At the recent PEI IR Member Meeting, investor relations professionals came together to compare notes on what’s working—and what’s not—as they navigate another year of evolving LP expectations, data complexity, and pressure to fundraise faster.

Across three sessions, a clear theme emerged: the future of IR is digital, data-driven, and deeply human. Teams are learning how to modernize their systems and workflows without losing the trust and relationships at the heart of private capital.

Here are the biggest takeaways and how leading firms are turning common challenges into opportunities for efficiency, insight, and stronger LP relationships.

1. Turning Data Chaos into Clarity

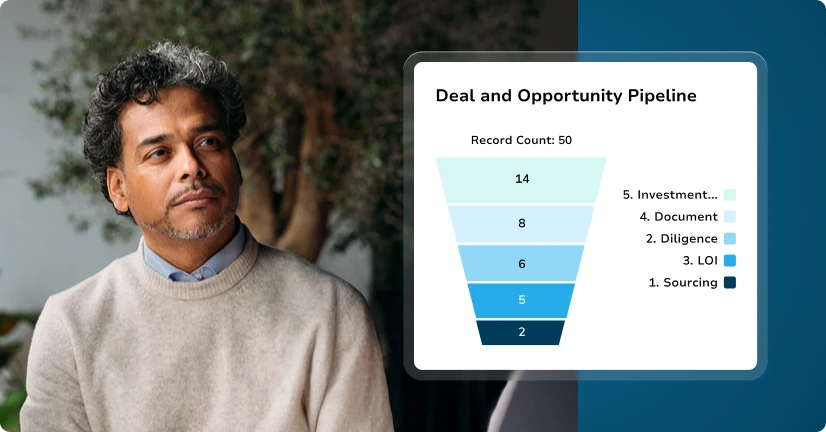

Many IR leaders shared familiar frustrations: messy CRM data, disconnected systems, and difficulty getting a true picture of LP activity. Some teams have even switched CRMs in search of better usability, while others are investing heavily in cleanup projects between fundraises.

The lesson was simple: data quality is everything. A CRM is only as valuable as the information inside it—and without connected systems, firms can’t act quickly or confidently.

Modern IR teams are focusing on unifying data across platforms and automating the flow between CRM, accounting, and investor portals. The goal isn’t just clean data; it’s usable data that fuels better decisions, faster fundraising cycles, and more meaningful LP communication.

That’s where integrated platforms prove their worth—offering one connected source of truth and automation that eliminates manual errors and guesswork, while providing clarity for the entire firm.

2. Technology Should Strengthen Relationships, Not Replace Them

As AI and automation take center stage, IR professionals were quick to emphasize one truth: technology can make you faster, but relationships are still the currency of private capital.

The best-performing firms are using automation to enhance personalization, not diminish it. Tools like AI note summarization, contact mapping, and engagement tracking are helping teams anticipate LP needs and deliver more relevant updates.

For smaller teams, this shift is especially powerful—replacing hours of manual reporting with intelligent workflows that surface insights instantly. The freed-up time allows professionals to focus on what matters most: building and maintaining trust through consistent, transparent communication.

The roundtable discussions made it clear: digital infrastructure isn’t about replacing the human touch; it’s about scaling it.

3. Building the Infrastructure for Confident Growth

With so many new tools entering the market, firms are balancing innovation with caution. Security, compliance, and scalability are top of mind — especially as AI becomes embedded in CRM and investor communication workflows.

Participants stressed the importance of data stewardship and responsible automation. A well-governed system — one that can grow alongside the firm without sacrificing accuracy or oversight — has become a competitive differentiator.

The most forward-thinking IR teams are implementing flexible, secure systems that can handle multi-fund operations, new communication channels, and increasingly complex LP requirements. Their systems aren’t just functional; they’re future-ready, providing confidence that as the firm expands, its data and relationships remain protected.

Bridging the Digital and the Human

The takeaway from the PEI IR Roundtable wasn’t about adopting more technology—it was about adopting the right technology. The firms gaining ground are the ones connecting data, automating intelligently, and empowering their people to focus on relationships rather than administration.

When digital systems, automation, and human expertise work in harmony, IR becomes more than a back-office function—it becomes a strategic driver of growth, trust, and investor confidence.

That’s the new benchmark for investor relations—and it’s where the future of private capital is headed.

Learn how Altvia helps private capital firms unify data, strengthen LP trust, and scale growth.

👉 Request a Demo