The dynamics of market competition are transforming Private Equity

How can Private Equity firms leverage current challenges to build a more future-focused organization? Investing in the firm’s future – or not – could mean the difference between growth and stagnation. And in Private Equity, stagnate firms are quickly replaced by those who choose to build for the future.

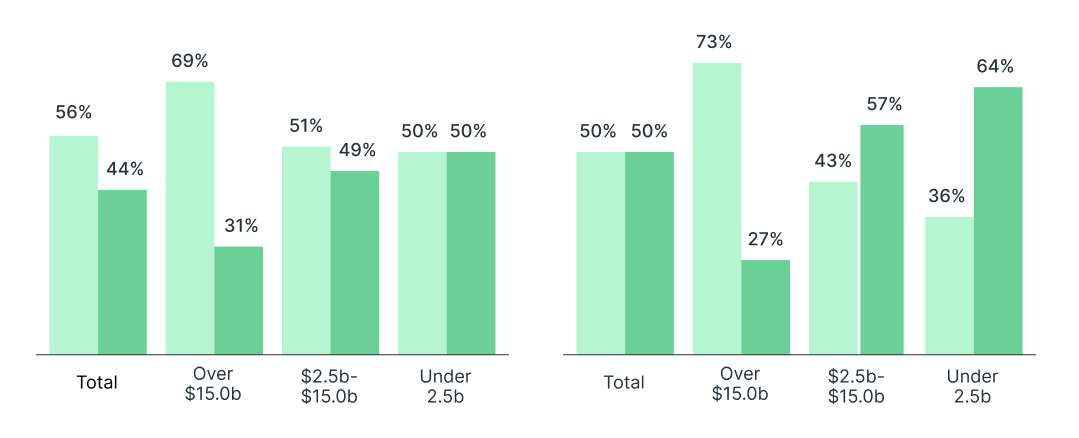

Are you using next-generation data or AI to support the investment process?

Harnessing data is rapidly developing as a must have capability.

Source: E&Y’s 2020 Global Private Equity Survey

In fact, larger private equity funds are increasing their investment in using next generation data (social media sentiment vs. market data) to support the investment process but smaller firms have not been able to take advantage of this trend and are potentially unsure of how to even take advantage of big data in their workflows. E&Y’s 2020 Global Private Equity Report looked into this movement to new data as well as how they are adopting artificial intelligence (AI) and found that “the increasingly competitive landscape of obtaining limited partner commitments and closing investment opportunities will challenge CFOs to reassess their views on the relevance of this technology in their operations. Firms looking to improve their analytics capabilities and are clearly investing in the technology tools. This is an obvious attempt to get data out of spreadsheets and in one centralized location.

Make no mistake, prioritizing data within the firm, effectively capturing and managing it and then establishing best practice workflows is a challenge.

Given the exponential increase in data volumes, it’s become apparent to fund managers that storing data in disparate legacy systems throughout the organization, or relying on portfolio companies or outside parties to dive into the data and operational metrics for them, simply isn’t sustainable. Investors are increasingly demanding real-time digital access to portfolio information and reporting along with more customization. And the only way to provide it to them is by storing data within one dynamic solution.