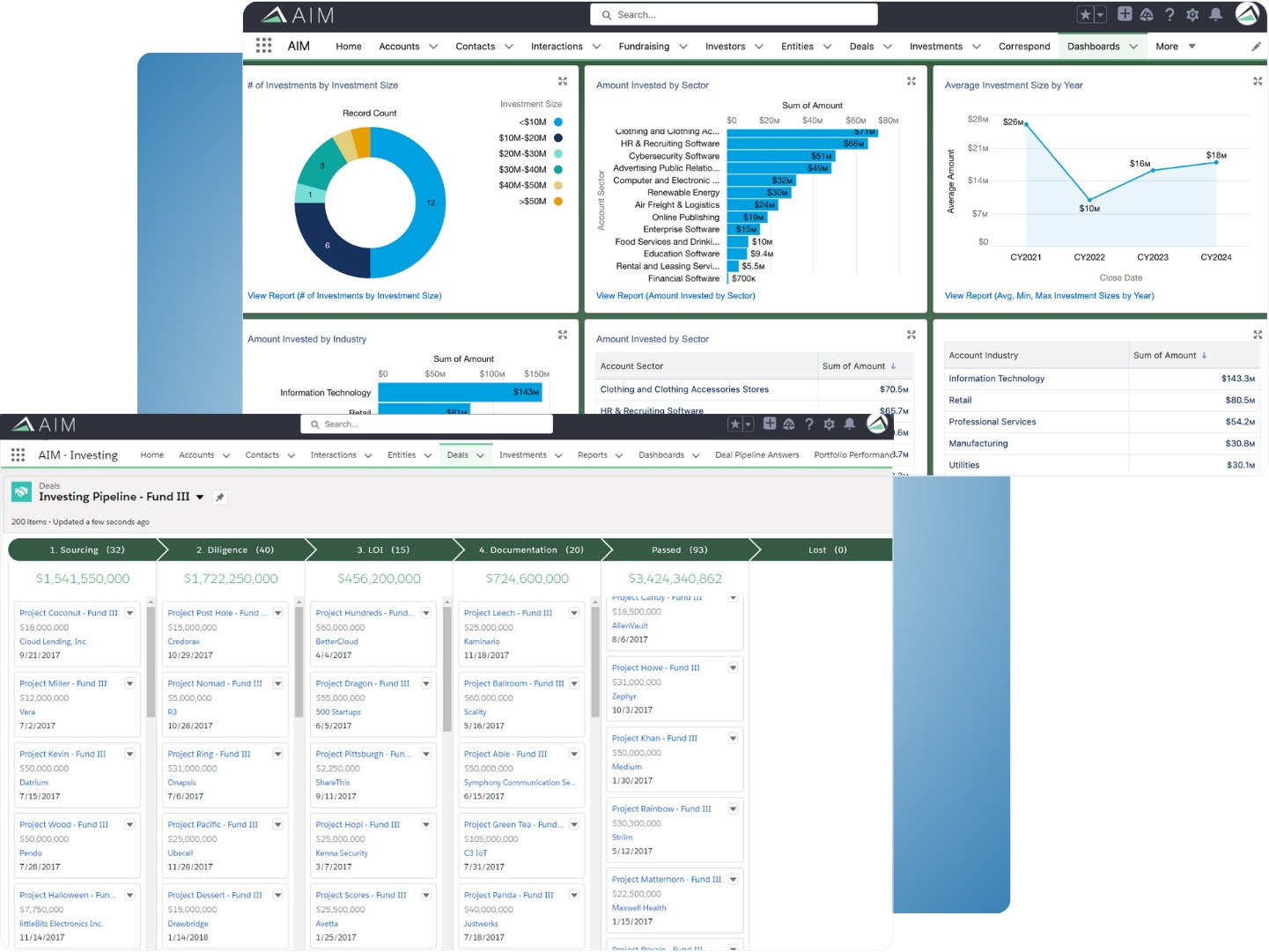

AIM Investment Sourcing

Deal Flow Management

AIM delivers clear insights on deal stages and which member of the deal team is managing each relationship optimizing the evaluation process of both fund and direct investment opportunities from sourcing to completion.

- Deal tracking functionality allows for detailed tracking of deals that come into your funnel, respective stages, personnel involved, and more

- Clear next-step indicators with logged interactions from emails, notes, and phone calls within each prospective account

- Define and streamline due diligence efforts using customizable checklists for different stages of the evaluation process

Deal Tracking

Track Portfolio Investments

Search, load, and organize your investors and track interactions and meetings in one source of truth.

- Track performance metric of investments in a structured fashion and refer back to them at any point

- Purpose built functionality to track portfolio investments allows your deals to be differentiated by type

- Custom fields allows you to store portfolio details to the level that your firm requires

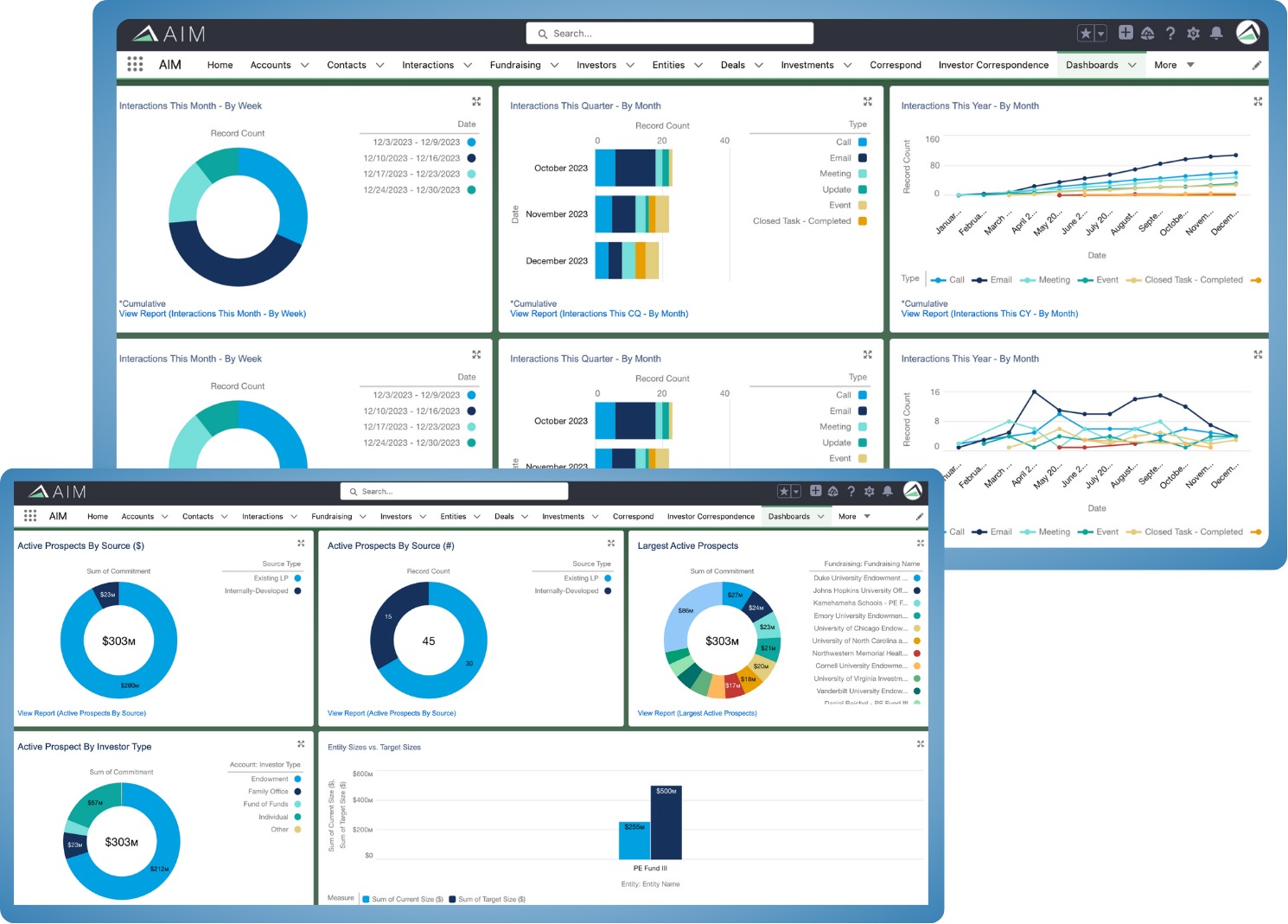

Reporting & Analytics

Custom Reporting & Data Analytics

Gain more insight by using rich reports and dashboards to your deal flow sources, valuation trends, and geographical and sector analysis, so you can prepare better, more accurate forecasting for your firm.

- Easily drill down report views from the entity, to the fund, to the fund holdings

- Mobile access to reports, dashboards, and deal records with the current stage path

- Create sophisticated, print-ready reports with the ability to export data out of AIM and into Excel