Private capital is at an inflection point. Fundraising is taking longer. LPs are digging deeper. And the bar to stand out keeps rising.

In just two years, the median PE fundraising timeline has grown by 35%—stretching from 14 to 19 months (Preqin). Nearly 90% of LPs now report receiving GP extension requests, a clear sign that capital is tighter and diligence is deeper (Coller Capital).

The reasons are no mystery: slower exits, reduced distributions, and mounting macro uncertainty.

For GPs, the impact is real. Every extra month on the road compresses IRR and gives rival firms a head start. Add in new regulations like the SEC’s Form PF update, and expectations shift—LPs, under pressure themselves, now demand sharper differentiation, real-time transparency, and operational rigor from the very first meeting.

Sidebar: SEC Form PF Update: At a Glance

- Effective June 12, 2025

- Requires more granular, fund-level data on structure, exposures, and liquidity

- Event-driven filings now mandated after adviser-led secondaries, fund terminations, and other key events

- Expanded reporting on counterparties, portfolio company financing, and fund-of-funds

- Faster, more detailed reporting is now the expectation from both regulators and LPs

Source: SEC Release No. IA-6838, Amendments to Form PF Compliance Date Extension, January 29, 2025. sec.gov

While performance still matters, LPs increasingly reward clarity—about your thesis, your numbers, and how you run your firm.

In this two-part series, we break down the 5 partner-level pillars that separate the GPs who struggle from those who succeed. First up: how mastering your story and surfacing data can convert faster, build trust, and move capital sooner.

Clarity Is Currency: A Story LPs Can Sell

LPs don’t have time for ambiguity. They want to know, in plain terms: Why now? Why you? What’s the upside? The most effective GPs don’t just present facts. They deliver a narrative that’s easy to retell and hard to forget.

Success pairs two skills:

- Disciplined content: a tight statement of gap, edge, and reward.

- Skilled delivery: an LP-focused narrative that answers objections before they arise.

Ground the narrative in hard metrics—earnings before interest, taxes, depreciation, and amortization (EBITDA) and other tangible KPIs—so it shifts from aspiration to investable reality.

What Makes a Fund Story Stick

A forgettable deck says, “We target fragmented markets with favorable demographics.” A memorable one is specific, concrete, and timely:

“We acquire U.S. rural outpatient clinics that generate about $3.8 billion of EBITDA a year and trade 25% below urban comps. Our operating bench has already doubled margins at 3 targets. We aim for a net IRR of 22% to 24% and a 2.0× DPI within 5 years.”

That is a story an LP can run with. It is clear, focused, and aligned with today’s investor expectations.

Lead with three essentials: a clear market gap, a distinct team advantage, and a realistic, well-supported upside for investors. This structure, central to strategy memos and the ILPA DDQ, helps GPs address LP priorities early and keep the fundraising process moving.

1. Describe the market tension, not just the trend

LPs see the same broad claims in every other deck. What lifts eyebrows is a quantified imbalance that still hasn’t closed. And a reason the window will not stay open forever.

Example: “Rural outpatient clinics generate roughly $3.8B EBITDA annually yet trade 25% below urban comps because consolidators avoid trip-wire state regulations.”

LP might think: If the discount is obvious, why hasn’t it vanished?

A five-year multiple chart with a timeline for spread compression is effective in signaling urgency and discipline.

2. Prove your edge in one breath

Alpha disappears when execution looks generic. Tie a specific result to a unique capability: “Three former operators lifted proprietary deal flow 40% and shaved diligence 15 days.”

Then walk through a recent deal sourced under that bench, including downside sensitivity if multiples compress 10%.

3. Anchor the payoff with ranges, not point targets

Ranges (e.g. “22–24% net IRR, 2.0–2.2× DPI”) signal scenario work. Translate to plain language: “double the money in five years.” Re-index prior funds to the same horizon and show quartile rank under stress to quell “too rich” return stretch pushback.

If an LP can echo your pitch in 2 sentences, you are ahead of the pack. A strong story forms the backbone for every conversation that follows, linking your numbers and your narrative.

Sidebar: GLPs Feel the Squeeze

- 29,000 unsold PE-backed companies are tying up liquidity. (Bain & Company)

- 79% of LPs declined re-ups in 2024 due to slow responses and communication gaps. (Coller)

Show What's Changed and Quantify It

LPs don’t fund yesterday’s story. They want proof of progress. The best GPs go beyond static numbers—they show real momentum. Forward-looking metrics matter: margin lift, pipeline velocity, and cycle time reductions all demonstrate execution and adaptability.

After the thesis, dedicate one slide to “Since Last Fund” and include:

- EBITDA margins up X basis points

- Pipeline covers Y months of planned deployment

- Term-sheet-to-close time cut Z days

Each of these metrics speaks directly to LP concerns: speed of deployment, confidence in value creation, and risk mitigation. But just as important is how transparently GPs communicate what’s behind those numbers.

LPs value managers who publish financing strategies, respond swiftly, and disclose portfolio decisions, including NAV loans or capital pacing shifts; this transparency builds trust and sets the tone for partnership.

Use visual timelines or before/after charts, such as pipeline velocity over time or EBITDA margins by vintage, to bring progress to life; even a lessons-learned slide signals strategic adaptation. A clear, visual track record makes it easy for LPs to see momentum and understand how your approach adapts to market realities.

Defend Your Right to Win

In today’s market, facts matter more than prose. GPs who stand out make their right to win obvious, not arguable. Build a 1-page bullet sheet that covers:

- Market timing

- Team edge

- Proprietary pipeline visibility

- Comparable exits (with multiples)

Cite primary sources beside each bullet. The discipline signals institutional rigor—exactly the assurance partners want LPs to feel. This is not about checking boxes. It’s about surfacing your edge, showing your work, and making the case for why your team is positioned to outperform.

LPs are comparing you to a dozen other managers. The more you can back up your claims with real, accessible data, the faster you move from “interesting” to “in diligence.”

Make Data Easy to Access and Easy to Trust

Once you’ve set your story and established your edge, LPs want substance behind the pitch. In Preqin’s 2025 survey, 73% of LPs cited inconsistent reporting as a top friction point. Every missing number or unclear update slows the close and erodes trust.

Lock in the Framework

Put Data Under One Roof

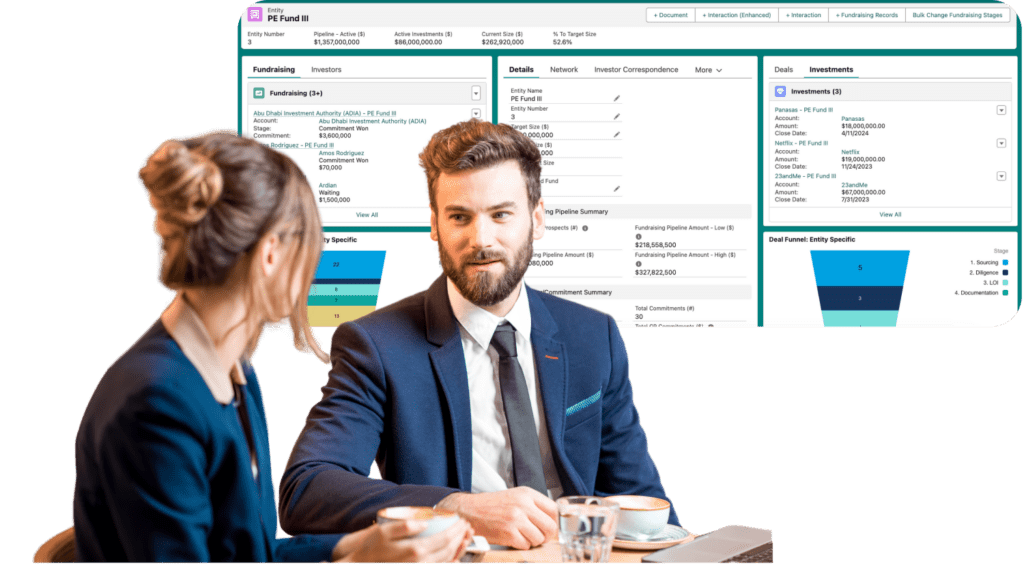

A centralized portal aligned with SOC 2 and ISO 27001 standards eliminates version-control issues and puts critical information front and center for LPs.

Past Fund Performance

Realized and unrealized results, with context and clear attribution

Active Portfolio Updates

Company-level progress, milestones, and operational highlights.

Proactive Communication

Regular updates on key developments, not just quarterly reports

Transparency on economics is equally important. LPs expect upfront clarity on cost structures, including fees, expenses, and terms that impact net returns–86% of LPs say this is critical during diligence.

Stay One Step Ahead

Don’t wait for LPs to chase you. Push tailored updates—concise emails linking to refreshed dashboards, quarterly video walkthroughs, or one-pagers on portfolio highlights and lessons learned. Let LPs filter by sector, geography, or value-creation lever. Track capital calls, exits, and other key events in real time.

Make Momentum Visible

LPs want to see momentum, not just static numbers. Visual dashboards should highlight performance across funds, current portfolio progress, and key milestones. Include IRR, TVPI, and DPI benchmarks, but also show how value was created—margin expansion, operational improvements, pricing power, or strategic exits. Visual timelines and before/after charts help LPs quickly grasp your evolution and adaptability.

Close Diligence Gaps

Prepare direct answers to recurring topics—team changes, gross-to-net math, pipeline breakdowns, attribution logic, and valuation policy—so conversations stay focused on strategy, not cleanup.

When LPs can benchmark, compare, and understand your portfolio in minutes, not hours, you demonstrate operational discipline and make it easier for them to move forward with conviction.

Visual storytelling is more than reporting. It builds trust, accelerates decisions, and gives LPs what they need to advocate for your fund internally.

From First Impression to Final Close

A story LPs can repeat is the first step. But it is the data—clear, current, and visual—that turns interest into conviction. When you combine a compelling narrative with transparent, well-structured information, you move from being “another deck in the pile” to a frontrunner.

Yet even the best story and cleanest data won’t close a fund on their own. The next differentiator is how you communicate, how you build trust, and how you deliver a seamless, frictionless experience from first call to final close.

In Part 2, we’ll go deeper on the operational and relationship side of the raise—how strategic communication, genuine partnership, and technology execution shape LP trust and set the stage for re-ups. In a market where every detail counts, the GPs who master the entire experience, not just the pitch, are the ones who keep capital coming back.

Schedule a Demo ➔

You’ll be amazed at what Altvia can do for you and your team. Let’s talk and see how we can help.

Pick a Meeting Time

Fill out the form below with your work email to be routed to a calendar to select your meeting time.