When evaluating potential investments, private equity firms and managers have plenty to discuss about capital efficiency. Is the company burning through its investment capital? What about the inventory turnover ratio? How can we improve capital efficiency post-acquisition?

These are the kinds of questions firms ask about the companies they invest in every day. However, it’s less often that they ask their internal teams to report on the ratio of outputs generated over capital expended.

Instead, the focus is usually on increasing profits—a natural goal to focus on, especially for firm leaders tasked with improving profitability. Just as you would for one of your investments, prioritizing the efficient use of capital is critical to your firm’s financial success.

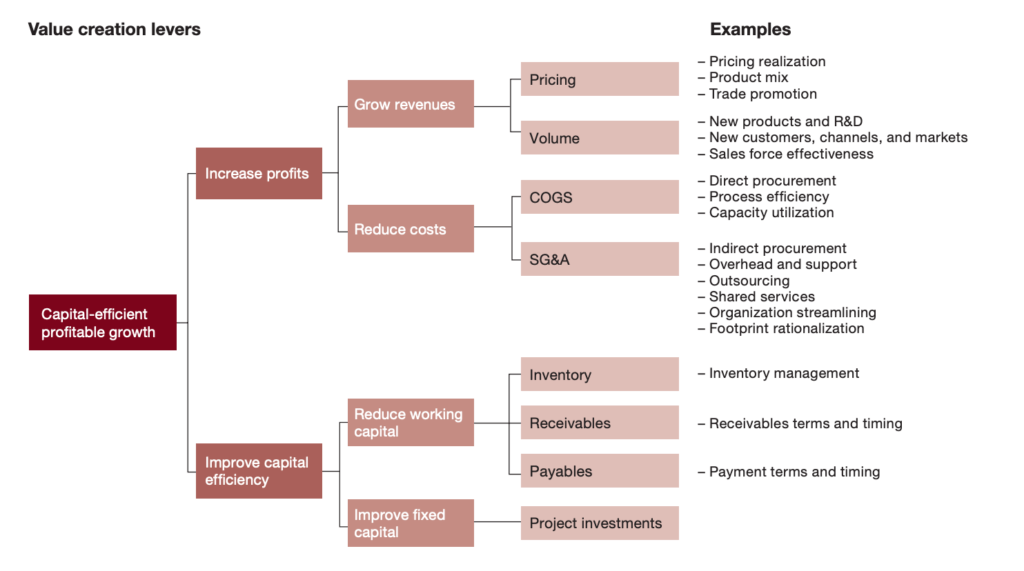

For context, take a look at the chart below from PwC. Then read on to learn more about framing your own company’s capital efficiency.

3 steps to capital efficiency

According to Strategy&, the global strategy consulting firm of PwC, firms focus on two principal value creation levers — increase profits and improve capital efficiency. Private equity firms take a particularly sharp-penciled approach to release cash flow, but public companies can still learn a lot from their example. We have helped many corporate clients pursue a PE-like agenda to enable capital-efficient, profitable growth. The key is to start with a blank slate and then objectively and systematically rebuild the company’s cost structure, justifying every expense and resource. We call this a “parking lot” exercise — we advise clients to, in effect, remove every resource and expense from the building, place it in the parking lot, and then determine whether it deserves to be let back in. There are three basic steps in this process:

1) Review completed work and determine its purpose

The suggestion Strategy& has is for management teams to assess every activity your company performs and assign it to one of three categories:

- “Must-have” work, which directly fulfills legal, regulatory, or fiduciary

requirements, or is required to run the ongoing operations of the company. - “Smart-to-have” work, which directly provides differentiating service

to customers, informs critical business decisions, or enhances

employee performance, strengthening critical capabilities

that allow the company to outperform its competitors. - “Nice-to-have” work, which describes all remaining expenses; in

the pursuit of quick cash and sustained value creation, these activities

should be viewed as discretionary and dialed down aggressively.

2) Eliminate low-value, discretionary work

Strategy& reports that “must-have” work accounts for as little as 15 percent of total expenditures, while “nice-to-have” work constitutes about 33 percent. Private equity and alternative asset firms have a tendency to reduce or eliminate “nice-to-have” and “smart-to-have” work, but it’s important to consider how each affects value creation before making that decision.

3) Optimize remaining high-value or mandatory work

Finally, streamlining the expenses related to “must-have” and “smart-to-have” work is a critical factor in realizing improved efficiencies. Explore automation, process improvement, consolidation, and even outsourcing to gain economies.

Atlas Venture, a biotech-focused early stage venture capital firm, thinks of capital efficiency as the “sweet spot” where the value is generated by per unit dollar invested. They’ve found that funding a company with extra capital will result in decreased returns while funding it too little will starve a business and also result in reduced profits. Put that way, why wouldn’t that fundamental principle be applied to your own private equity or venture capital firm?

Of course, investment prowess will continue to be the main attraction for potential investors. However, these days, you can expect those same investors to want to know how efficiently your firm is managing its funds and day-to-day operations. With a savvy capital efficiency plan in place, your firm can easily prove that you practice what you preach.