Institutional Investor Software

Transform how you manage portfolios, conduct due diligence, and communicate with stakeholders.

Supercharge your investment strategy to preferred returns.

As an Institutional Investor, you have to manage large and complex portfolios, ensure compliance with stringent regulations, and meet the growing demands for transparency from your stakeholders. Altvia’s software for institutional investors is designed to address these challenges head-on, empowering you to optimize portfolio management, conduct rigorous due diligence, and enhance stakeholder communications.

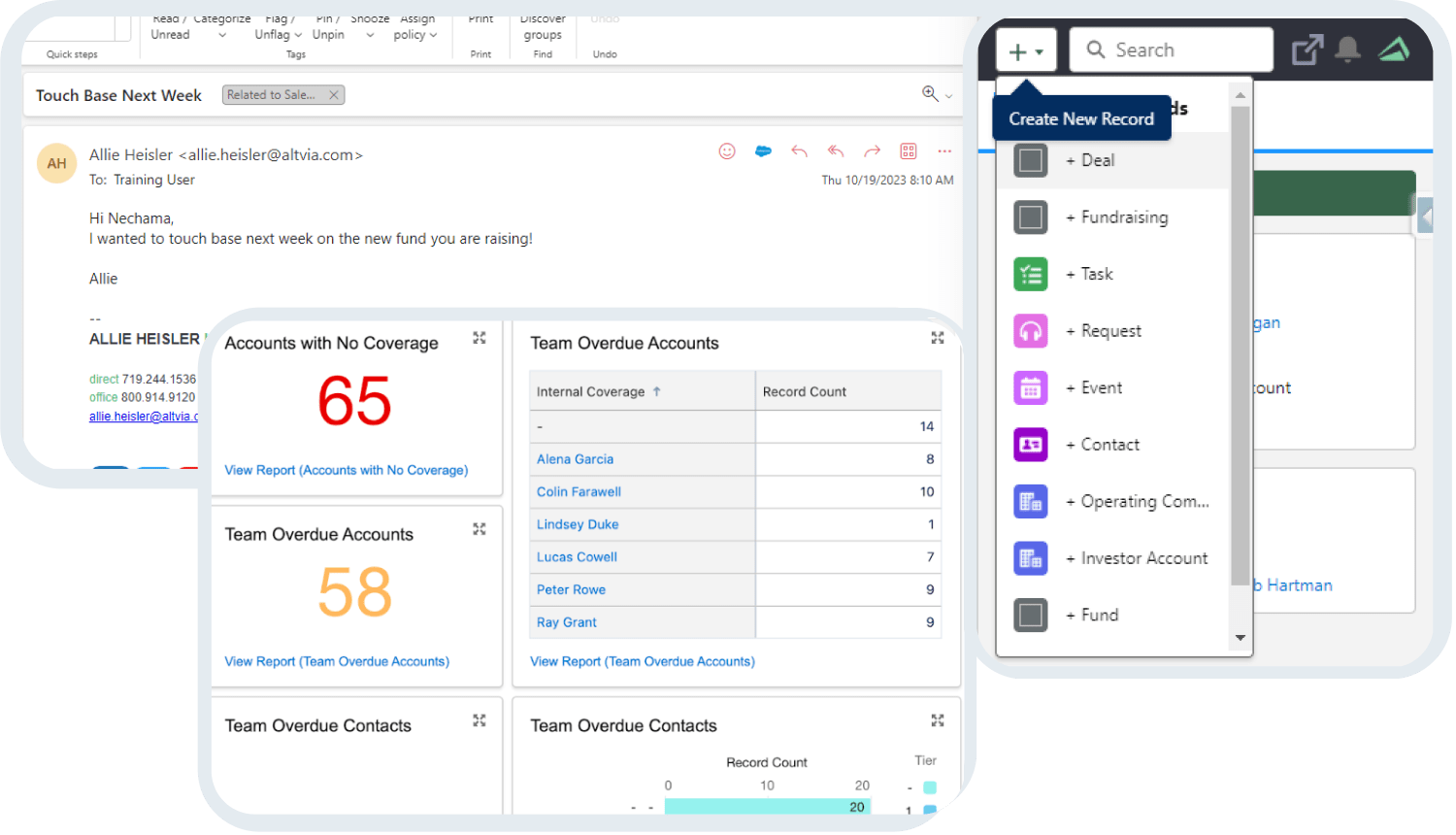

Strengthen your due diligence processes with tools that enhance accuracy, transparency, and collaboration across your investment teams.

- Streamline the due diligence process by centralizing documents and communication in a secure, accessible platform.

- Utilize email and calendar integrations and an intuitive UI to track all touchpoints with Fund Managers, Intermediaries, and Portfolio Companies.

- Collaborate efficiently with team members and external partners through shared access to critical information and real-time updates.

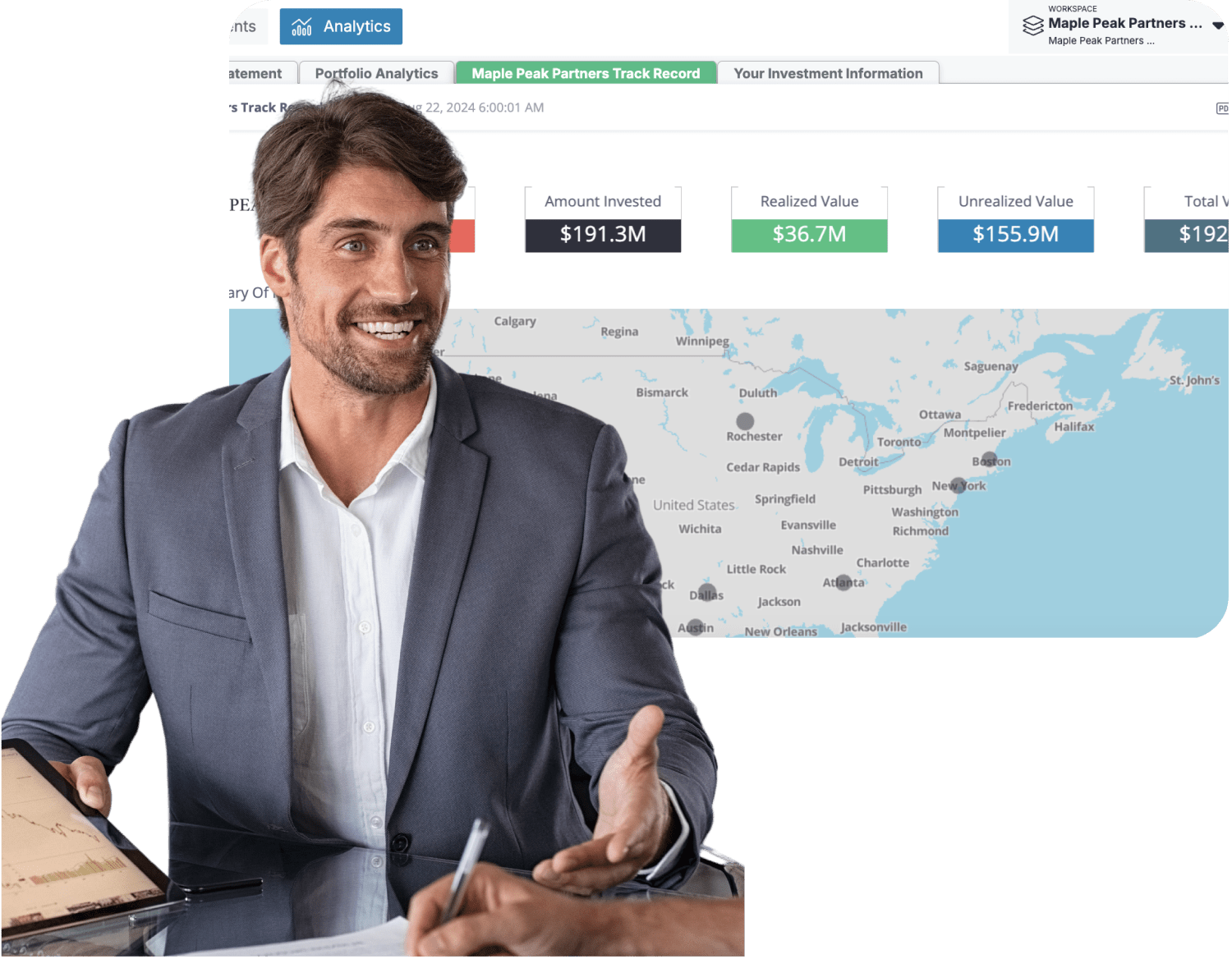

Maximize the performance of your portfolio with Altvia’s advanced analytics and reporting tools, designed to give you deep insights into your investments.

- Centralize portfolio data to gain a comprehensive view of your investments and performance metrics.

- Leverage advanced analytics to identify trends, assess risks, and make data-driven investment decisions.

- Manage fund allocations and track your forward calendar of investments for upcoming fund launches.

Build trust and confidence with stakeholders by providing them with clear, timely, and accurate information about your investment strategies and performance.

- Track and report on team member meetings, email activity, and upcoming follow-ups.

- Provide transparency through detailed reports and dashboards that give stakeholders insights into your investment strategy.

- Demonstrate your commitment to excellence with secure and transparent operations that meet regulatory requirements.

Strengthen your due diligence processes with tools that enhance accuracy, transparency, and collaboration across your investment teams.

- Streamline the due diligence process by centralizing documents and communication in a secure, accessible platform.

- Utilize email and calendar integrations and an intuitive UI to track all touchpoints with Fund Managers, Intermediaries, and Portfolio Companies.

- Collaborate efficiently with team members and external partners through shared access to critical information and real-time updates.

Maximize the performance of your portfolio with Altvia’s advanced analytics and reporting tools, designed to give you deep insights into your investments.

- Centralize portfolio data to gain a comprehensive view of your investments and performance metrics.

- Leverage advanced analytics to identify trends, assess risks, and make data-driven investment decisions.

- Manage fund allocations and track your forward calendar of investments for upcoming fund launches.

Build trust and confidence with stakeholders by providing them with clear, timely, and accurate information about your investment strategies and performance.

- Track and report on team member meetings, email activity, and upcoming follow-ups.

- Provide transparency through detailed reports and dashboards that give stakeholders insights into your investment strategy.

- Demonstrate your commitment to excellence with secure and transparent operations that meet regulatory requirements.

Ready to Optimize Your Investment Strategy?

Elevate your investment approach with Altvia’s comprehensive software solution. Contact us today to learn how we can help you maximize portfolio performance and ensure rigorous due diligence.