The pace of AI innovation in private equity is no longer a future-facing topic—it’s a present-day imperative. In just two years, generative AI has evolved from exploratory pilots to delivering measurable business outcomes. For top-performing firms, AI isn’t a side initiative—it’s being embedded directly into the firm’s strategic agenda.

But success with AI isn’t about finding the perfect tool. It’s about readiness: having the right data foundation, governance, and internal alignment to confidently move from experimentation to transformation. At the center of it all is one competitive advantage that continues to separate leaders from laggards—data.

What High-Performing Firms Are Doing Differently

A September 2024 Bain & Company survey of firms managing $3.2 trillion in assets revealed four key practices that top firms are using to accelerate AI adoption and value realization:

- Systematic Learning at the Fund Level

The most advanced firms don’t treat AI as a one-off experiment. They institutionalize it. That means establishing Centers of Excellence, critically assessing tools for specific fund needs, and building internal forums for portfolio companies to exchange AI use cases and outcomes—transforming isolated experiments into repeatable, cross-fund playbooks. - Targeted Capability Building

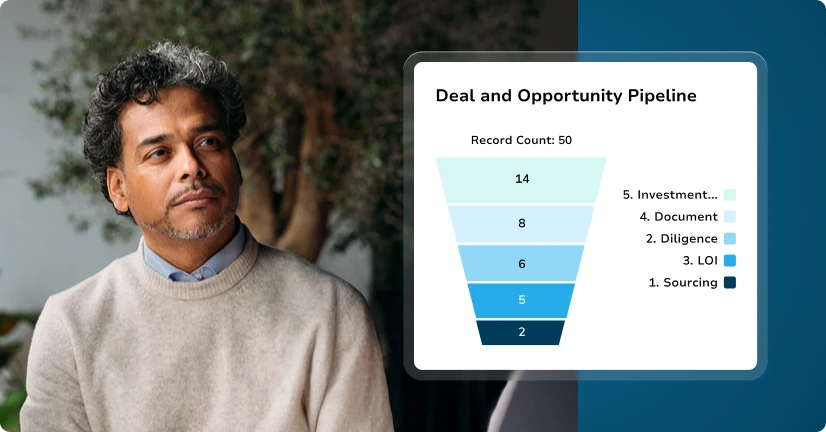

Winning firms don’t try to build everything from scratch. They recruit specialized AI talent, forge partnerships with their existing technology partners, and codify internal governance to ensure responsible scale. This intentional capability-building helps firms stay ahead of a fast-moving landscape without losing control. - Strategy-First Use Case Selection

Rather than jumping at the newest AI trends, these firms anchor their AI efforts in business strategy. They prioritize use cases that drive the firm’s core value—like deal origination, diligence acceleration, or operational efficiency. If an initiative can’t tie back to ROI or core goals, it doesn’t make the list. - Rapid Build-Buy-Partner Decisions

Momentum matters. High performers avoid getting stuck in analysis paralysis by developing a clear framework for deciding whether to build, buy, or partner on AI capabilities. With the right decision-making process, they keep transformation moving forward without stalling in the planning phase.

Your AI Adoption Roadmap

No two firms follow the same path to AI maturity—but there is a framework to guide your journey. Whether you’re exploring your first pilot or preparing to scale across the portfolio, these phases can help you move confidently from concept to value.

Strategic Alignment

- Tie AI use cases directly to firm goals (e.g., sourcing, diligence, operations, exits).

- Set clear KPIs to measure success (e.g., 30% faster diligence cycles, 15% sourcing uplift).

Data Readiness

- Inventory all critical data across systems—CRM, portfolio tools, documents.

- Standardize and clean inputs to ensure models are trained on trusted information.

- Centralize access through a secure, unified analytics layer to power firm-wide AI.

- Work with a trusted technology partner to prioritize data hygiene.

Focused Pilots/Betas

- Start with targeted, low-risk pilots to understand what outcomes will drive value and evaluate outcomes against KPIs, capture learnings, and iterate before scaling.

- Reach out to a technology partner to hear about their strategic approach to AI and opt-in to their AI Beta Programs (if applicable).

- Use results to inform your build, buy, or partner approach.

Continuous Learning & Scaling

- Codify success into internal playbooks for repeatability.

- Expand AI into high-impact areas like LP personalization, forecasting, and compliance workflows.

The Firms Winning with AI Aren’t Just Smarter—They’re More Ready

Every private equity firm is somewhere on the AI journey. Some are still exploring use cases. Others are deep in pilot mode. A few are already scaling what works. But the difference between dabbling and driving real value comes down to one thing: readiness of your data, your people, and your strategy.

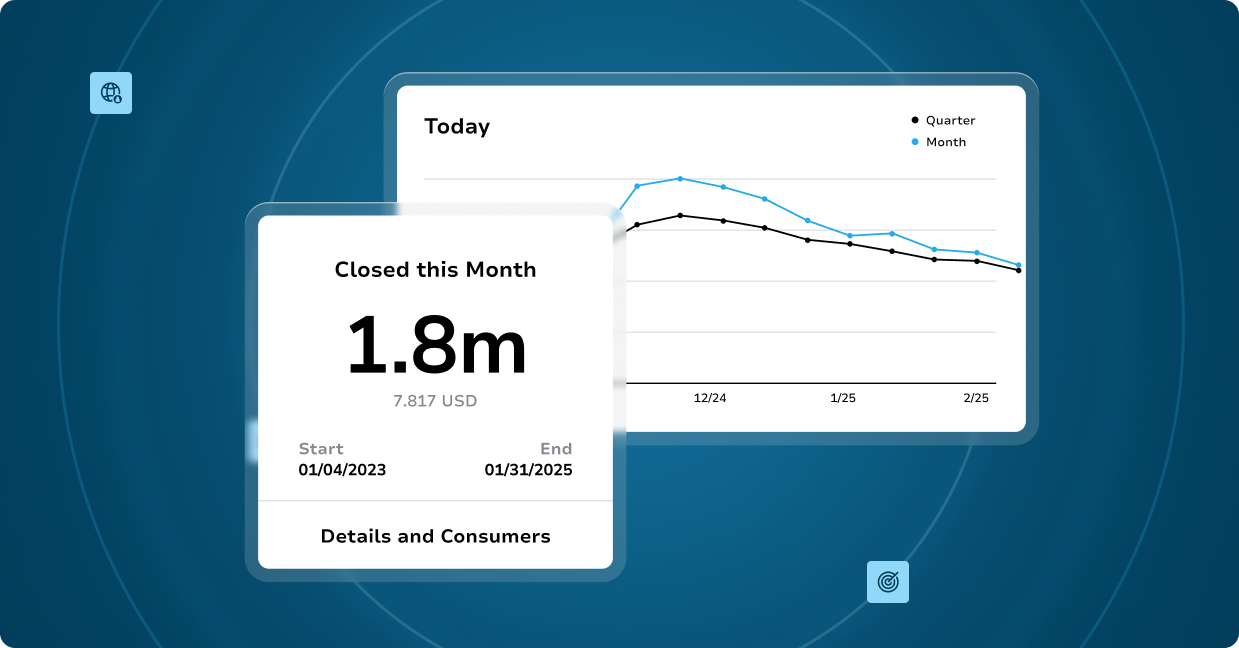

At Altvia, we meet firms where they are. Whether you’re laying the foundation with clean, connected data, launching a high-impact pilot, or embedding AI into workflows across the firm, our team—and our new AI assistant, AIMe, helps you move faster and smarter.

The opportunity is real. The impact is measurable. And the time is now.

Let’s build your roadmap to value starting with a conversation.