We’ve shared how important it is to properly implement technology in order to realize the full organizational impact of new systems on your firm. The industry agrees— deal flow management tools help firms gain visibility and improve the investor experience.

But anyone who’s ever been involved in the process knows that there are real challenges to implementing systems and managing change in order to get full value out of technology, including tools designed for alternative investments.

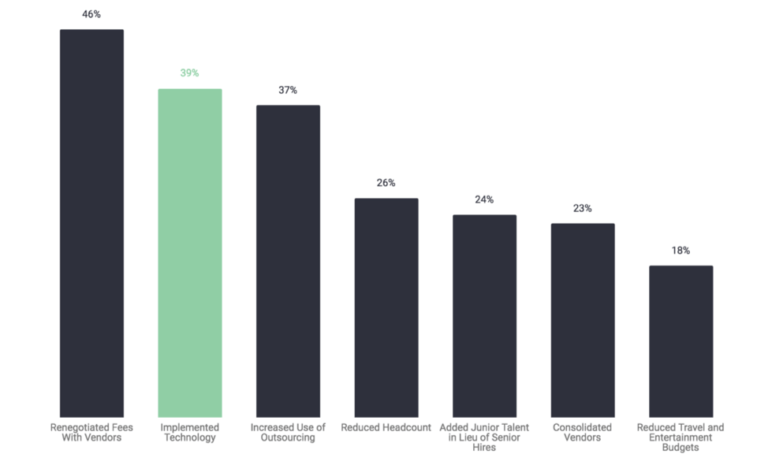

Which of the following actions have you taken to mitigate margin erosion of your deal flow management company?

While most firms plan to adopt technology in order to strengthen investor relationships, there isn’t a clear path to successful implementation. And without a plan, proper deployment and getting users on board can be very challenging.

In fact, it has been our experience that barriers like change management challenges, achieving a high user adoption rate, and providing adequate initial and ongoing training can be daunting and have the potential to derail projects.

It’s not uncommon for a firm to get 80% of the way to its goal of implementing a deal flow management and fundraising solution only to find that the last 20% is the most difficult.

It’s a little like running a marathon. People who have completed one will tell you that the last few miles are more taxing than the prior 24 combined! But you have to finish, of course.

Partially implemented alternative investment solutions are of no use to anyone.

We’ve found that painting a clear and compelling picture of the positive impact that deal flow management and other deal technology tools can have is a strong motivator for teams to do whatever it takes to get across the finish line.

Understanding how systems like a CRM or business intelligence engine can streamline operations, increase productivity, and, in general, help the firm succeed makes everyone want to collaborate effectively.

And that collaboration can be the key to completing the firm’s transition to an organization-wide use of advanced technology for alternative investments.

To motivate you, we would like to share an example of what 100% can look like.

We compiled some data into an Altvia Answers dashboard to show the types of questions you can answer when you fully adopt deal flow management technology and leverage clean, accessible intel to power your deals and inform your fundraising activities.

The firms we work with will tell you: Implementing deal flow management and other solutions is a true game-changer.

For one thing, once you have your advanced technology for alternative investments up and running, the insight you need to inform your decisions is just a few clicks away. That means less time manually analyzing data and more time taking action.

For example, the right CRM and business intelligence tools can answer critical questions about alternative investments, including:

Which industries and sectors have the highest investment activity in you deal flow management system?

Generally speaking, it is not a good use of time and resources to “hunt” in areas where there is very little happening.

One quick query can help you zero in on industries and sectors where there is more potential for profit. If you don’t do that search, you can end up wasting your efforts while other firms are reaping the benefits of their deal flow management solution.

In which countries are the most active sector investments happening?

It is crucial to have a big-picture understanding to help guide your activities. And that understanding needs to be based on current data. Being able to see at a glance what’s happening in a particular country or region gives you a competitive edge.

When are investments made in my sector?

An accurate gauge of investing trends helps you align your work and objectives with the rhythms of the industry. Going “against the grain” tends not to produce the best results.

Total number of monthly commitments and amount raised by each investor type.

Here again, going after investor types that aren’t demonstrating robust activity—or at least increasing activity—is typically not a great strategy. A quick look at your dashboard can give you the information you need to choose wisely.

Is it time for your firm to implement leading-edge deal flow management technology specifically designed for alternative investments?