It’s increasingly imperative to be strategic and differentiate your firm. Our focus is on redefining the relationship between GPs and LPs with upgraded products to reduce the time on investor demands and communication.

We believe that technology is the most efficient way to provide a better investor experience with minimal additional effort, and we’re thrilled to announce an all-new, improved version of Correspond Investor Edition in 2020.

Here are 6 new features designed to help you better audit documents and offer more flexibility to track and send documents.

Filter from Reports

Problem it solves: In some cases, users have subgroups within a single entity (ie, GPs and LPs) and need to send a different static doc to each group. One current workaround is to attach the sponsor group doc to all the investors in the batch and remove that doc, one-by-one, from the investors who shouldn’t get it. Not only is this process tedious, but it also leaves room for error. The user then has to repeat the process for the second group’s static document.

How it works: Using a Salesforce report, users can now choose a subset of an entity’s investors as recipients.

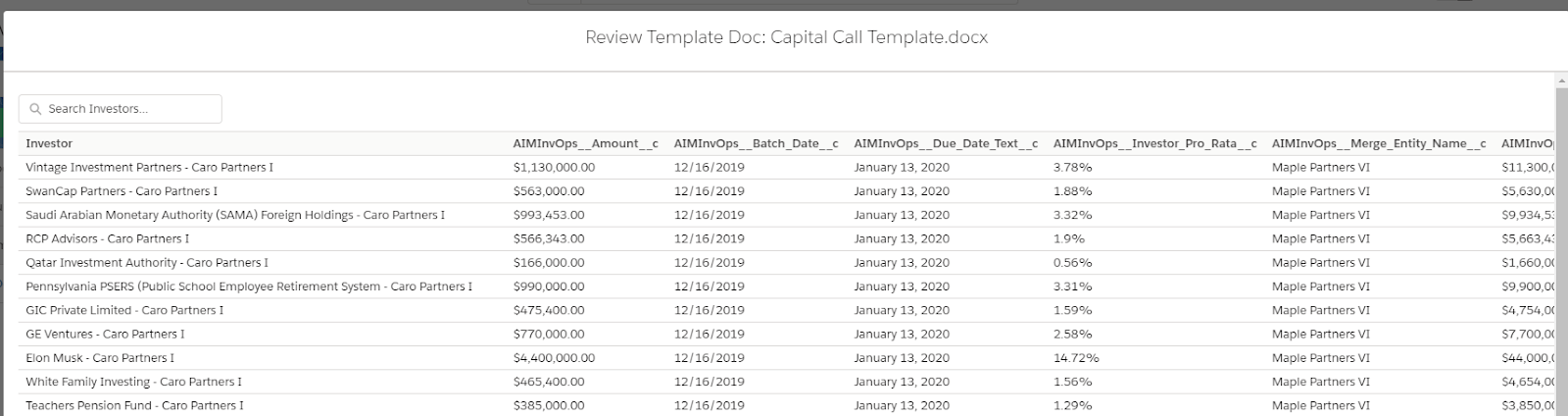

Merge Data Inspector

Problem it solves: Users populating merge data using tools like XL Connector may have varying degrees of experience/comfort with data loading. Historically, users have to spot check their work by generating documents and opening PDF by PDF, which is time-consuming and tedious.

How it works: Once users have generated a document from a template, we’ll provide them a searchable list of merge fields that have been incorporated into each Investor’s document.

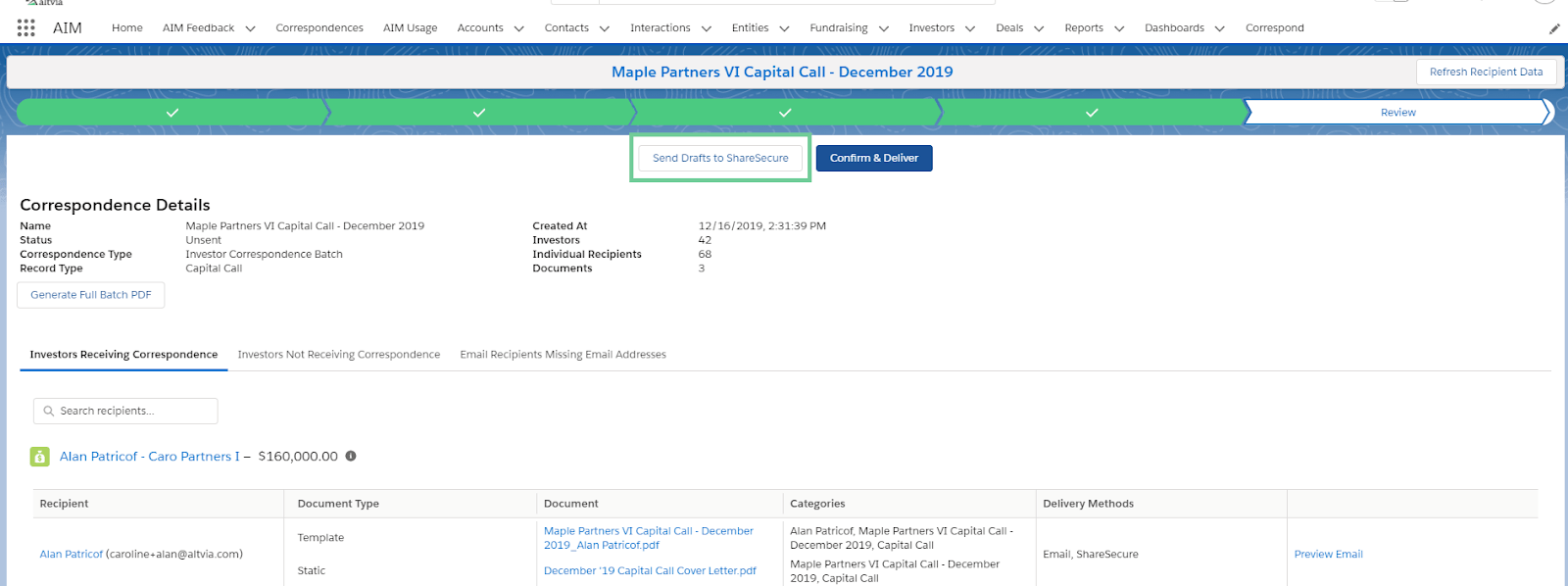

Drafts to ShareSecure

Problem it solves: Sending important documents to LPs is a stressful process for many of our users. Many of them want as many ways to verify that the correct recipients will receive the correct documents as possible.

How it works: Users can now send their deliveries to ShareSecure as drafts for a final spot check on documents, recipients, and categories before you officially share them.

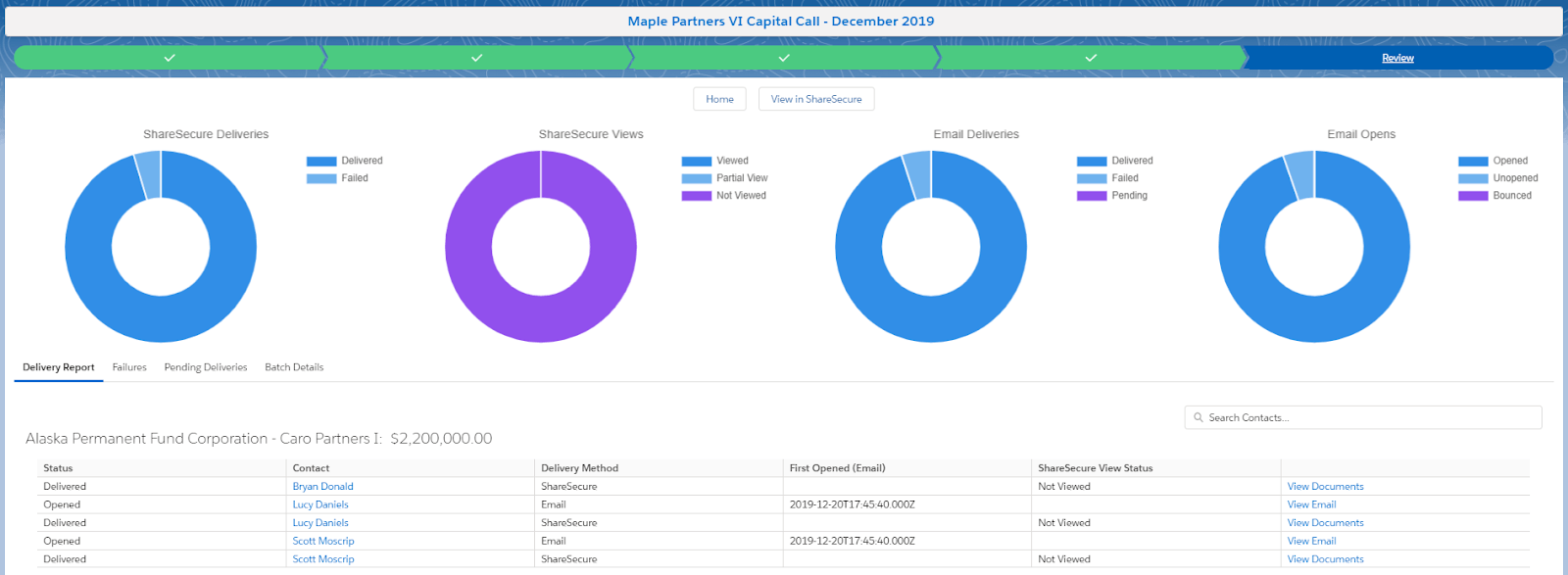

Enhanced Delivery Report

Problem it solves: Previously, once a batch had been sent, users didn’t have a centralized location to check whether all their documents had been successfully delivered.

How it works: The new delivery report includes charts and filtering that helps users easily figure out which recipients have viewed documents in ShareSecure and opened emails. Users can also easily fix and resend any failures.

Investor-Specific Static Documents

Problem it solves: Occasionally, specific Investors need one-off documents delivered to them in a batch. Previously, we didn’t have a good way to accommodate this requirement.

How it works: Users simply upload the Investor-specific document through a newly added pop-up.

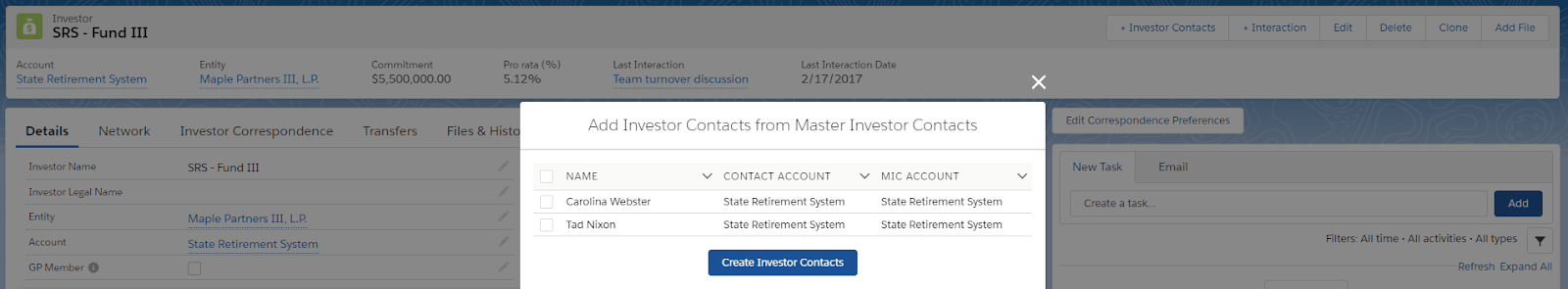

Master Investor Contacts

Problem it solves: IR professionals have needed to make time for repetitive, error-prone data entry that’s historically been required when users create a new Investor commitment, update a Contact’s Correspondence Preferences, or add a new Investor Contact to all of an account’s Investor commitments.

How it works: Master Investor Contacts (MICs) allow you to set up a standard set of Contacts for an Account that can quickly be added as Investor Contacts to that Account’s Investors. For example, if the State Retirement System always wants Carolina Webster and Tad Nixon to receive Investor Correspondence, you could add them as MICs for that Account. Whenever you create a new Investor record, you can quickly add Carolina and Tad as Investor Contacts with the Preferences and override values that have been defined on the Master Investor Contacts you created.