Using an investor relations software to support LP relationships is a challenge experienced by almost all private equity firms right now. This point is illustrated in the Ernst and Young Annual Global Private Equity Survey.

The other day, I was on a call with a firm that invests in the management companies of large, premier GPs and helps them to address strategic operational priorities. They had downloaded our Investor Experience guide because, in their words, “The bulk of what we hear about from our GPs is how much they’re struggling with the ability to properly service their LPs and how they’d like help understanding what technology is out there to improve that.”

Technology transformation and improved investor reporting are still top-priority items for CFOs and the value of technology and its role in investor relationships is more widely recognized each year.

What are your top priorities for an investor relations software?

Many firms understand that technology investment can improve margins. And it seems that firms are adopting technology to manage fund accounting and investor relations.

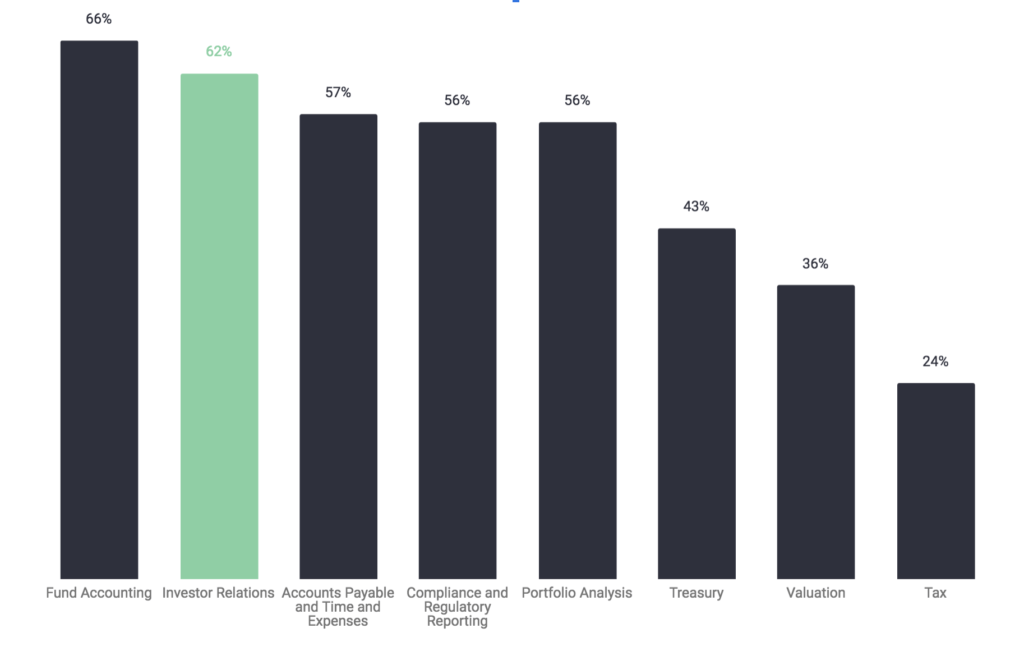

Which of the following actions have you taken to mitigate margin erosion of your management company?

In fact, much of the technology innovation is being realized in the investor reporting side of the business. According to the survey results, private equity managers continue to focus on enhancing the investor experience with better reporting through portals that improve the level of access to information.

In which areas did you make investments in investor relations software in the past three years?

How do you share your portfolio information with clients?

Additionally, respondents to the EY survey report that they will “use business intelligence and application programming interfaces (APIs) and data feeds to provide information to clients in the coming years, even if they are not using these tools today. “

And respondents believe that “leveraging these new solutions will be paramount to support investor satisfaction in accessing timely information via a format that meets their preference.”

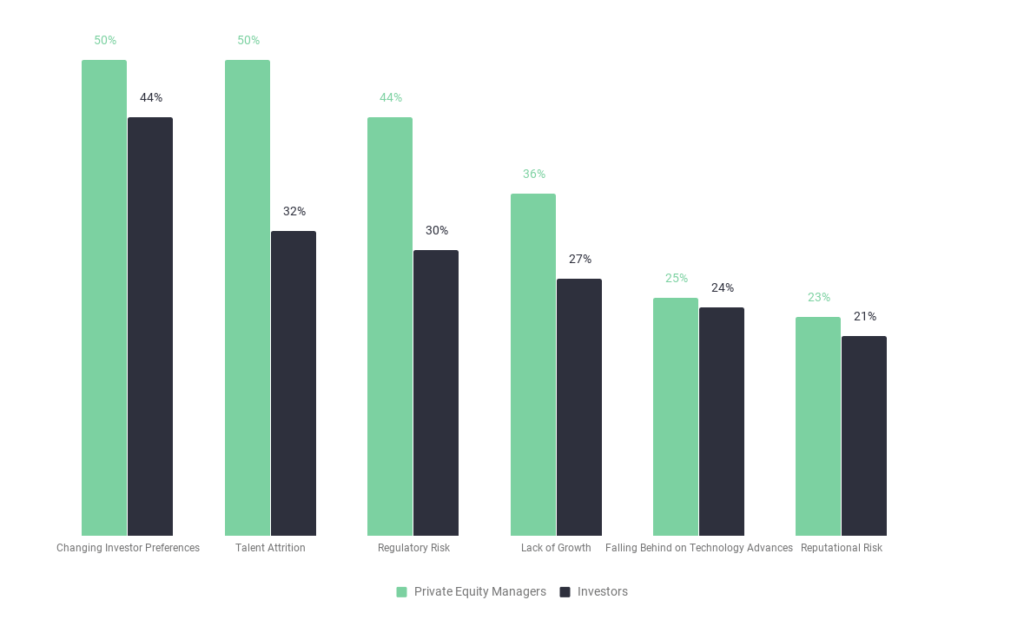

Private equity CFOs recognize the importance of investor satisfaction, as 20 percent more CFOs recognized changing investor preferences as a top risk facing the industry. As a result, changing investor preferences now ranks as a top-rated risk along with talent attrition.

What are the most critical risks affecting the private equity industry over the next five years?

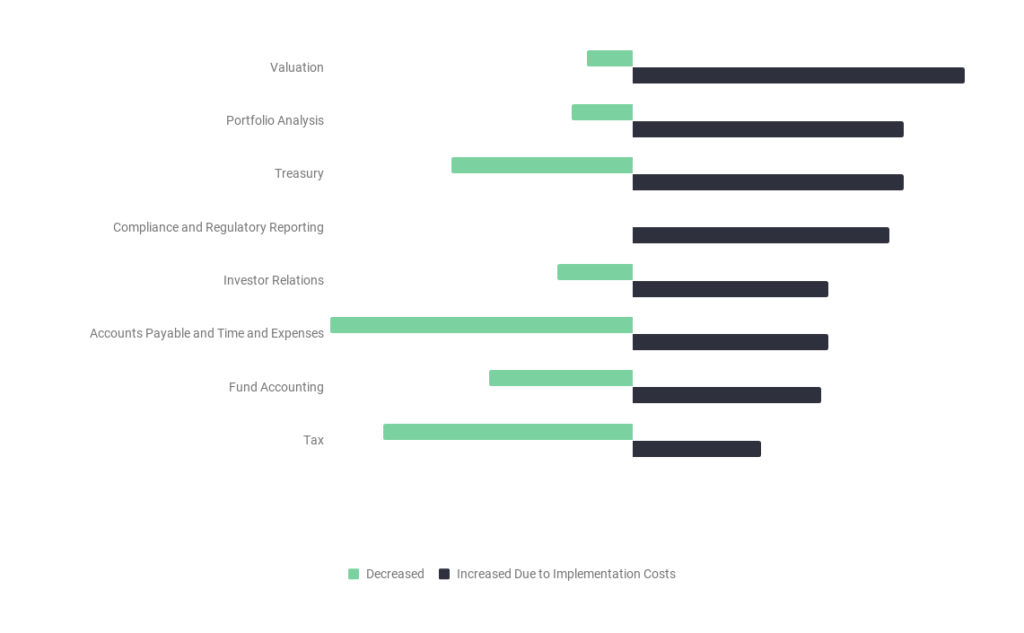

However, firms report that they haven’t yet seen a return from technology investments.

What is the overall impact to date of technology investments on operating expenses?

This is where the opportunity exists.

The industry agrees—technology is a powerful tool to improve the investor experience. And, providing excellent investor management and reporting is critical to a firm’s success. But there are real challenges to implementing systems and managing change in order to get full value out of the investment in technology.

This is the key. While most firms plan to adopt technology in order to strengthen investor relationships, there isn’t a clear path to successful implementation.

To differentiate, your firm must be able to effectively implement technology and realize real impact. Deciding to invest in technology is just the first step. Systems implementation, configuration, integration across systems and departments, and education and training of the firm and its investors are critical pieces to the puzzle.

Over the next couple of weeks, we’ll discuss the steps required for successful implementation and provide examples of what it looks like when a firm effectively implements and uses technology to support its LP relationships.