FUND OF FUNDS COMPLEXITY HAS MET ITS MATCH

Simplify Fund of Funds Complexity with Altvia

Since its inception, Altvia has been the leading solution for Fund of Funds, helping firms navigate complexity, drive efficiency, and build stronger investor relationships.

Trusted by Fund of Funds innovators

Firms are ditching legacy platforms to deliver an engaging experience at every level.

Every single client has reported a return on investment with Altvia.

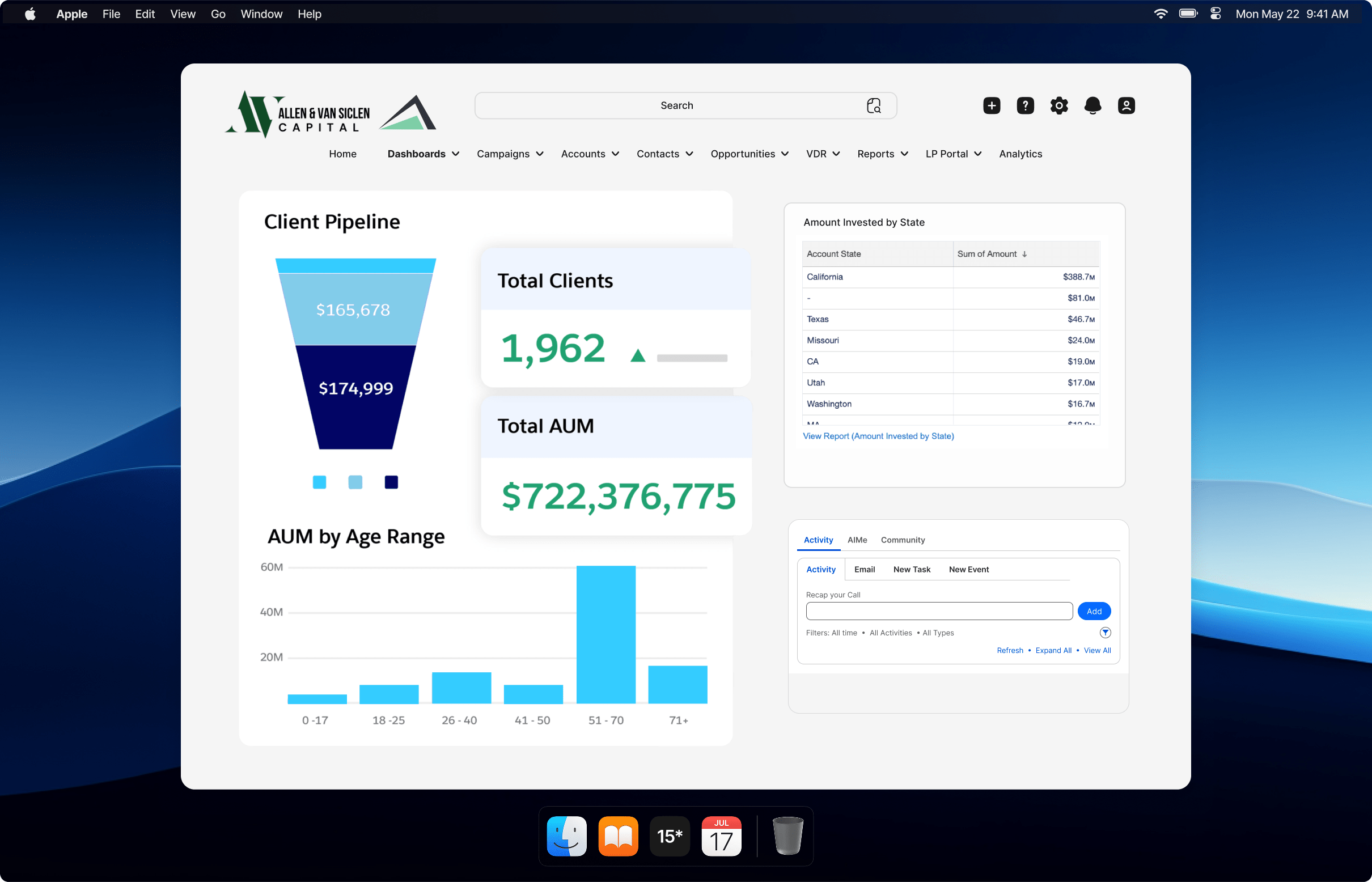

CENTRALIZED DATA

Easier Data Management

Cut through the data clutter and move faster by centralizing your data into one easy-to-manage platform. Streamline operations and make smarter decisions – without the endless clicks

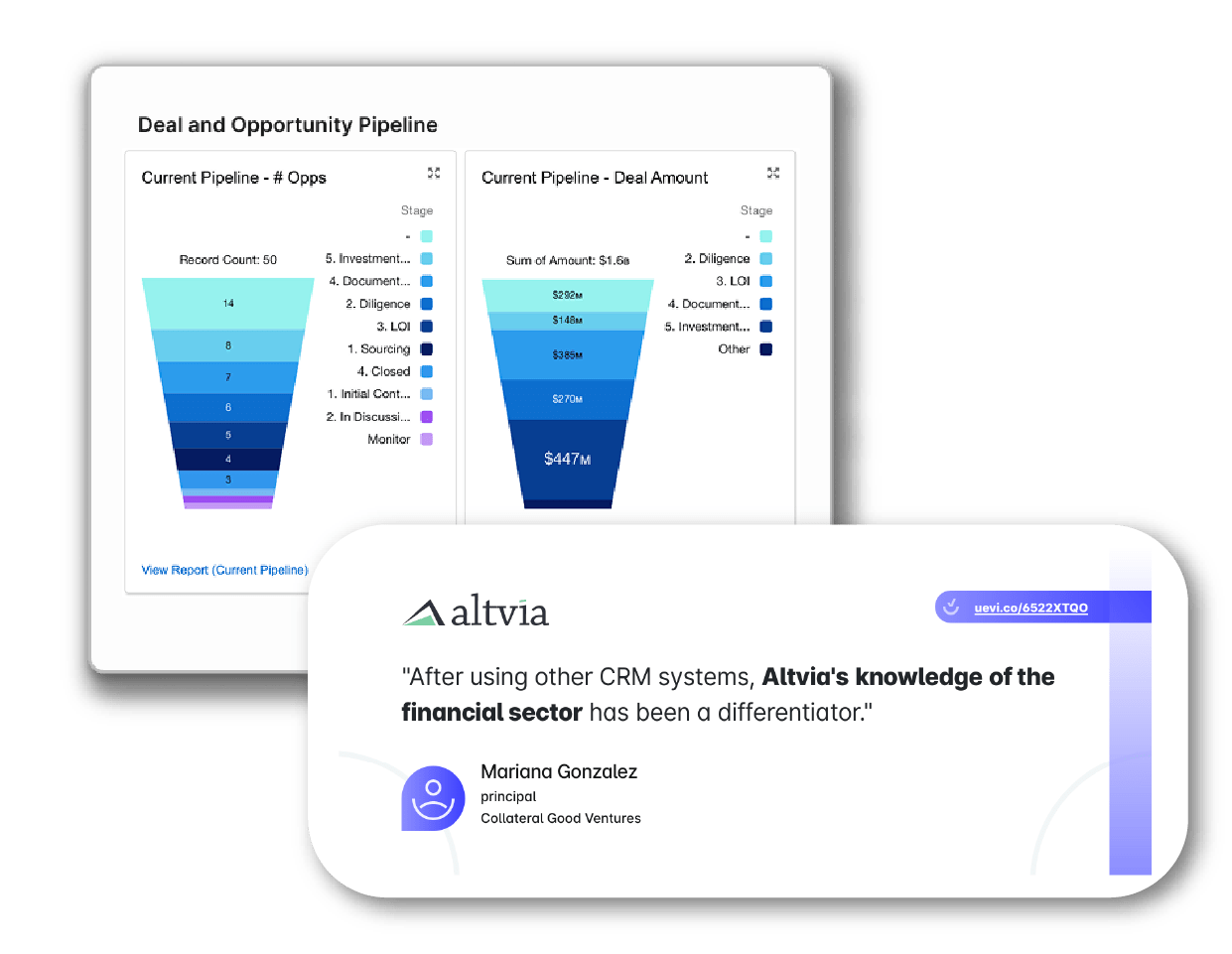

ACCELERATE ALL FUNCTIONS

Raise & Deploy Capital Faster

Secure commitments quickly and stand out as a differentiated investor by having proprietary data at your fingertips. Altvia centralizes everything, helping you raise and deploy capital with speed and confidence.

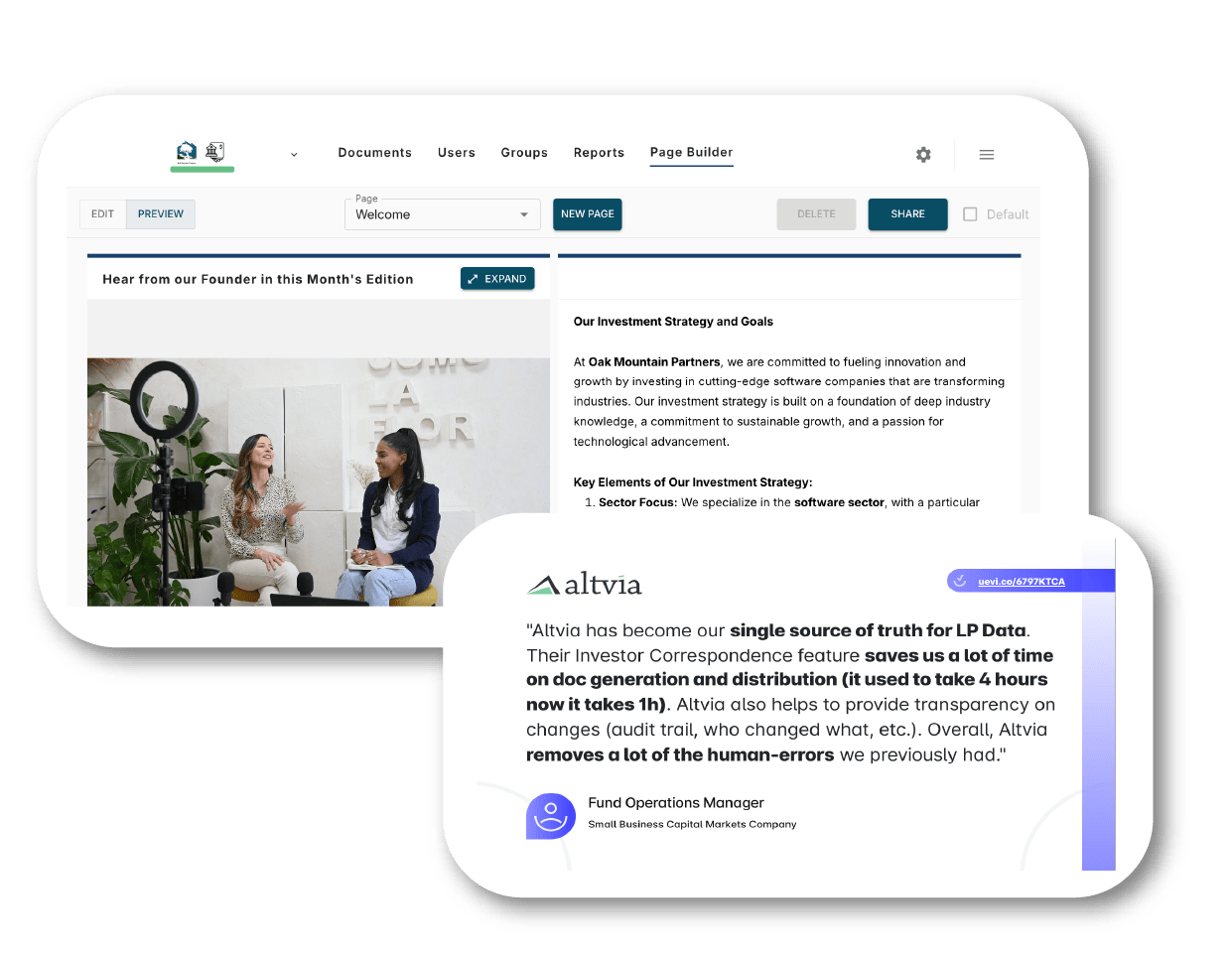

REAL TIME LP UPDATES

Stay proactive by keeping your investors in the loop with real-time updates. Altvia empowers you to keep LPs securely informed, aligned, and confident in your strategy.

Schedule a Demo ➔

You’ll be amazed at what Altvia can do for you and your team. Let’s talk and see how we can help.

Pick a Meeting Time

Fill out the form below with your work email to be routed to a calendar to select your meeting time.