Data & Technology Guide For Private Equity Firms

Learn how to thoughtfully develop future-proof solutions that not only optimize your current processes, but also scale with the challenges that come with tomorrow.

Chapter 1: Data & Technology Trends

While the topic of how to interact, leverage, and utilize data to gain valuable insights on how to increase LP transparency is still topical, the dominant trend in the industry right now is around the utilization of AI and advanced data analytics.

Whether you are a believer or an AI skeptic, it’s clear that the new AI trend has accelerated the need for alternative asset professionals to learn, embrace, and adopt new technology strategies to remain competitive and relevant.

Now, firms are assessing how data and technology can facilitate informed investment decisions, address regulatory challenges, and enhance operational processes. Long story short, embracing a data and technology-first mindset is no longer just a strategic advantage—it’s a necessity for staying competitive in an increasingly data-driven world.

*E&Y 2023 Global Private Equity Survey

While LPs have increasingly institutionalized, recent vintage private equity funds have seen a narrowing range between return quartiles. This has heightened demands on managers from LPs and prompted firms to adopt new strategic approaches to positioning and differentiation.

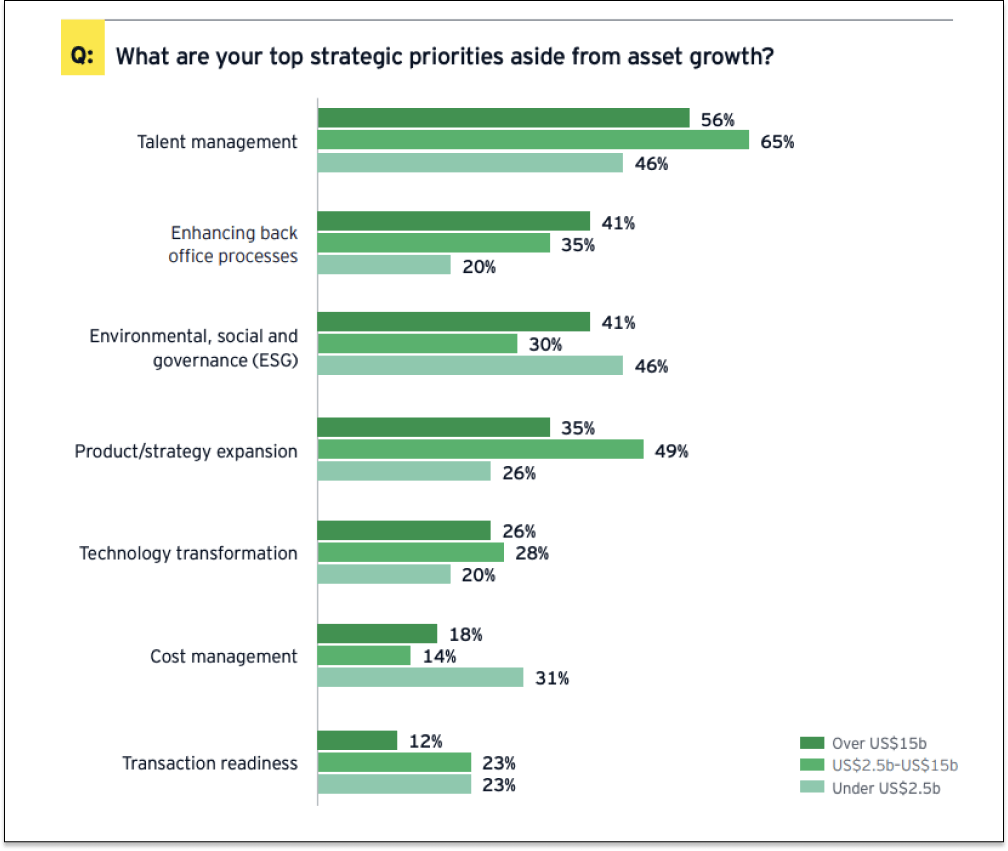

In EY’s 2023 Global Private Equity Survey, technology transformation still ranked high as a strategic priority to firm growth. And despite firm differences, many of the other strategic priorities have “data” at their core, which shows that data and technology continues to emerge as a central and strategic lever to effectively address increasing LP demands.

What’s already becoming clear to those leading this technology evolution is that simply throwing money at data and technology point solutions is not the answer.

In this rapidly changing and competitive market, it’s important to evaluate technologies that address firm challenges holistically. Taking the time to thoughtfully evaluate and develop future-proof solutions that not only optimize your current processes, but also scale with the challenges that come with tomorrow will help your firm stand out from the rest of the pack. Investing in a solution that will be your partner tomorrow is a new trend that transcends market fluctuations.

Chapter 2: Demystifying Data & Technology Evaluations

While it’s tempting to formulate a comprehensive data and technology strategy by skipping right to product demonstrations, it’s important to pause to consider your firm’s biggest challenges and needs. Otherwise, you might as well look no further than Microsoft Excel, the global leader in managing data and building charts for the last four decades.

Instead, focus on what problems or gaps your firm currently faces on a daily basis. By focusing on what you would like to be able to do as part of a data strategy, uncovering what you’re doing that’s working, and identifying issues that present gaps in getting to your end goals, you will be better equipped to find solutions to the challenges that make your operation distinct.

Identifying the specific problems you’re looking to solve makes you one step closer to pursuing demos. Understanding the evaluation criteria of your evaluation and the basics of how a solution will work for your firm is key to making the most of the time you spend scheduling demos.

What to ask when considering a technology solution for your firm:

- Which part(s) of your operations would be best served by increased data capabilities?

- Who are the stakeholders who stand to benefit from a data strategy? How do they benefit?

- Where are there problems in your ability to generate and capture data?

- Which processes could be streamlined by or be better-informed by data?

- What data would you like to have but don't currently?

- Where could technology be used to facilitate internal processes that may be generating data that isn't currently captured?

- Where and how do you currently store data?

- How usable is your data in it's current form?

- Who do you depend upon to make your data usable?

Chapter 3: How to Approach Formulating a Firm Data Strategy

Once you have a clear understanding of the data gaps your firm may be facing, you will have a better idea of what to look for from providers. There are countless combinations of products and/or processes to solve for firm challenges, so here is a 3-step guide to find the answers your firm needs to properly evaluate a technology partner.

Step 1: Accessing and/or Connecting to Data

In any tech evaluation, the initial step is accessing and connecting to your firm’s necessary data. This process begins with identifying the specific data required for analysis, sourcing it from various internal and external channels such as databases, APIs, or third-party providers. Once identified, you need to ensure that vendors have proper data collection and extraction techniques available to ensure the acquisition of raw data.

Integration and consolidation of disparate datasets follow suit, harmonizing them into a unified format suitable for analysis. Establishing connectivity between data sources and analytics platforms is paramount for seamless data access.

Step 2: Preparing Data to be Properly Analyzed

The preparatory phase stands as a pivotal juncture in any data workflow, wielding significant influence over the accuracy and ease of subsequent analyses. Regardless of data origin, every dataset necessitates meticulous preparation, which can entail simple tasks like rectifying typos or eliminating duplicate entries. However, reliance solely on traditional methods, like Excel, harbors inherent limitations. These methods are often laborious, error-prone, and lack repeatability.

Consequently, they pose risks of unnoticed analytical discrepancies during data consumption. Conversely, contemporary data preparation solutions have transcended the constraints of local desktop solutions, leveraging advanced techniques to streamline the process. By harnessing robust data warehouses, these solutions centralize disparate datasets into a single, authoritative source.

They execute persistent transformations to align data structures and syntax, while also automating deduplication, which readies data for downstream analysis and consumption. Once configured, this approach operates autonomously, mitigating the need for human intervention and circumventing the pitfalls associated with error-prone methods and limited tools.

The preparation layer is likely to be one, in identifying problems with your data, that uncovers a centralized dependency on specific skills and/or long periods of time required to meet reporting demands. In assessing their current situation against this step, many firms become aware of an unhealthy dependency upon analysts with impressive Excel skills. Then, upon seeing modern capabilities, discover that the time required of analysts to perform these analyses — together with the risky error-prone nature of them doing so — is a compelling reason to look at turning to technology to improve this step. In doing so, analysts become valuable resources that can be redeployed to other more valuable activities — in many cases, ones nobody had been doing — that allows firms to become strategic in differentiating themselves.

Step 3: Performing the Analysis on and/or Consuming the Data

Properly prepared, data is now ready for its ultimate purpose — to be analyzed, consumed, and shared. This is the area that modern technology has impacted most significantly in recent years, having dramatically changed the ways in which data can be analyzed and consumed, the scale at which data can be interacted with, and even the influence of AI to predict insights based on data without humans even having to ask the questions.

One of the biggest modern innovations in this regard comes from tools that provide business users, who don’t possess technical data skills, to intuitively complete complex analyses without the help of IT, and to do it in real time. While the business intelligence and analytics category has traditionally been IT-led and required complex resources like data analysts and data scientists, the entirety of the data analytics market has now shifted to empower business users, without the dependencies of IT skills, to create and consume their own analyses. This “self-service” model has led to dramatic improvements in the time it takes to get answers from data, to discover insights in an engaging, interactive way, and in turn has dramatically reduced the bottlenecks associated with dependencies on people, skills, and process to get there.

Gartner’s Magic Quadrant for Business Intelligence and Analytics Platforms, shed light on this shift, which it had been tracking in previous years’ versions of the same report. The opening commentary reads “The business intelligence and analytics platform market’s shift from IT-led reporting to modern business-led analytics is now mainstream.” Industry-leading private equity firms are empowering their business users to discover insight in their data themselves, in record time, and in ways that seamlessly combine data across the entire organization. In doing so, the data and reporting challenges they once faced are now forgotten, having instead turned their attention to how to take their newly-enabled capabilities on the offensive to beat their competition and to provide a new level of differentiated service to their partners.

Chapter 4: Advantages of an All-in-One Technology Solution

An all-in-one solution provides benefits of a more unified firm approach. Not only because it centralizes your firms data, but it also unifies firm collaboration, which decreases the risk to execute on strategic initiatives.

And while it’s reasonable to assume that large, transformational technology initiatives result in the throwing away of existing technology and starting fresh, industry leaders are actually discovering compelling reasons to consider data strategies that don’t always lead to total replacement. They’re finding success in keeping the systems that work well, finding best-of-breed replacements for those that don’t, and investing in the newest innovations in technology, which focus primarily on integrating and facilitating the ability for these otherwise disparate systems to provide insights that can be turned into strategic differentiation.

When evaluating technologies, fund managers often realize that have a fully integrated solution is not the norm. This realization often makes fund managers settle for less-than-capable solutions, as they are faced with tough decisions about which functional areas to prioritize.

After all, whether technologies are significantly more effective — or only marginally more — than the systems being replaced, there is still a learning curve of adopting new technology, which may lead to low adoption rates. And if so, the foundational layer of having a data strategy is compromised.

With a multitude of potential solutions in the market, it is key that each firm consider developing its own strategy, irrespective of its current systems, that focuses on the problems their strategy aims to solve. Then those involved in the process are more effectively able to assess the available universe for solutions to firm problems, without compromising.

Ready to Arm Your Firm With An Effective Data-Driven Strategy?

Fill out the form below to get started: