The 'Digital Collision' Coming for PE & VC

Written by Kjael Skaalerud

Table of Contents

Introduction

Digital is coming for Private Equity and Venture Capital,

the same way it is coming for every industry on the planet. However, a revolution in this industry may have the greatest potential for value creation and sweeping shifts in market dominance. Indeed, private capital markets is an industry that underpins industry itself, determining all-important flows of capital and elite talent, hugely influential in executive decision making, and so on. Cash and power aside, one might suggest the vast potential lies in the fact that Private Equity and Venture Capital have gone unchallenged for decades, and as a result, this industry may be especially antiquated in its ways.

In the words that follow, I attempt to communicate the underpinnings of digital revolutions – by way of analogy and what we’ve witnessed in other industries, and by way of mechanics, in terms of the general characteristic these newly crowned digital leaders embody. We will then take a look at the current state of PE / VC and the sentiments of the industry’s thought leaders. To conclude, we’ll envision what the leaders will look like in this new era…

Chapter 1: By Way of Analogy

Most of the excerpts below come from “Competing in the Age of AI: Strategy and Leadership When Algorithms and Networks Run the World,” published in 2020 by Harvard Business School professors Marco Iansiti and Karim R. Lakhani, where the authors analyze the AI capabilities of hundreds of firms, drawing the conclusion that the capacity for digital technology to revolutionize business has yet to be fully appreciated. I found this quote below to provide a great starting point:

“While Marriott and Hilton own and manage properties, with tens of thousands of employees in separate organizations devoted to enabling and shaping customer experiences, Airbnb’s lean organization sits on top of a virtual AI factory, aggregating data and using carefully crafted algorithms to match users to its digitally tracked and managed community of property owners. And where both Marriott and Hilton are a cluster of groups and brands, each with its own siloed business units and functions equipped with their own information technology, fragmented data, and organizational structure, Airbnb’s lean and agile organization sits on top of its integrated data platform, accumulating customer and process information, mining analytic insights, running rapid experiments, and producing predictive models to inform key decisions.” (Age of AI)

Leading up to this point, domination in every industry was mostly a byproduct of domain knowledge/expertise, skilled labor, asymmetric access to information or resources, operational/supply chain efficiency, and the like. Though as Airbnb demonstrated in hospitality, a new breed of firm is quickly toppling the most respected and entrenched incumbents. How can this be? How does it happen so fast?

“As we saw in the Industrial Revolution, technological change is transforming the nature of capabilities. However, the adoption of AI is doing so in a fundamentally different way. In almost every setting, AI-powered, network-centric organizations are taking on companies that have highly specialized capabilities and skills…As this transition continues, we are witnessing a marked erosion of traditional differentiation strategies…” (Age of AI)

“We are witnessing a new generation of digital operating models transforming the economics and nature of service delivery. Software, along with data- and AI-centric architectures, is removing traditional operational constraints and enabling a new generation of business models that cut across industries.” (Age of AI)

It is not my intention to dive too deeply into the nuances of these operating models or the specific applications of machine learning, as I would quickly be out of my depth. Instead, my hope is to paint the general picture and share AirBnb’s story to provide a case in point, which supports the argument that legacy industries of every kind must accept the game of business is radically changing. And fast.

Before moving on to PE / VC today, I’ll leave you with another perspective, which helped me comprehend the foundational aspects of the shift that is occurring without the need to fully grasp AI, data pipelines, etc.

“It isn’t just that businesses use more software, but that, increasingly, a business is defined in software. That is, the core processes a business executes—from how it produces a product, to how it interacts with customers, to how it delivers services—are increasingly specified, monitored, and executed in software.” – Jay Kreps, CEO of Confluent

Chapter 2: What Does This Mean for PE / VC?

Over the last nine months, I’ve been shocked to understand where PE / VC is on the general technology adoption curve. Even after business school, I always perceived these firms atop mighty ivory towers, peering into glass balls, determining global value creation, while us mere mortals turned the axles and cranks in steamy factories. Turns out, most sit in an office off of main street, spending their days bouncing between outlook and excel spreadsheets, hoping not to forget to call their buddy from HBS every thirty days or so to see if they have any new and interesting deals that are worth a look. Here is a quick and dirty view, more in-line with the respective value drivers of a firm and common practices:

- Fundraising – manually copying and pasting email templates with details on a new fund, the strategy/thesis, and their historical track record, to then place a follow-up call to every individual and start securing interest, which is tracked and managed in a spreadsheet.

- Dealmaking – break out the spreadsheet with their main lead sources, or look at the source of their best deals from the last fund, and begin a similarly manual outreach process to then build a spreadsheet-based pipeline of targets, to then reach out to the respective management teams and get a deal process going, which is again managed in a spreadsheet with columns for the deals that are in LOI, Due Diligence, etc. It’s worth noting that many firms have a generic, or deal-focused CRM, though, this typically contributes to a lack of coordination and access to relevant data for other functions in the firm because it is not part of a comprehensive technology strategy.

- Portfolio Monitoring – send one-off emails to the portfolio company CFOs with an excel template containing columns for the metrics the firm tracks, to then spend a few weeks chasing up said CFOs via phone calls/emails, to then consolidate the data into a larger spreadsheet, and ultimately static smart-art charts and pie graphs.

- LP experience – sending investors to a beefed-up document storage site and praying they don’t forget their password.

For my fellow go-to-market professionals, if this reminds you of your days prospecting circa 2010, it should…

Workflows and technology infrastructure aside, there are other aspects that might yield a firm’s competitive advantage, or their ‘edge’. Yet again, from a place of true honesty, I have spoken with maybe ~200 GPs the last 9 months, and for +75%, their differentiation is entirely rooted in ‘a smart team that is well networked with a good track record’. If 75% of anything is common, it is not differentiated. This gets really interesting in the context of an industry that is becoming wildly more competitive, with ~25% growth in PE AUM by 2021 (as forecasted by Deloitte).

So what is an LP (Investor) to do? Ask GPs to rock, paper, scissors, and cut a check?

Surely, the players toppling retail, hospitality, automotive, etc. will someday soon set their sites on an industry whose most valuable technology is Office 365, on average. Surely, this new generation will prove true differentiation and root themselves in the most modern technology available. And my sense is the transition of power will be sudden. And it will be quiet. The digital generation does not announce itself…

“Let’s talk a little bit about disruption in the private equity industry itself. …when I think of the most manual industries, I start with something like landscaping and very quickly get to private equity investing after that.” – Hugh MacArthur, Global Head of PE, Bain & Co.

Chapter 3: What Will the Winners in PE / VC Look Like?

If I ran a fund, I would gladly take one high school dropout digital warlord over an army of 1,000 ivy league educated analysts. This comment will certainly raise eyebrows, when most firms seek to solve just about any problem by hiring more human power, as long as the credentials are there. Let’s again, consider the orientation of the winners in the digital age:

“As with Amazon’s supply chain or Ant Financial’s credit scoring process, Airbnb moves human labor from the core of the operating model to the edge, in this case even outside the company boundaries (the hosts). Airbnb constantly mines its data to acquire new customers, identify new traveler needs, optimize experiences, and analyze risk exposure. As it does so, it accumulates even more data on hosts and travelers, and it uses artificial intelligence and machine learning to provide new insights, confirmed through frequent experimentation.”

“From moving data to storing it, querying it, analyzing it, visualizing it and monitoring it – companies are building best in class solutions throughout. We believe the market size [for vendors] here is massive as every single company in the world will need to make better use of data to compete.” – BVP – State of the Cloud

Up until this point, I have perhaps presented a biased view of the industry, as there are without question thought leaders who have a vision for what their firms must look like to compete in a digital age.

“With the idea being to create a platform where all of the data can be accessed and used by everybody within Riverside, from the front-office to the back-office, to do their jobs successfully. It’s an orchestration across different departments that historically might have worked in isolation.” – Eric Feldman CIO, Riverside

“Given the growing industry competition, only GPs that can harness the value of their data assets are likely to remain top quartile performers.” – Preqin, Special Report

“In addition to considering new strategies and products, private equity firms need well-defined plans around digital transformation and ESG to remain competitive in the future. Organizations who dismiss these factors as distractions from the core business are likely to cede ground to competitors, regardless of their success in other areas.” – Axial

There is a growing appreciation that, at a minimum, technology can be used to create firm-wide visibility, better-coordinated teams, and avoid time wasted chasing data housed across applications; however, for most industries, this is barely table stakes.

So what might a truly modern and progressive Private Equity and Venture Capital industry look like?

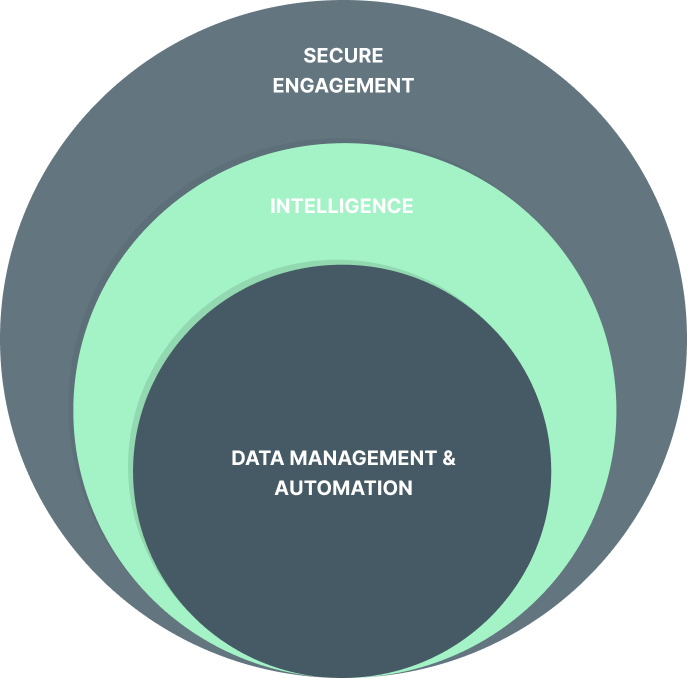

A centralized data warehouse (or system of record) is the foundation of a modern tech stack. Generally speaking, a firm’s most proprietary data (i.e., how they engage investors and raise capital or how they source deals and execute deal process) is the tip of the speer and harvesting data related to these objects and activities must happen as a byproduct of the workstreams themselves (think: email exchanges instantly captured and indexed vs manually keying info). This data is then rounded out with 3rd party data sets (think: Preqin for targeting LPs and Pitchbook for potential investments) to provide the firm a comprehensive view without lifting a finger.

Now comes the action layer of the tech stack (think: email communication that easily scales via automation, which is programmatic to maintain high levels of personalization). Per the system of action, all activities are measured to provide raw visibility into the machine and accountability for KPI attainment. This is also an interesting feedback loop, as a firm gets more precise in correlating their activities (i.e., emails) to priority outcomes (i.e., new investors). Visibility breeds accountability. Feedback loops breed improvement.

After the action layer, comes the insights layer of the stack. A firm can now visualize the proprietary data housed in their system of record (note: it is likely that associates interact with the data via the CRM, though more progressive firms power the insight layer via a data warehouse where all data sets are ingested and normalized), enriched with 3rd party data sets, which can be further complemented by portfolio and fund performance data from accounting systems, and the like.

This is where it starts to get really interesting. As you’ll often hear in our meetings, “opinions are great, but show me the data”. Gone are the days of subjective perspectives on a firm’s differentiation, or the repeatability of an investment thesis. Objective data becomes the focal point of all storytelling and decision-making. A few examples to add color:

- Portfolio value creation:

- We got involved with portfolio company A at this point in time and conducted X activities aimed at lifting Y metrics. You can see a clear trend line in top-line revenue and margin expansion that increased enterprise value to Z on the intended timeline. (Thras.io does an incredible job with similar storytelling)

- When we buy a company with X percentage of the Total Addressable Market (TAM) and Y in existing sales pipeline, with a concentration of competitors that looks like Z, we can expect 30% growth in top-line revenue over the first six months of owning that asset.

- Fundraising:

- We need to have X prospective investors in our pipeline six months before the desired closing date and we need to see a conversion rate of Y after LOI to close $Z in AUM.

- When we see communication velocity (i.e., email exchanges / calls in a week) reach eight interactions a week, we have a 30% likelihood of bringing on the investor.

- If we don’t speak with a prospective investor for 10 business days and they engage with our materials (i.e., open or click) fewer than five times, we have a 5% chance of securing an investment.

Let’s now move on to painting a more pointed picture, based on the workflows we analyzed earlier. This is what a firm’s primary value drivers might look like for the next generation:

- Fundraising:

- A simple clustering algorithm identifies the attributes (aka features in ML speak) most commonly found among your key investors (think: 2yr growth in net worth, current exposure by vertical, etc.), which is used to short-list and score potential investors most likely to convert.

- An automated email campaign that is highly personalized via programmable fields is executed, and fundraisers only spend time chasing up the most engaged investors (as objectively measured by how they interact with the material and communication).

- Over time, patterns in engagement emerge and the firm can fine-tune its messaging to increase overall conversion rates for future investors and funds.

- Associates are compensated on investment velocity (aka the time from initial contact to investment) and rate of improvement across the stages of the fundraising pipeline.

- Dealmaking:

- Bots scrap various platforms for intel re: businesses for sale. The data is cleaned and fed to algorithms, which score and short-list target companies (like investors). Bots also scrape the web to add less common identifiers (i.e., 6mth growth in sales headcount on LinkedIn) to the scoring matrix. Priority targets that score well and align with the firm’s thesis are accepted into the crm, with outreach executed via the action layer.

- Outreach is automated and only the most engaged management teams are actively pursued with messaging that has been iterated on and validated by the market.

- Firm’s share a data-driven perspective on their playbooks and ability to generate returns, which is interactive for viewers so the firm can measure the management team’s engagement with the material as a proxy for conversion

- Associates are compensated on deal cycle (a.k.a. time to investment) and improvement in conversion rates across the pipeline stages.

- Portfolio monitoring:

- All portfolio companies utilize a consistent accounting software, which feeds financial / performance data into a consolidated database every night via API.

- The aggregated data feeds a business intelligence tool, which turns spreadsheets into interactive data visualizations that accelerate the viewer’s comprehension and provide real-time interactivity to quickly identify trend lines and abnormalities.

- LP experience:

- Investors step into a web-based, consumer-like portal, which surfaces the data visualizations detailed above and provides real-time transparency into their investment, allowing them to slice and dice charts, graphs, etc., as they please.

- The firm measures every action an LP takes on the portal to understand their respective level of engagement, the engagement of the broader LP base, and the content most interacted with to inform all future communications and how the firm represents itself in the marketplace.

- LP questions are analyzed for pattern recognition, which informs proactive communication meant to head off frequently asked questions.

- Associates are compensated for a lift in LP engagement over a fixed period of time, and response time to LP inquiries.

Final Thoughts

Simply put, Private Equity and Venture Capital firms must exploit the technology available to broader society if they are to maintain their dominant position in the industry. New players enter the market every day and many come from domains that have been revolutionized via digital-first tactics and practices. Leverage comes from giving common tasks to machines and ensuring activities, and ideally, outcomes, are predictable and repeatable. Firms design the systems, monitor closely, and improve them over time, while machines execute and deliver insights that are a byproduct of data points that are harvested throughout the entire process.

At Altvia, it is our distinct privilege to support, and indeed accelerate, the adoption of technology and digital transformation in Private Equity and Venture Capital. We enable firms to sharpen their edge and fortify a defensible moat. There is without question a new era on the horizon and for those who have yet to appreciate this reality, a collision is coming.

col·li·sion

/kəˈliZHən/

noun

1. an instance of one moving object or person striking violently against another.

Digital is here. Digital is winning in every domain. Private Equity and Venture Capital are firmly established as laggards, behind the curve. The traditional model is being challenged and those who remain idly behind the curve will be left behind. The question is what actions can be taken today so a firm’s fate looks more like Airbnb and less like Marriott…