In the wake of the COVID-19 pandemic, it seems that many companies will continue to work remotely indefinitely, if not permanently. This poses a new challenge for capital market deal teams as they attempt to perform due diligence on companies they can’t visit. A process that used to involve multiple in-person meetings will now have few or none.

How will firms adapt to this change? It’s clear that they’ll have to rely more heavily on private equity technology. However, before implementing new tools or expanding your use of existing ones, it’s important that you prepare your firm for this new approach. In particular, it’s critical that you have a carefully crafted due diligence process that your deal team knows well and is comfortable with. The last thing you want to do is wrestle with making a somewhat arbitrary physical process work in a new, more virtual format.

Key Virtual Due Diligence Tools and Processes

As you look to “go virtual” with your due diligence processes, the first tool to acquire and master is a reliable video conferencing system. And it’s important not just to identify and implement it, but also to take some time to learn how to use it effectively. Online interactions can be somewhat awkward to begin with. You don’t want to compound the problem by being unfamiliar with how to share your screen, give another participant the ability to share theirs, etc.

It’s also vital that you have a fast and effective way to track interactions that you are having with the prospective operating company. This is especially important today since deal team members working remotely won’t have the luxury of sitting down with you in person to talk about your notes. When tracking interactions, it’s vital to link or “relate” records—contacts, deals, fundraises, etc.— to one another to create helpful context for other users at the firm.

Third-party apps are also likely to become a more important component of your “technology stack” as you move to virtual due diligence. Tools like SourceScrub, SalesLoft, LinkedIn Sales Navigator, and DataFox track and send operating companies and investor updates directly to your CRM, saving you time and help ensure accuracy. That is, of course, if your CRM has integration capabilities.

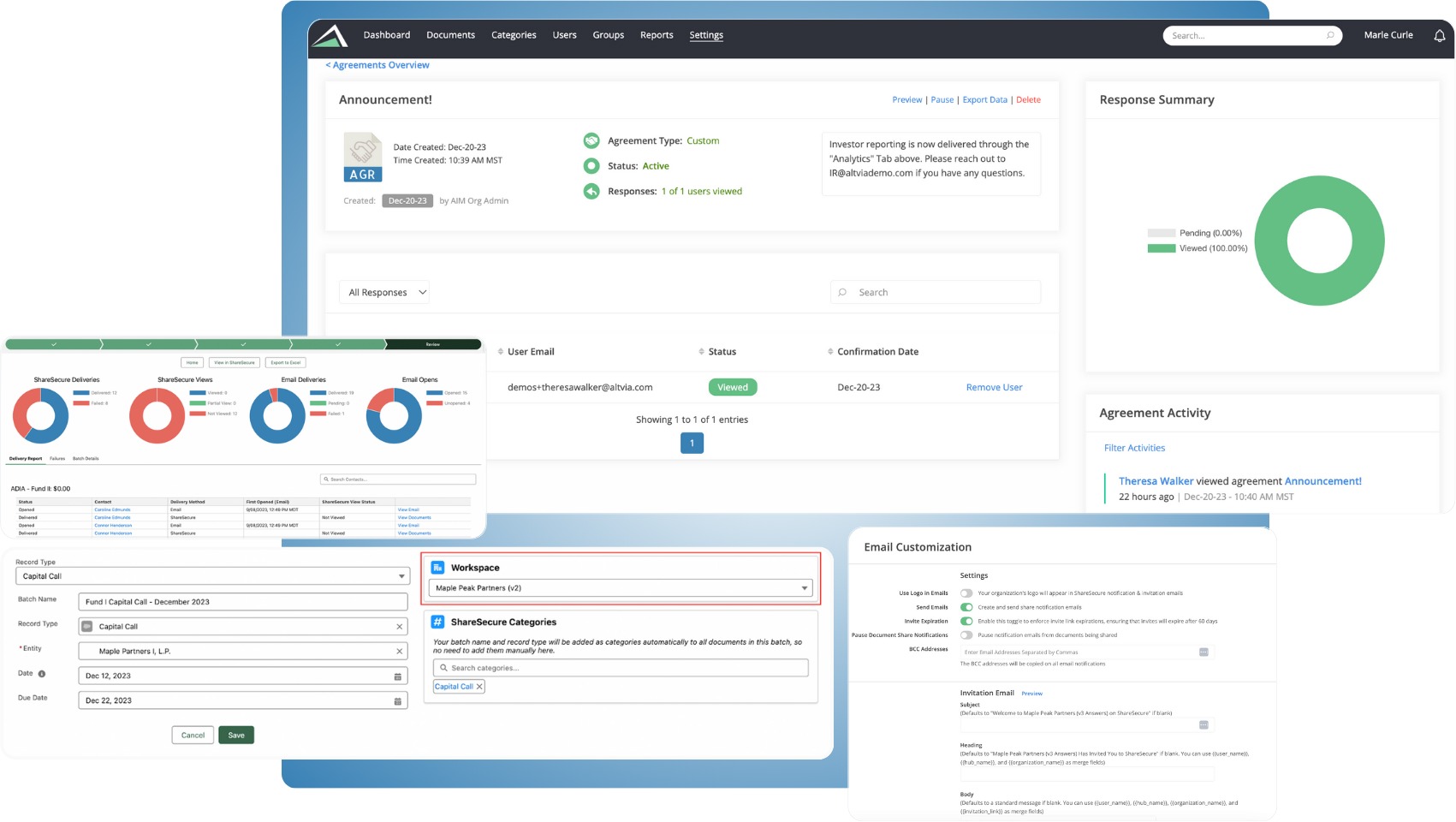

And finally, having a secure virtual data room and engagement platform like ShareSecure is absolutely essential in the due diligence “new normal.” Using an approach like simply sharing Google docs may be efficient for another industry, but due to lack of security for capital markets, is discouraged. Instead, deal teams should use an industry-specific tool that enables the safe sharing of a wide variety of file types. A purpose-built private equity platform provides many added benefits, like empowering team members to see who has viewed each document made available through the system and allowing remote document signing.

Take Decisive Action to Enable Effective Virtual Due Diligence

Firms and deal teams that try to “duct tape” their existing due diligence processes and make them work until the business world “gets back to normal” will be in trouble if it never does. On the other hand, private equity firms that embrace virtual due diligence and equip themselves to conduct it effectively will have a distinct competitive advantage.

Some degree of in-person—if socially distanced— due diligence interaction is likely to return at some point. But it’s better to assume that physical meetings will be few and far between, and prepare your firm to move forward accordingly.

If your capital markets deal team is looking for a way to better manage processes, download our free guide below Winning Deals in a Hyper-Competitive Market.