After a period of uncertainty and cautious optimism, the private equity landscape is beginning to show signs of renewed vitality, driven by an encouraging shift in the sentiment of Limited Partners (LPs). This resurgence in confidence hopefully marks the beginning of a promising, enduring trend and signals a favorable shift in how LPs view private equity as a cornerstone of their investment strategies. For fund managers, this renewed confidence offers a unique opportunity to re-engage with LPs and secure fresh commitments, laying the groundwork for future value creation. Recent data from Preqin also indicates a notable uptick in investment activity and a growing belief in the essential role of private markets for achieving adequately diversified portfolios.

In this blog, we will cover the key factors contributing to this renewed confidence, explore the shifting dynamics within the private equity landscape, and discuss how fund managers can capitalize on these trends to strengthen relationships and attract new LPs.

LP Sentiment: A Positive Shift

For some time, the private equity sector has grappled with the challenge of maintaining LP confidence amid market volatility and economic headwinds. However, new data suggests that these concerns are beginning to fade. According to fundraising advisor, Rede Partners, investor sentiment towards private equity has shown notable improvement in the first half of 2024, reflecting a growing willingness to deploy capital into private equity funds.

As we enter this promising new chapter, it’s clear that those able to meet LPs’ increasing demands for transparency and reliability will lead in safeguarding existing relationships and attracting new LPs. LPs are actively diversifying their portfolios by forging alliances with GPs, especially those presenting innovative and pertinent strategies. This trend underscores a readiness to explore new prospects and redistribute investments to emerging managers. At Altvia, we’re poised to support fund managers in navigating these dynamics, ensuring they capitalize on this evolving landscape to drive sustained success in private equity.

What’s Driving the Change

According to the Rede Liquidity Index 1H 2024 Publication, several factors are contributing to this resurgence in LP confidence. Notably:

- Resilience in Performance: Lower-midmarket buyout funds, in particular, have shown consistent performance even in challenging market conditions. The appeal of these funds lies in their potential for diversification and lower exposure to leverage, making them a reliable choice for LPs seeking stability and growth. This consistent performance has reinforced the attractiveness of private equity as a resilient asset class, even when broader markets face turbulence.

- Innovative Liquidity Solutions: This shift in sentiment undoubtedly reflects the growing creativity among GPs and LPs in achieving liquidity while the M&A and IPO markets remain relatively stagnant. The report highlights that confidence in distributions has rebounded to a two-year high, with an RLI score of 58 indicating that LPs are feeling far more confident in the outlook for distributions. Liquidity has been a primary concern for LPs over the past twelve months, and the ability of GPs to provide reliable distributions has played a crucial role in restoring LP confidence. This increase in distribution confidence signals that LPs are increasingly optimistic about the ability of their investments to deliver returns, even in a less active exit environment.

- Growing Appetite for Private Markets: The demand for private market investments continues to grow, with LPs increasingly viewing private equity as an essential component of a diversified portfolio. The report shows that LPs have a strong appetite for North America-focused GPs, with the RLI score for North American strategies rising by eight points to 65. Additionally, interest in European markets is also on the rise, with an RLI score of 58 reflecting an overall intention to expand deployments in this region. This growing appetite for private markets indicates that LPs are eager to explore new opportunities and reallocate capital toward promising strategies and emerging managers, further reinforcing the positive sentiment in the sector.

Capitalizing on the Moment

As LP confidence builds, so too do their expectations. LPs are not just looking for strong returns—they want to be assured that their capital is being managed with the highest levels of transparency and care. For fund managers, this means that now more than ever, effective communication and reporting are critical. Hear it from one of our valued clients:

“With Altvia, distributing information to our LPs and prospects save us many, many hours of work each week. In the past, it would be a half-full-day project to send emails out to LPs with the correct documents. Now it can be set up and sent in 1-2 hours. Our LP data is accurate and consistent across multiple investments, which saves us 1-2 days of updating records and sending tax documents for the finance team during audit/tax season. We are also able to create better marketing materials and track LP responses to ensure emails are sent. Overall, this was the greatest platform upgrade we’ve made to date!” https://app.userevidence.com/assets/9702TSLH

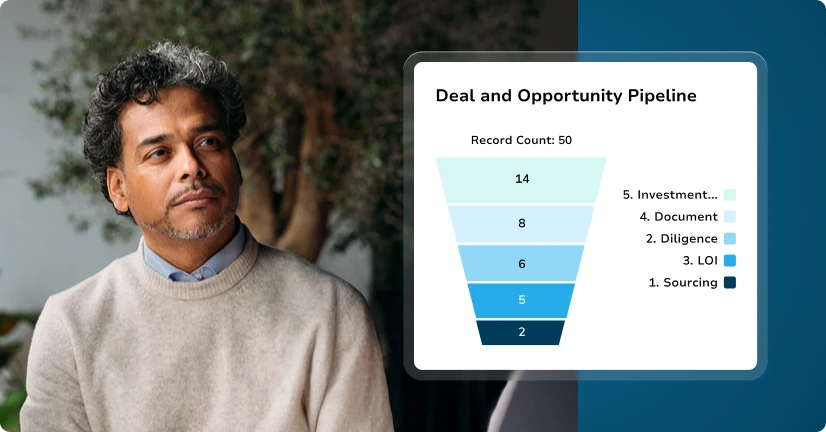

As the technology pioneers for alternatives, Altvia’s platform is uniquely positioned to support the above needs, with its ongoing innovation and ability to help firms differentiate in the eyes of LPs. With solutions like AIM and ShareSecure, fund managers can provide LPs with real-time updates, detailed reports, and a transparent view of how their investments are performing. This level of transparency helps to foster trust and ensures that LPs feel secure in their decision to commit capital.

The improving sentiment among LPs presents a golden opportunity for fund managers. By doubling down on efforts to engage with LPs, demonstrating strong performance, and offering the transparency they demand, fund managers can position themselves as trusted partners, capable of delivering results even in uncertain times.

A New Phase of Renewed Confidence

As LPs renew their confidence in private equity, fund managers have a critical role to play in sustaining this momentum. By prioritizing transparency, communication, and performance, firms can build on this positive sentiment and drive long-term success. At Altvia, we understand the need for transparency, effective communication, and robust performance reporting to ensure strong and modern GP-LP relationships. Our platform ensures that you can meet—and exceed—those LP expectations, positioning your firm as a leader in the industry. Talk to one of our experts to learn how the right technology infrastructure can help you strengthen existing relationships and secure new commitments. https://altvia.com/book-a-meeting.