RISE ABOVE WITH ALTVIA.

Our leading alts platform simplifies data complexity, streamlines capital raising and deployment, and delivers a modern LP experience. As your needs evolve, we help you adapt – turning relationships and opportunities into preferred returns, strong investments, and lasting partnerships – helping you rise above the competition.

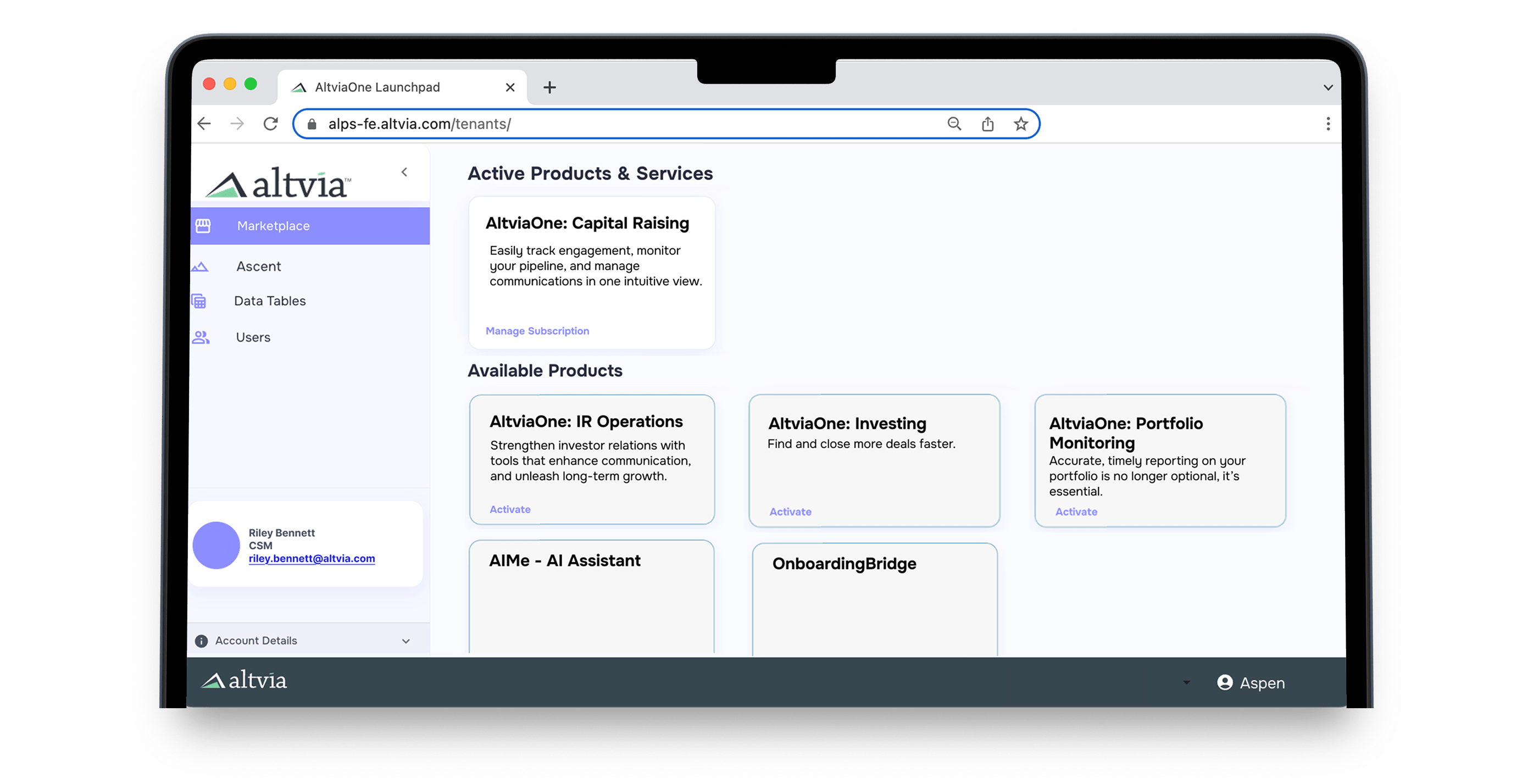

An End-to-End Platform for Peak Productivity

Get access to a full platform without having to buy multiple one-off point solutions and products to achieve your business goals.

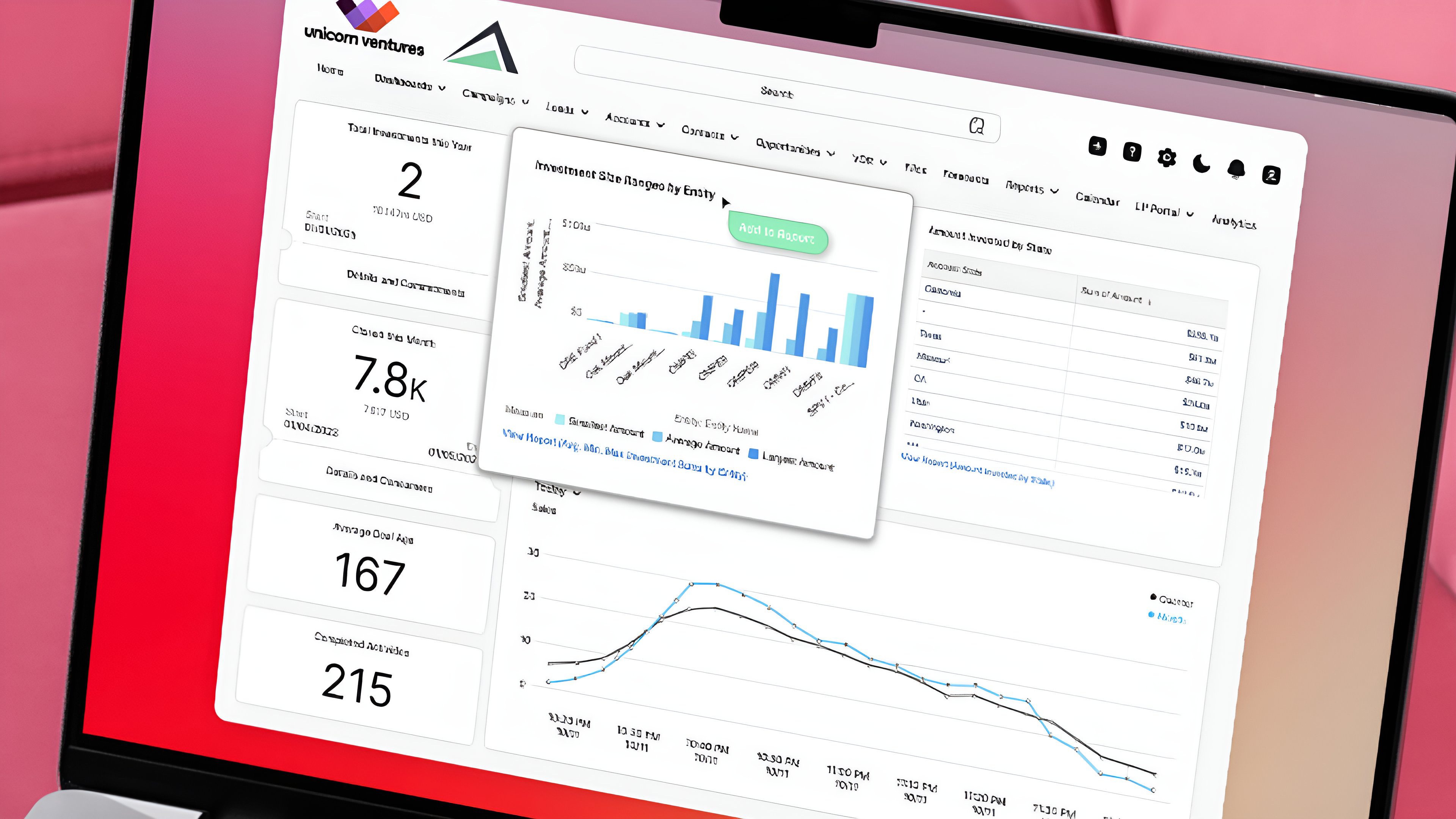

CRM

An incredibly simple to use CRM purpose-built for firms who want to grow private capital relationships and close deals.

VDR & Portal

Deliver a best-in-class LP experience with our innovative portal & VDR that make data presentation a compelling story.

Insights

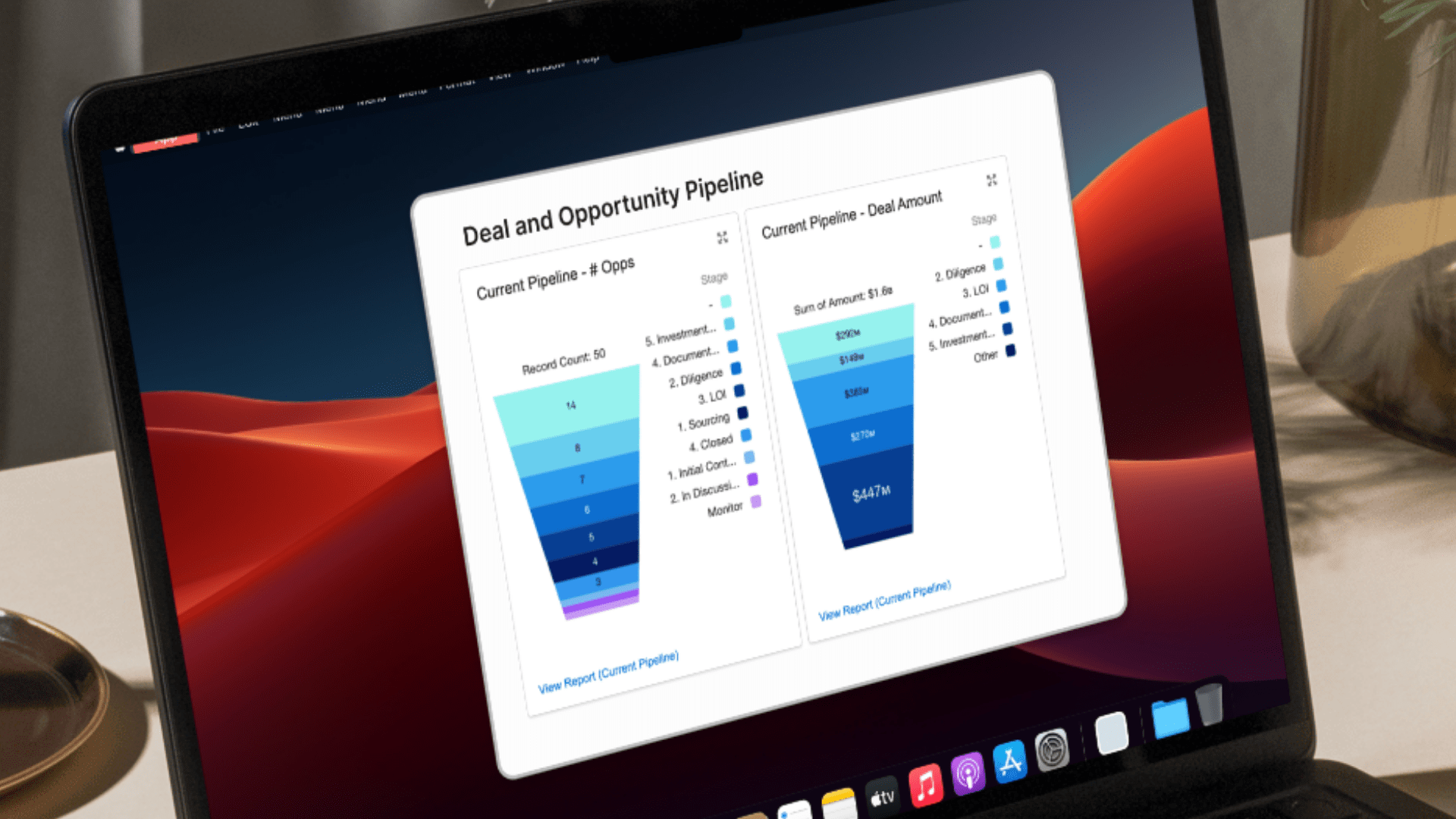

The demand for swift and accurate reporting is paramount. Analyze deal, fund, and relationship data with precision in minutes.

CRM

- Be ready for Monday morning with accurate data at your fingertips.

- Know exactly where your fundraising and deal pipeline stand at any given moment.

- Quickly access key details about existing and prospective investors.

- Focus on the most impactful deal sources with a streamlined, data-driven approach.

- Send tailored messages to key stakeholders for increased engagement.

- Streamline the creation and distribution of capital calls, PPMs, and updates for timely, accurate communication.

- Facilitate collaboration across your team for faster decision-making.

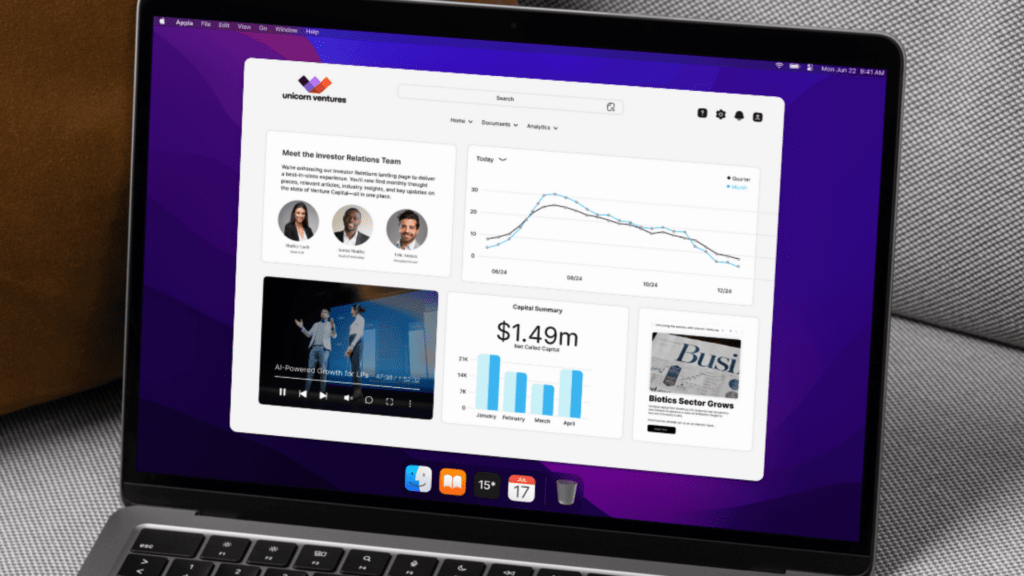

VDR & Portal

- Safely share sensitive documents with the right stakeholders.

- Create a secure, branded experience that reflects your firm’s identity in the digital space.

- Tailor messages and updates to your investors, improving engagement and trust.

- Easily manage and segment your data to target the right investors and stakeholders.

- Real-Time Performance Updates: Provide your investors with up-to-the-minute performance insights, enhancing transparency.

- Facilitate collaboration across your team for faster decision-making.

Insights

- Ensure your firm’s data is clean and accurate, reducing errors and increasing reliability.

- Access key insights without wasting time in emails, spreadsheets, or disconnected tools.

- Effortlessly upload and integrate unstructured data into your tech stack for greater efficiency.

- Gain access to comprehensive analytics and reporting to make informed, strategic decisions.

PLATFORM

Key Features & Benefits For A Seamless Experience

The most modern user interface, driven by AI, to ensure your platform actually gets adopted.

CRM

Empower Your Team With Award-Winning Relationship Management Tools

Unite all of your firm data, tools, and teams on a single customer platform.

- Pipeline Management

- Investor Activity Tracking

- Lead Management & Prospecting

AI

The Only AI Built for Private Capital Markets

AI isn’t just about automation; it’s about solving specific problems with precision to drive productivity gains. Leverage our AI Assistant, AIMe, and proprietary AI Agents, to do more, faster.

- AI Assistant

- AI Agent: Sentiment

- AI Agent: Research

SHARESECURE

Digital Investor Experience

In today’s competitive market, proactive engagement with investors sets you apart. Strengthen investor relationships with tailored updates that enhance communication, and unleash long-term partnerships.

- Data Room

- Smart Data & Document Segmentation

- Firm Branded LP Portal

- Generate Custom Templated Reports

CORRESPOND

Redefining Marketing Standards with

Exceptional Features

Engage investors faster, raise capital more efficiently, and scale with ease, minimizing time spent on admin tasks and workflows.

- Design and send marketing emails at scale.

- Securely send capital calls to investors.

- Safely distribute PPMs with potential investors.

- Send correspondence to LPs across multiple entities.

REPORTING

Flexible & Fast Business Intelligence, Data Analysis & Reporting

Eliminate manual and error-prone procedures, enhance data transparency, enable deeper insights and flexibility for informed and strategic decision-making.

- Standardized Insights embedded in CRM and Portal

- Portfolio Management

- Intuitive Data Visuals

- Event Management (Roadshows)

Schedule a Demo ➔

You’ll be amazed at what Altvia can do for you and your team. Let’s talk and see how we can help.

Pick a Meeting Time

Fill out the form below with your work email to be routed to a calendar to select your meeting time.