Today, firms use interesting technologies to improve and quantify their processes but when compared to the vastly more impressive capabilities of modern data science techniques, Excel and Outlook just aren’t cutting it in the lifecycle of a private equity fund.

By far the largest latency PE firms face today, is the lack of connectivity across their operations. For example, most firms will have a detailed Excel file with a list of all the prospective LP contacts their ex-investment banking analysts and associates connected with back on Wall Street.

Some of the more technologically driven firms might even send this file to an outsourced marketing company that sends generic emails to these potential investors in the hope they set a meeting with one of the General Partners. While time-tested, this way of dealing with investors is rudimentary at best when we look at all the possibilities of raising capital with a modern tech stack.

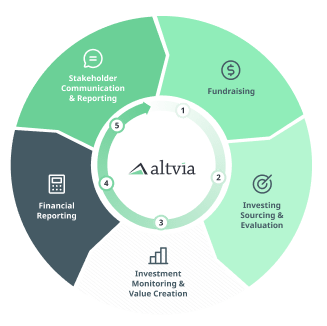

Fundraising isn’t the only stage of a firm’s life cycle where robust data analytics can drive improved results. Efficiently collecting, storing, analyzing, and presenting data will vastly improve a firm’s performance at every stage of the process.

Communicating to Potential Investors

Fundraising is the first and often one of the most tedious processes for a firm. During this process firms are hounded with problems, many of which determine whether or not the firm will survive; dealing with constant rejection from potential LPs, updating pitch decks right before a meeting with an investor, modifying the presentation of the firm’s thesis for each investor are just some of the many examples of something that can go wrong in the traditional approach to fundraising.

Proper data analytics uproot many of these issues from the source. For example, Altvia allows you to create ideal investor profiles which can be matched to investors searching for firms increasing the chance of each LP meeting ending with a metaphorical ‘cheque’ so to speak.

One of the often-overlooked aspects of fundraising is the direct investor communications such as capital calls, firm updates, and even just meetings with the general partners all of which can be automated using the Altvia platform.

Private Equity Fund Pipeline Management

The next stage is to deploy capital. This stage is the one that the vast majority of people attribute to working in finance. In reality, deployment really only takes up 20 to 30% of the average analyst’s or associate’s job description.

Deployment is often characterized mainly by sourcing New Deals that fit the investment thesis. This can also mean thinking of new industry niches and creating industry reports to seek out new avenues for investment.

The implementation of software here, however, is there exists a massive amount of data spread out over multiple sources that can be quantitatively analyzed to immediately source, contact, and analyze prospective Investments.

Altvia consolidates these data sources to create a dashboard of the most current Private Financial information for GP’s to use. Improve deal flow by ranking and sorting deals depending on attributes, attractiveness, and stage in the deal process.

Portfolio Performance & Analysis

Managing already made investments constitutes the vast majority of what a PE firm does. Analyzing/adjusting investment company operations, identifying new strategic acquisition targets, and generally improving the profitability of Investments is the real meat of the job.

The unique perspective that PE holds over investment management is that these firms have an inside look at both the company and the industry. Altvia optimizes this perspective to minimize inefficiencies in investment companies by comparing them to comparables in their space at every level of the company.

Another advantage software gives PE firms is the quantitative method by which they’re able to analyze a company’s operations. Today, most investment companies have multiple sources of revenue, an ever-changing list of costs, and a medley of very different operational tasks.

Connecting these disparate data sources always allows you to perform machine learning and other modern data analytics techniques to dynamically predict which operation desertions will end up helping or hurting the investment company.

Instead of outsourcing operational management or having investment companies evaluate themselves, an upgraded tech stack can help PE firms get more in-depth and personal control over their Investments.

Private Equity Fund Performance & Analysis

Once the majority of operational decisions have been taken and value has been added, it is time to analyze the fund’s performance. Most notably, this entails creating accounting reports, tax statements, in-depth capital structure statements, and other general reports necessary for the fund’s exit in the investment.

Consolidating this data into these accounting reports is a time-heavy task and an expensive one at that. Hiring an accounting firm to keep a track of a firm’s cash flow is a heavy recurring cost. Altvia’s centralized data collection, storage, and analysis are able to support data collection and support the collection process.

LP Engagement

Finally, the last stage of a firm’s life ties back to our first one, Investor Feedback.

IR is the real backbone of a firm and so having efficient, centralized software to manage it is ever more crucial. Announcing post-exit earnings to investors is a very exciting period for a firm and it should be treated as such.

Furthermore, transparency with investors after an important exit is also crucial and so an investor dashboard is an essential part of any tech stack.

An investor dashboard provides a way to self-serve metrics to track data visualization. Limiting LP requests for your IR team.

Combined with the aforementioned announcement and automation, Altvia’s software allows firms to focus on what matters most, financial analysis and value creation.