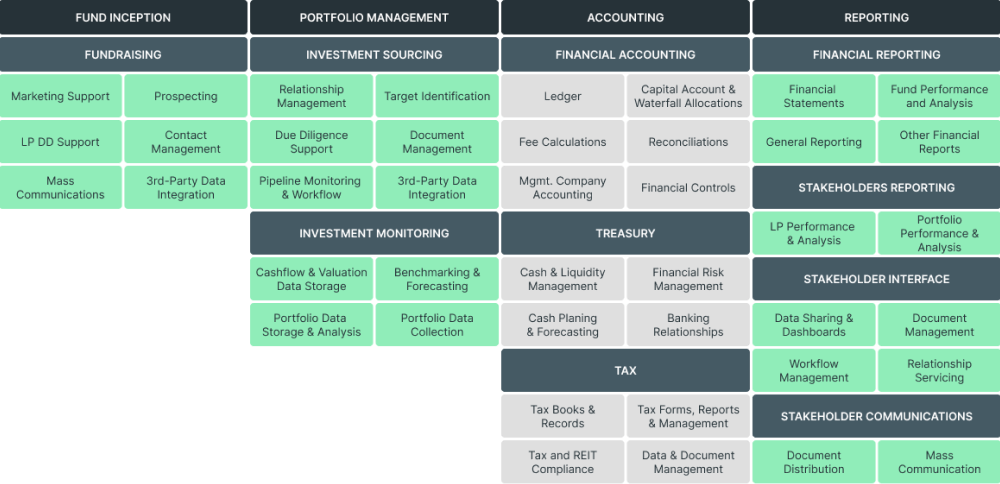

The PEriodic Table of Technology

A guide to manage system complexity to facilitate world-class relationships.

Introduction

The traditional CRM is built for “customer” scenarios and provides a generic solution that many industries can use. However, for private capital markets, this generic version isn’t quite right. Why? Mainly because the standard CRMs assume all businesses operate with the same parts—a customer, a sale, and a service. However, for private capital markets, this approach is missing key industry-specific pieces.

By customizing a technology-driven experience for LPs, firms can create a differentiated and opportunistic customer experience. And that all starts with building a tech stack that aligns to your firm’s unique goals and operations.

What distinguishes a good tech stack from a great one is that great technology enables the entire firm throughout the whole investment or fund lifecycle (vs enabling a single team or workflow). This guide provides step-by-step detail on what you need to know to structure your firm’s tech stack for more efficiency and to best enable yourself to stand out from the competition. Altvia’s PEriodic Table of Technology demonstrates how technology maps to the traditional functional areas of a private market investment firm.

Structure Your Firm’s Tech Stack For More Efficiency

Altvia’s PEriodic Table of Technology, created by Jeff Williams, Chief Strategy Officer

Chapter 1: Fund Inception

Starting at the fund inception stage, there are four areas during fundraising where your tech stack should provide support to help identify opportunities, increase your efficiency, and improve the investor experience:

1. General Communications

From personalization and improved organization in email communication, to the ability to segment groups of investors, your CRM can help your firm better communicate with the right investors, in the right ways, at the right times.

2. Document Sharing

There’s a lot of document sharing during fundraising—from due diligence questionnaires to reports and agreements. Leverage your tech stack to empower your firm with a centralized system to organize and host these documents, support version management, and ensure nothing gets lost in the shuffle.

3. Status Management

Offer faster response to LPs with the confidence that you’re providing accurate and consistent information through customizable, templated responses.

4. Firm Differentiation

Prove your firm outranks competitors, and build trust among investors, through activities like email nurture campaigns that identify areas in the fundraising process (and beyond) to build brand equity and personalize communications.

The right CRM can assist in establishing communication objectives and defining audience segments to send relevant, helpful information to every contact at every stage in your funnel. A strong investor communications strategy that focuses on building relationships with investors is critical in securing funds, which is why technology-powered marketing support is a must.

This includes identifying the right investors (and building a connection with them) during prospecting. Through tools like Altvia, firms can hone in and prioritize the most engaged investors (measured via interactions, email opens / clicks, etc.), while gaining insight into their past activity and future plans.

When it comes down to contact management, firms can track relationships associated with an investor account, and identify key contacts and other industry connections (like former employees and placement agents) to prioritize outreach and provide personalized communication.

Finally, you can contact multiple investors through mass communications and then track individual performance (like investors who opened or clicked your last email) to identify and prioritize key accounts to follow up with.

Chapter 2: Portfolio Management

To streamline portfolio management, firms need a tech-enabled solution within Altvia’s PEriodic Table of Technology that spans across every deal stage, from deal sourcing to investment monitoring.

Investment Sourcing

Deal sourcing is the lifeblood of any private capital markets firm and by following industry best practices (such as hiring business development professionals to help leverage data analytics and technology) firms can supercharge sourcing efforts to stay ahead of the competition throughout the deal stage.

In the research and due diligence phase of a deal, firms can use both internal and industry data to get a holistic view of the market to inform decision-making. They can use existing portfolio data to create comparables for valuations and performance expectations, or refer to historical diligence for similar deals and avoid reinventing the wheel as each new deal enters later stages of the pipeline.

For value creation plans, better quality data and analytics can help speed up the process while unveiling growth opportunities. With broader data sources, firms can better understand the market, uncover consumer behavior and trends, and even develop data-driven insights to help the target company attract new customers and gain greater market share. All before executing an investment.

Investment memos and preparation for investment committees is another time intense exercise for most firms. With a modern technology platform in place, this exercise can be fully automated, quickly consolidating the relevant data points already held in the CRM and Portfolio Monitoring layers into a pre-built template in a few clicks.

Investment Monitoring

The industry is moving faster than ever. If you don’t have the information you need to make decisions wisely and rapidly, it’s likely that you’ll lose deals to other organizations that move more quickly.

Through sophisticated portfolio monitoring software, firms can optimize dashboards to report on the KPIs and metrics that matter to their team and investors and quickly assess dependencies between and among projects and portfolios. Additionally, tech-enabled portfolio monitoring arms firms with predictive analytics and the ability to quickly spot trends, analyze their impact and determine actions and next steps to act upon them.

Finally, using this same data, firms can articulate recent value creation and rationalize the desired valuation when it comes time for an exit.

Chapter 3: Accounting

The tech stack you build for your firm won’t be satisfied by a single tool. From financial accounting software to treasury and tax tooling, your firm is likely powered by several platforms across the business. This is exactly why the ability to connect multiple platforms within your stack is critical.

Whether your firm is trying to connect disparate forms of data across multiple platforms or use technology as a market differentiator to attract investors, there’s no question that you must pay careful attention to your technology investment strategy.

Choosing the right software to meet your firm’s immediate needs and long-term goals will streamline operations today and position your firm to flourish.

It’s common for multiple systems to be used across firms—your investor relations team might use a different technology than your accounting and deal management team. So, whichever platform you choose, make sure that it can manage integrations with external systems to support:

- A Comprehensive Integrated Platform: With the ability to connect each platform, you should be able to marry your data across the organization to create a single source of truth.

- Data and Insight Enhancement: Many firms use third-party data providers to augment their existing data. This additional information provides a richer understanding of relationships, deals, and investors.

Chapter 4: Reporting

Data drives decisions, and the ability to share relevant insights quickly is rewarded with a best-in-class reputation in today’s competitive marketplace. That’s exactly why no PEriodic Table of Technology is complete without solid reporting throughout the entire investment lifecycle.

Financial Reporting

To create scalable revenue across a variety of industries within the portfolio, you’ll need a single, centralized solution to record financials, provide information for monthly financial reviews, and produce quarterly and annual reports.

Through an automated data collection platform, like Altvia, fund managers and institutional investors can leverage smart technology to not only collect reliable data that displays the financial performance of companies, but also access insights to inform the drivers of the performance.

Stakeholder Reporting

It’s critical for teams to understand how to best interact with investors, be visible, and adapt to market changes to ensure effective communications. To do this effectively, IR teams need to be proactive and reduce the time it takes to do administrative tasks while increasing the quality of their communication with investors.

By leveraging technology, firms can save time and sift through mountains of data in seconds to gain better insight into their investors, what they need, and where their interests lie.

It’s also advantageous to empower investors with access to the information they’re looking for instead of continuously relying on the IR team to react to one-off questions and requests. Through platforms like Altvia’s secure portal, investors can review information and analytics at any time, while IR teams can gauge what type of information their investors are most interested in.

Automating communication can also reduce the manual labor IR teams spend on common workflows and regular communications. Technology allows these types of outreach to be customized, automated, accessible, and distributed at the right time.

Committing to Clean Data: With a centralized tool designed to house data in one place, the entire team can easily access, organize, and analyze information at the same time, along with the ability to filter, track, and monitor deals by preferred stage, investment type, and asset class.

Taking Advantage of Data Visualization: Through visual representations of data, decision-makers can see and understand trends, outliers, and patterns from massive amounts of information at a glance.

Built-In Secure Sharing: Instead of back-and-forth emails and phone calls, firms can manage important relationships through simple, secure, and transparent data sharing platforms through streamlined reporting.

Conclusion: How to Implement a Data Strategy for Your Firm

While data strategies or technology for pipeline management has been a “nice to have” in the past, they’re becoming the standard for firms looking to level up their growth. And, to implement a data strategy guaranteed to drive performance, a robust, centralized software solution designed to accommodate and connect the various teams, workflows, and data is a must.

A VC/PE-specific solution arms key stakeholders with powerful insights on everything from portfolio performance to status of diligence, and empowers the firm to focus on strategic initiatives that create value, as opposed to administrative exercises that simply wrangle and format data.

With a strong data strategy, firms can leverage the information they already have to improve performance and outcomes throughout every lifecycle stage. With the functionality to continually monitor the industry and emerging trends, firms can combine alternative and internal data to identify trends and help find better deals. When the time comes to add value, this same data can unveil new opportunities and boost value for current portfolio companies.

Ready to Arm Your Firm

With An Effective Data-Driven Strategy?

It’s important to remember that while data can improve outcomes and firm performance, it still requires a human touch to effectively execute the strategy and make decisions based on the data’s information.

We have a team of experts, with decades of private equity experience, to support system adoption and change management.