The Art of Virtual Fundraising

We sat down with some of the sharpest minds in the industry to see how they’ve embraced technology to connect with investors and hit fundraising targets.

Virtual Fundraising In Private Equity

Fundraising—both in private equity and venture capital—is much different today than it was just a year ago. With stakeholders of all types working remotely, for the most part, investor relations teams aren’t able to have in-person meetings with potential investors and must take a new approach.

As firms adapt to a new operational model, many have questions about how best to maintain investor engagement and develop and nurture relationships with new investors. These activities are much more challenging now that the traditional means of communicating and building trust are not available.

Private Equity & Venture Capital Climate

Needless to say, stakeholders throughout the industry had their confidence shaken by the pandemic. Most firms experienced a month or so when there simply was no investing activity taking place, which was concerning. However, even with some “hiccups” in fundraising, activity did start to pick up again, and the firms that were able to regain traction most quickly were those that had fundraising technology in place that allowed them to quickly shift to a more remote operating model.

In fact, our panelists agreed that for all the negative impacts the pandemic has had on business (and life in general), it did produce efficiencies for team members who didn’t have to spend time traveling around the country to meetings. Firms that didn’t have the right technology are now scrambling to get systems implemented. Our panelists also observed that the pandemic has accelerated a number of trends that began before the crisis, such as using technology to share more information in advance of conversations rather than during them.

Our fundraise was 30% faster because of virtual meetings and not having the inefficiencies of travel.

Conrad Gorospe

Head of North American Fundraising, Insight Partners

How Firms Build Virtual Relationships

In order to “weather the COVID-19 storm,” many GPs relied on existing relationships and technology to get more out of relationships. This was necessary because most LPs, not surprisingly, tightened their capital commitments. One of our panelists also talked about how pre-marketing the launch of a fund to a now-captive audience helped his firm enjoy a successful launch.

When you’re not meeting in person for the long diligent sessions, getting that information to an lp ahead of time for them to do the work on their own is where we were going already but [covid] has just accelerated that trend.”

Angela Sibley

VP, Investor Relations, Lightspeed Venture Partners

Creating a Positive Investor Experience

The ShareSecure virtual data room and GP-LP engagement platform—which a panelist pointed out was a favorite of LPs before the new remote working model became the norm—is appreciated even more in today’s environment for the way it supports virtual fundraising. Firms are also finding that the right technology, like Altvia’s AIM CRM solution, can help them segment their lists more effectively and send investors information that they truly care about, including engaging with them outside of fundraising, which is more important now than ever.

In addition, having the right systems in place is conducive to more frequent “mini-events” that keep stakeholders interested and engaged, and those systems will also be crucial once the pandemic is behind us, as hybrid annual meetings will continue to be preferred by many in the industry.

We use altvia to track our lps, our regular communication with regards to fundraising so we can record their interactions, and emails.

Keith Janosky

CFO, Head of Investor Relations, Khosla Ventures

The Investor Experience Leader

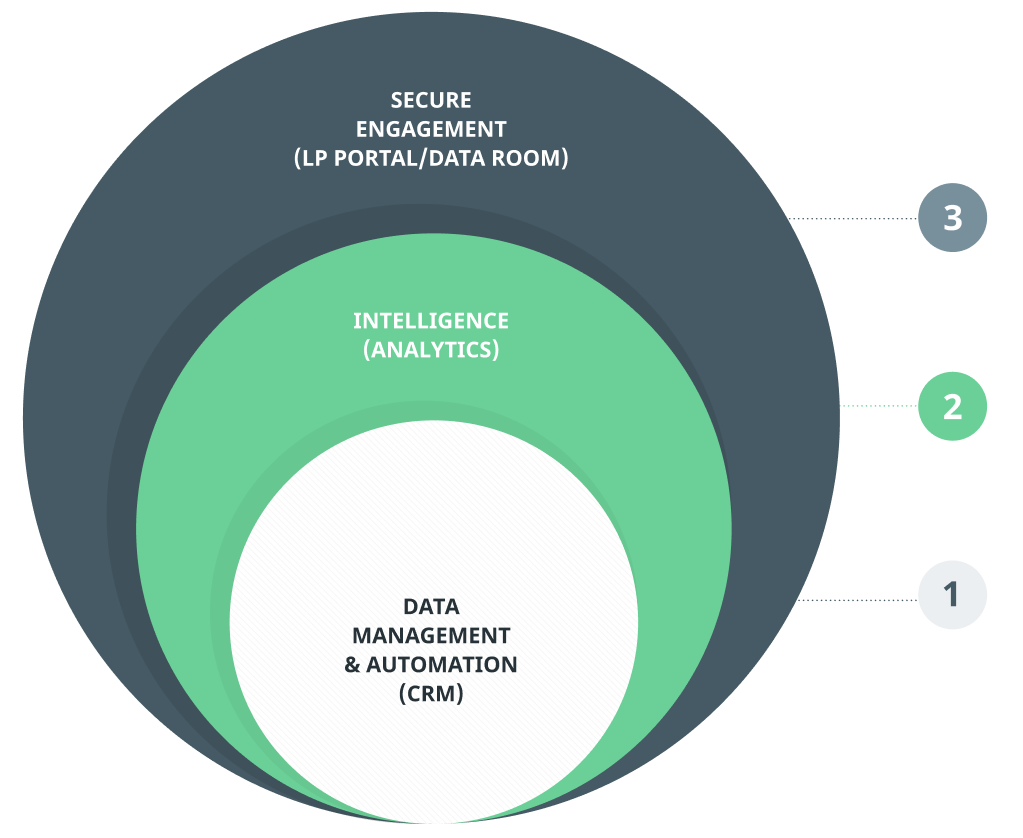

Altvia provides a purpose-built platform for private capital firms that encompasses the various stages of the entire firm life cycle – relationship management, fundraising, deal flow management, investor relations, and portfolio reporting.

-

Unify data across multiple sources to inform internal decisions

Empower external communication - Organize, harvest, and execute on critical data Leverage workflow automation

-

Distribute personalized content (PPMs, K1s, Capital Calls, etc.)

Enhance the investor experience with a secure porta

-

Distribute personalized content (PPMs, K1s, Capital Calls, etc.)

Enhance the investor experience with a secure porta - Organize, harvest, and execute on critical data Leverage workflow automation

-

Unify data across multiple sources to inform internal decisions

Empower external communication