Imagine you’re hosting a dinner party—one of those first-time gatherings with new friends where every detail counts, from the perfectly paired wine to the carefully curated playlist. The goal? To impress, to connect, and ultimately, to build lasting relationships. Now, swap out that dinner party for a fundraising campaign in the alternative investment space. The principles are surprisingly similar: you want to create an unforgettable and differentiated experience for your guests (or in this case, your investors), connect on a personal level, and build a shared vision for an enduring partnership.

Private Equity fundraising is more than just presenting numbers; it’s about crafting an experience that resonates with investors, making them feel valued and excited about what you have to offer. In a world where competition is fierce and attention spans are short, how do you stand out? How do you make your campaign the one that everyone wants an invite to?

At Altvia, we’ve honed the art of fundraising into a science, blending data-driven insights with a touch of creativity to ensure your campaigns are not just successful, but memorable. We’re not here to tell you to just follow trends—we’re here to help you set them. So, whether you’re a seasoned pro or a rising star in the alternative investment space, these five tips will elevate your fundraising game, making your campaign the talk of the town (or at least the boardroom).

Ready to start your next fundraise? Let’s dive into the essentials that will make your campaign the one everyone’s talking about.

1. Harness the Power of Data Analytics

Leveraging analytics is no longer optional for alternative investment firms looking to be the best. Investors increasingly expect fund managers to provide detailed, data-backed insights.

By utilizing advanced analytics tools, you can:

- Understand Investor Preferences: Analyze past interactions and investment behaviors to tailor your pitches.

- Predict Trends: Use data to forecast market movements and adjust your strategies accordingly.

- Demonstrate Performance: Present clear, data-supported evidence of your fund’s performance and potential.

Embracing data analytics not only enhances decision-making but also builds credibility with prospective investors.

2. Embrace Digital Solutions for Communication

Traditional private equity fundraising methods are evolving. Digital platforms offer unprecedented opportunities to efficiently reach a broader audience. Consider the following:

- LP Portals & VDRs: Utilize flexible and brandable platforms that streamline the investment process, making it easier for investors to commit and stay updated, while also giving you visibility throughout the process.

- Social Media Engagement: Share insights, updates, and thought leadership to build your brand presence.

- Virtual Meetings and Webinars: Facilitate connections without geographical constraints.

By leveraging digital solutions into your communication strategy, you can engage with investors more effectively and efficiently.

3. Foster Transparency and Build Trust

Trust is the cornerstone of successful fundraising. Transparency fosters trust, and in the age of information, it’s easier—and expected—to maintain openness. To build trust:

- Detailed Reporting: Use technology to offer comprehensive, easy-to-understand reports that highlight key metrics and developments.

- Regular Updates: Keep investors informed with consistent, transparent updates about fund performance and strategies.

- Open Communication Channels: Encourage questions and provide clear, thoughtful responses.

Demonstrating transparency not only reassures current investors but also attracts new ones who value candid and straightforward communication.

4. Utilize an Industry-Specific CRM

Managing relationships is pivotal to fundraising success. It’s table stakes for a firm to use a CRM in today’s landscape, so why waste your time with a generic CRM that’s not tailor-made for your workflow? The benefits of purpose-built solutions for private capital markets include:

- Intelligently Concealed Complexities: Say goodbye to the clutter of endless custom fields that only add confusion. A private equity CRM comes preconfigured with the specific features and workflows you need, streamlining operations and allowing your team to focus on what matters—building relationships and closing deals.

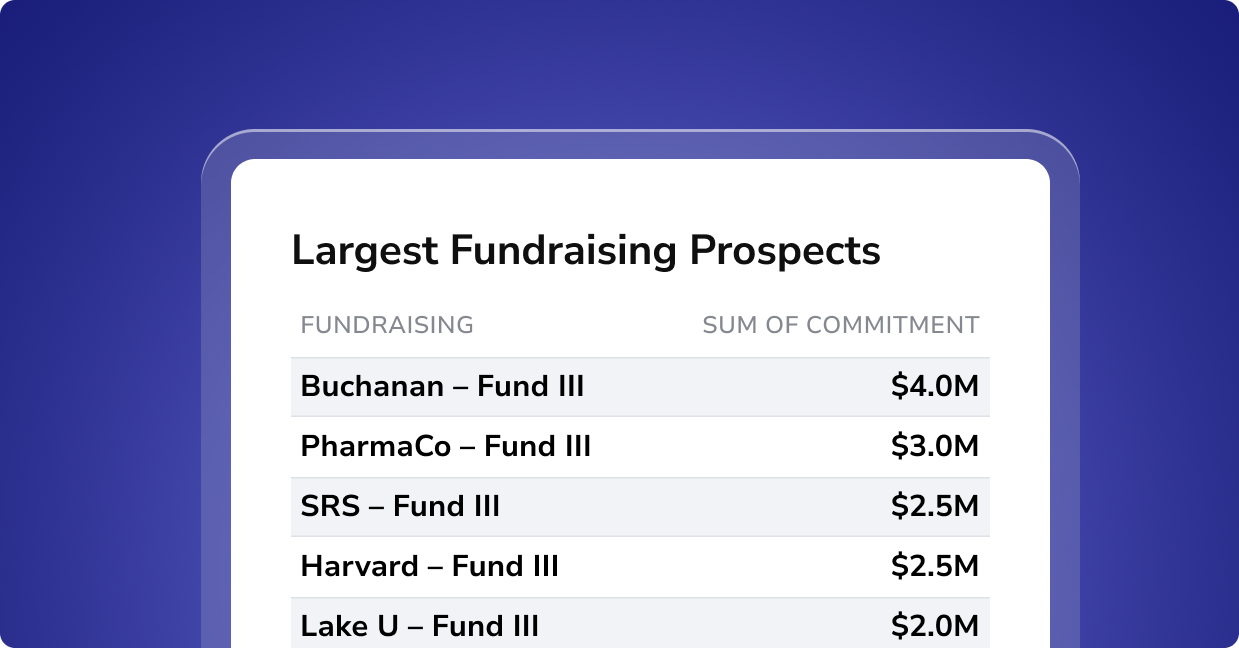

- Curated Reporting: Generate investor-specific reports with ease, pulling in data from multiple sources to create tailored updates that speak directly to your investors’ interests and concerns. This level of customization enhances your communication strategy and demonstrates your commitment to transparency and precision.

- Seamless Integration: A purpose-built CRM effortlessly integrates with your existing tools and data sources, creating a unified platform that boosts productivity across your entire operation. This ensures that all teams—from deal origination to investor relations—are working from the same playbook, driving efficiency and collaboration.

By choosing a CRM specifically designed for the alternative investment industry, you’re not just managing relationships—you’re optimizing them for long-term success.

5. Craft a Compelling Story and Value Proposition

Beyond numbers and data, storytelling is a powerful tool in fundraising. A compelling narrative can differentiate your fund and resonate with investors on a personal level. To craft your story:

- Highlight Unique Value: Clearly articulate what sets your fund apart and the unique opportunities it offers.

- Share Your Vision: Convey the long-term impact and goals of your investment strategy.

- Incorporate Technology: Showcase how technology enhances your operations, from data analytics to investor relations.

A well-crafted story not only captures attention but also fosters an emotional connection with potential investors.

The Dynamic Nature of Fundraising

Fundraising in the alternative investment space is constantly evolving, with technology playing a pivotal role in shaping successful strategies. By leveraging data analytics, embracing digital platforms, fostering transparency, utilizing a purpose-built CRM, and crafting compelling narratives, you can enhance your fundraising efforts and build lasting relationships with investors.

At Altvia, we’re committed to supporting you on this journey with solutions and insights that empower your success. Explore how we can navigate the future of fundraising together with our fundraising software: https://altvia.com/fundraising-and-marketing/.