The Platform for Growth

Our data management platform expands the capabilities of a regular CRM. Built for private capital markets, the platform accounts for all relevant stakeholders and value drivers in a private capital markets firm setting.

The Platform for Growth

Our data management platform expands the capabilities of a regular CRM. Built for private capital markets, the platform accounts for all relevant stakeholders and value drivers in a private capital markets firm setting.

Purpose-built fund lifecycle platform to facilitate world-class partnerships between LPs & GPs.

Purpose-built fund lifecycle platform

to facilitate world-class partnerships between LPs & GPs.

Fundraise

Accelerate fundraising by prioritizing your most engaged LPs, and target new LPs who fit the ideal profile

Manage Deal Flow

Manage your deal flow with a new level of insight, allowing you to prioritize deals based on source, or similarity to the firm’s top-performing investments

Business Intelligence

Answers ensures you have precise data at your fingertips, providing a powerful advantage in streamlining data analysis and reporting.

LP Loyalty

Elevate your investor relations strategy with seamless data management and robust tools that empower confident decision-making and foster long-lasting investor partnerships.

Data Management & Automation (CRM)

Most firms are spread across a generic CRM, an email platform, and static spreadsheets. Disparate data sources across the firm make it hard to see the whole picture.

Our data management platform expands the capabilities of a regular CRM. Built for private capital markets, the platform accounts for all relevant stakeholders and value drivers in a private capital markets firm setting.

A cohesive view stores contact information, conversations, email exchanges, and leverages 3rd party data enrichment, all in one place.

Data Management & Automation (CRM)

Most firms are spread across a generic CRM, an email platform, and static spreadsheets. Disparate data sources across the firm make it hard to see the whole picture.

Our data management platform expands the capabilities of a regular CRM. Built for private capital markets, the platform accounts for all relevant stakeholders and value drivers in a private capital markets firm setting.

A cohesive view stores contact information, conversations, email exchanges, and leverages 3rd party data enrichment, all in one place.

Real-time Intelligence (Analytics)

Stop consolidating fund accounting and portfolio performance metrics in excel and let an intelligence layer do the leg work to surface insights.

LPs demand proof of execution and repeatability of a thesis or investment strategy and data is the backbone of objective storytelling.

Use data visualization to transform, normalize, and display your data to empower stakeholders to find insights quickly and take appropriate actions.

Secure Engagement (LP Portal & Data Room)

Leverage our data layer for unparalleled insights into the engagement levels of LPs and deeply personalize the most important touch points while automating the redundant ones.

Standardize performance reporting so LPs can obtain the transparency they crave, access information in a self service manner on their own schedule, and stay well informed without requiring countless hours from your IR team or analysts.

Cleanly articulate your edge with visual representations of fund performance while measuring LP engagement to ensure your narrative resonates across the LP base

Secure Engagement

(LP Portal & Data Room)

Leverage our data layer for unparalleled insights into the engagement levels of LPs and deeply personalize the most important touch points while automating the redundant ones.

Standardize performance reporting so LPs can obtain the transparency they crave, access information in a self service manner on their own schedule, and stay well informed without requiring countless hours from your IR team or analysts.

Cleanly articulate your edge with visual representations of fund performance while measuring LP engagement to ensure your narrative resonates across the LP base

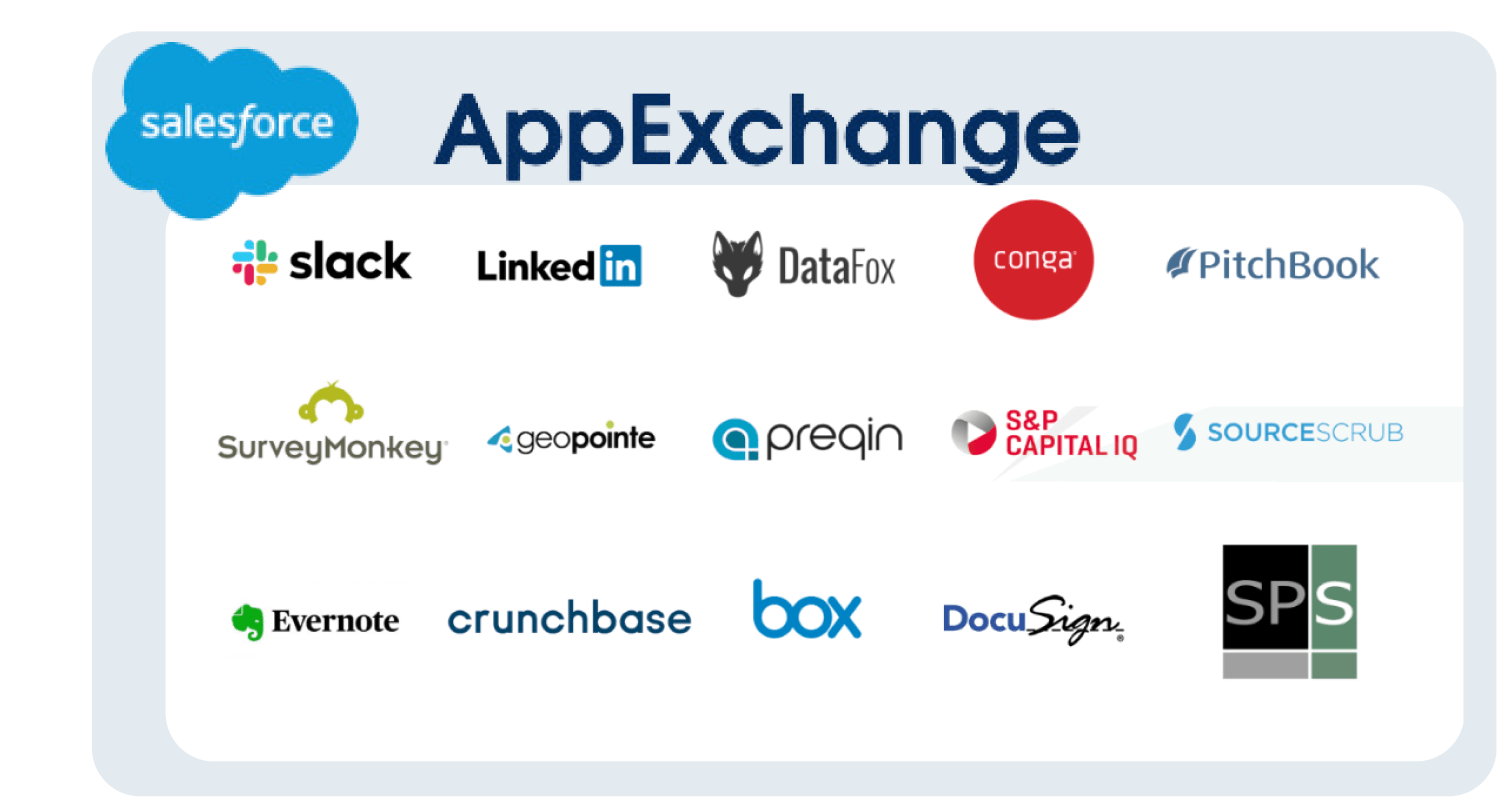

Data-Enhancing Applications To Increase Efficiency

Enhance your firm’s workflows with a wide range of Salesforce app integrations. Altvia, built on the Salesforce platform, allows alternative asset managers to connect with thousands of apps via the AppExchange, streamlining data collection and boosting user adoption.

- Choose from thousands of app integrations to support your firm’s workflows.

- Connect and enhance data in one location for streamlined data collection.

- Utilize frequently used Private Equity tools like Pitchbook, Capital IQ, Datafox, Sutton Place Strategies, and Preqin.

- Enhance firm-wide processes with third-party applications.

Want to get started?

We have a team of experts, with decades of private equity experience to support system adoption and change management.